Best Telegram Game Airdrops to Trade on Coinrule

Coinrule emerges as a powerful platform for traders looking to capitalize on lucrative opportunities in cryptocurrency airdrops. This comprehensive guide will explore the best strategies to trade airdrops on Coinrule and provide expert insights on maximizing your trading potential.

Here are some of the most anticipated Telegram token airdrops you can trade on Coinrule for 2026:

- Vertus – 12th January, 2025

- Lost Dogs – 14th January, 2025

- Frog Farm – 21st January, 2025

- TapSwap – 23rd January, 2025

- PAWS – Late January, 2025

As we move on, we’ll look into what makes Coinrule stand out from other trading platforms, provide you with 8 essential steps to trading with Coinrule, explore risk management strategies for your Telegram game airdrops, highlight common trading mistakes to avoid, and offer final tips for success in airdrop trading.

As of February 2026, this guide contains the most up-to-date information to help you navigate the exciting world of airdrop trading on Coinrule.

What Makes Coinrule Stand Out?

Coinrule has quickly established itself as a leader in the automated trading space, offering a unique blend of features that set it apart from its competitors. One of the platform’s standout features is that unlike many other trading bots that require coding knowledge, Coinrule’s intuitive design allows users to create complex trading strategies easily.

Another key differentiator is Coinrule’s extensive library of pre-built trading templates. These templates, crafted by expert traders, provide users with a solid foundation for trading strategies. Additionally, the platform’s backtesting capabilities allow users to test their strategy against historical data, helping to refine and optimize trading rules before risking real capital.

Coinrule’s integration with multiple exchanges is another feature that sets it apart. This allows traders to execute strategies across different platforms, take advantage of arbitrage opportunities, and diversify their trading activities.

Sign up for Coinrule today and experience the power of automated trading and the excitement of Telegram game airdrops. With its user-friendly interface, extensive features, and robust security measures, you can be assured to trade airdrops on Coinrule in 2026 and beyond successfully.

8-Step Guide to Start Trading on Coinrule

Coinrule has revolutionized how traders approach cryptocurrency airdrops, offering a user-friendly platform that automates and optimizes trading strategies. Let’s dive into how to start trading Telegram game airdrops using Coinrule.

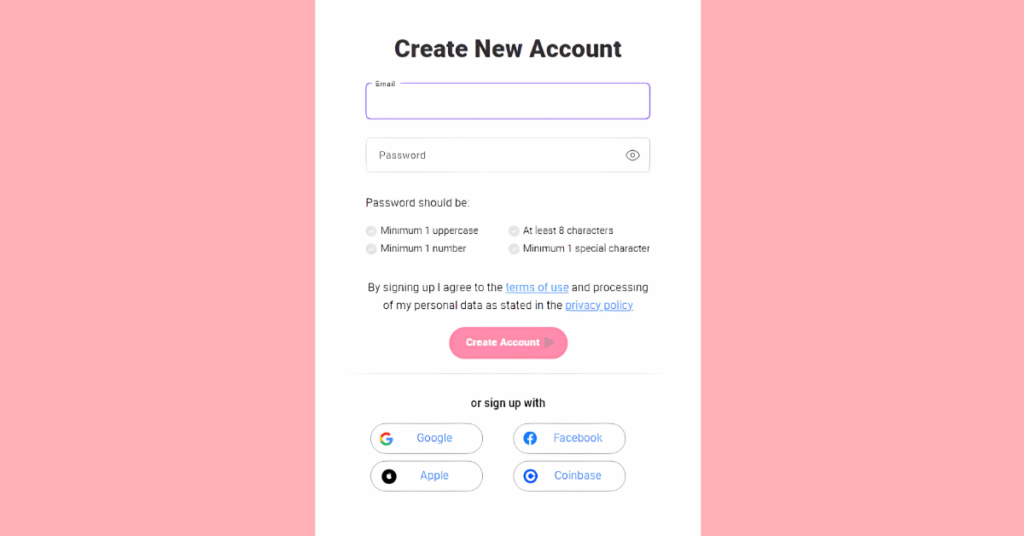

Step 1: Set Up Your Coinrule Account

To begin your journey with Coinrule, you must create an account. Visit the official Coinrule website and click the “Sign Up” button.

Register using your email address or through third-party authentication like Google or Facebook. Once you’ve verified your account, you’ll be ready to explore the platform’s features.

Coinrule offers various pricing tiers, including a free Starter plan that allows you to test the waters without any financial commitment. This plan includes two live rules and two demo rules, making it perfect for beginners to get acquainted with the platform.

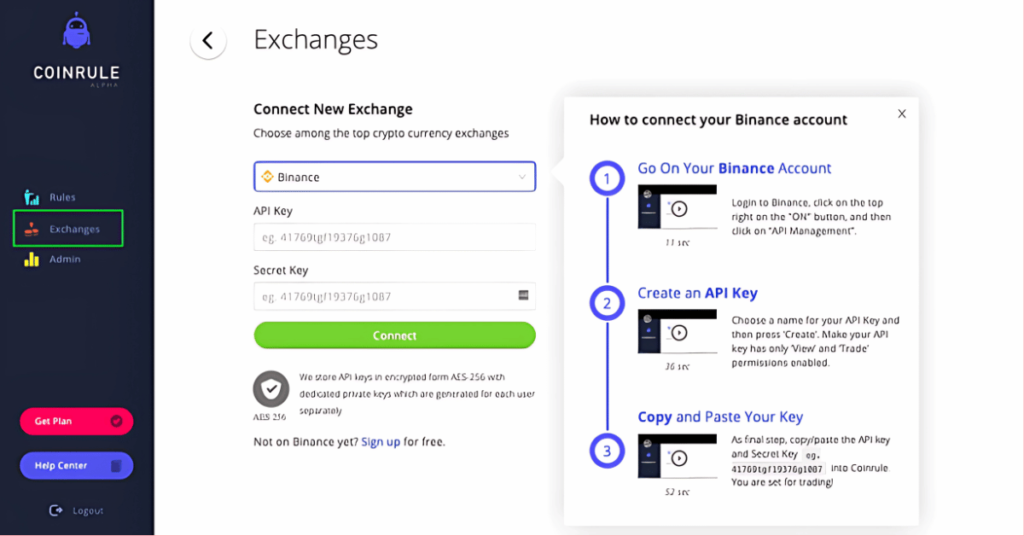

Step 2: Connect Your Exchange

After setting up your account, the next crucial step is to connect Coinrule to your preferred cryptocurrency exchange. Coinrule supports over 10 popular exchanges, including Binance, KuCoin, and Kraken. To connect an exchange, navigate to the “Exchanges” section in your Coinrule dashboard and select your desired platform.

You’ll need to generate an API key from your exchange and input it into Coinrule. This process varies slightly for each exchange, but Coinrule provides detailed instructions for each supported platform. Remember, Coinrule never requests withdrawal permissions, ensuring the safety of your funds.

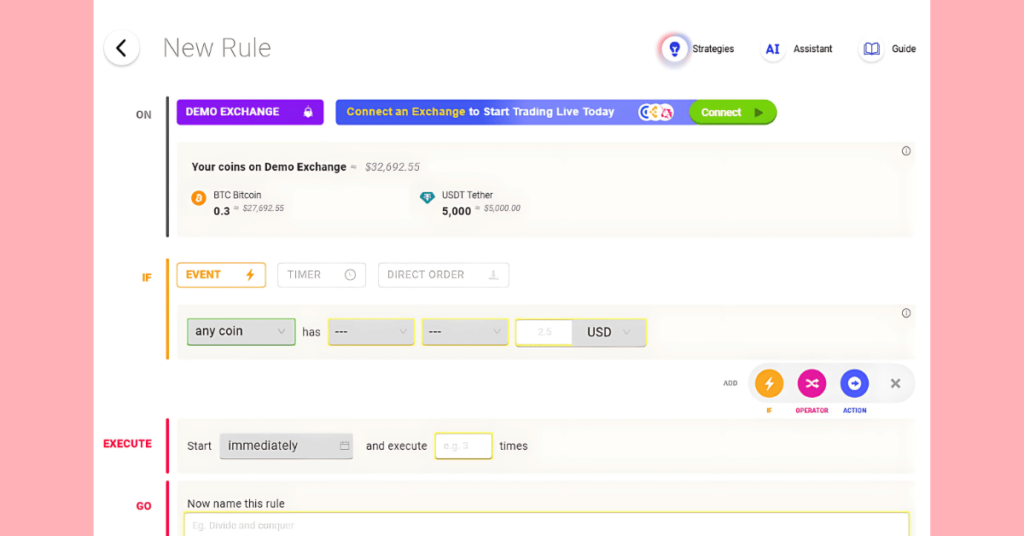

Step 3: Master Rule Creation

The rule creation process is the cornerstone of successful trading on Coinrule. Let’s dive deeper into this crucial step:

Start by exploring the “Templates” section in your Coinrule dashboard. Here, you’ll find over 150 pre-built strategies designed by experienced traders. These templates cover many scenarios, from simple “Buy Low, Sell High” rules to more complex multi-condition setups specifically tailored for airdrop trading.

To create a custom rule, click on “Create Rule” and give it a descriptive name. The rule editor uses an intuitive “IF-THEN” structure:

- The “IF” part defines the conditions that trigger your trade

- The “THEN” part specifies the actions to take when those conditions are met

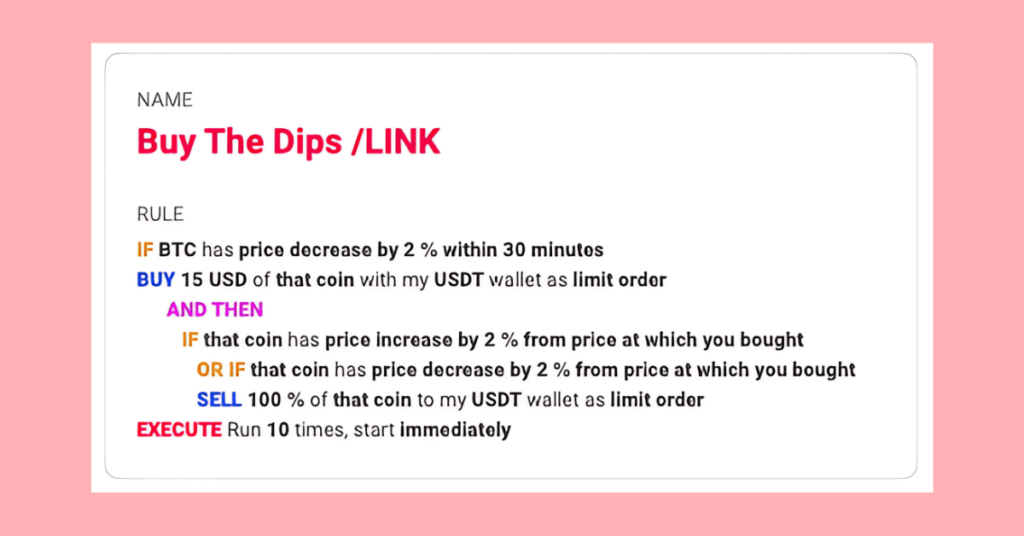

For Telegram game airdrops, you might create a rule like this:

IF [Any Coin] is listed on [Your Exchange] AND [24h Volume] is greater than [$100,000]

THEN Buy [$50] worth of [Coin] using [USDT]

AND Set Stop-Loss at [10%] below purchase price

AND Set Take-Profit at [50%] above purchase priceCoinrule allows you to add multiple conditions and actions, enabling you to create sophisticated strategies tailored to the volatile nature of airdrop tokens. Experiment with different indicators like RSI, Moving Averages, and Volume to refine your entry and exit points.

Step 4: Implement Advanced Risk Management

Building on the basic rule creation, it’s crucial to incorporate advanced risk management techniques:

- Position Sizing: Never risk more than 1-2% of your total portfolio on a single trade. Coinrule allows you to set trade amounts as a percentage of your balance.

- Trailing Stop-Loss: Instead of a fixed stop-loss, use a trailing stop to lock in profits as the price moves in your favor. For example:

IF [Price] increases by [10%]

THEN Set Trailing Stop-Loss at [5%]- Time-Based Exit: Set rules to automatically close positions after a specific time, regardless of profit or loss. This can be useful for highly volatile airdrop tokens:

IF [Time since entry] is greater than [24 hours]

THEN Sell [100%] of [Coin]Step 5: Backtest and Optimize Your Strategy

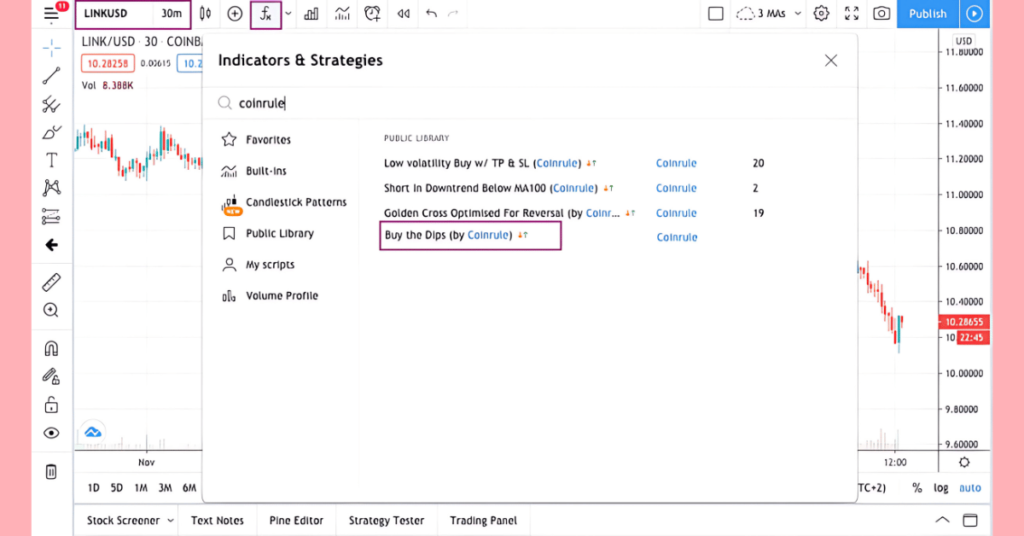

Backtesting is crucial for validating your strategy before risking real capital. Coinrule’s integration with TradingView makes this process straightforward:

- Select the airdrop token you want to trade

- Choose a relevant time frame (e.g., hourly for short-term trades, daily for longer-term holds)

- Apply your strategy and analyze the results

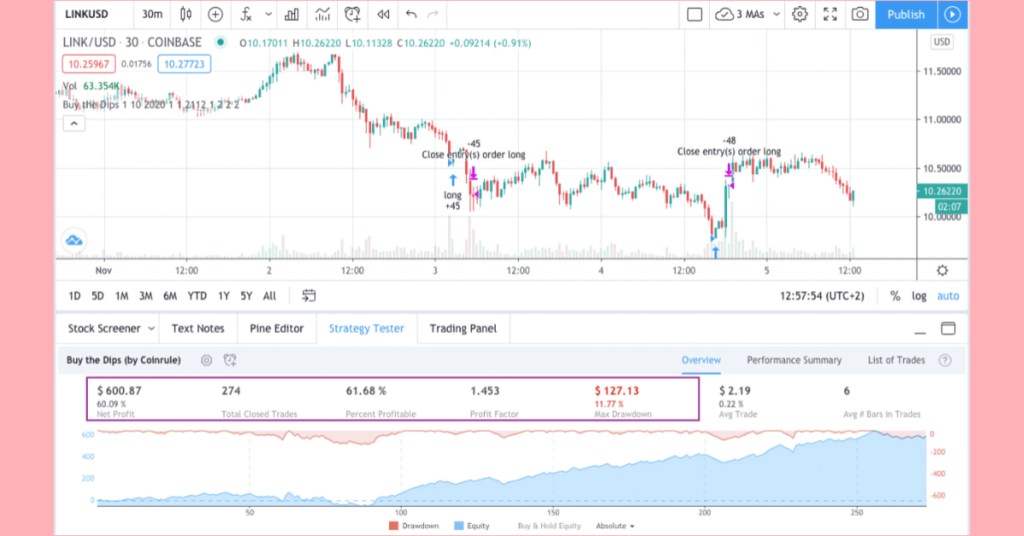

Pay attention to key metrics:

- Net Profit: The overall return of your strategy

- Win Rate: The percentage of profitable trades

- Profit Factor: The ratio of gross profit to gross loss

- Maximum Drawdown: The largest peak-to-trough decline

For a potentially viable strategy, aim for a win rate above 50% and a profit factor above 1.5. If your results aren’t satisfactory, iterate on your rule. Adjust parameters like entry conditions, position sizes, and exit points to optimize performance.

Step 6: Start with Paper Trading

Before going live, testing your strategy in a risk-free environment is wise. Coinrule offers a demo mode that allows you to paper trade with virtual funds:

- Go to your rule settings and switch to “Demo” mode

- Allocate a realistic amount of virtual funds

- Let your rule run for at least 2-4 weeks

Monitor the performance closely. Look for consistency in returns and how well the strategy handles different market conditions. Use this data to fine-tune your rules before risking real capital.

Step 7: Launch and Monitor Your Live Strategy

Once you’re confident in your strategy’s performance, it’s time to go live:

- Switch your rule from “Demo” to “Live” mode

- Start with a small amount of real capital, no more than 10-20% of what you ultimately plan to trade

- Closely monitor your live trades, comparing them to your backtests and paper trading results

Set up Coinrule’s notification system to alert you of significant events:

IF [Rule] executes a trade

THEN Send [Email] notification

AND Send [Telegram] messageRegularly review your strategy’s performance. Markets evolve, especially in the fast-paced world of airdrops. Be prepared to adjust your rules based on changing market conditions.

Step 8: Scale and Diversify

As you gain confidence and see consistent results, consider scaling your strategy:

- Gradually increase the capital allocated to your successful rules

- Develop multiple rules targeting different airdrop tokens or market conditions

- Explore Coinrule’s more advanced features, such as using webhooks to integrate external data sources for more sophisticated trading signals

Remember, diversification is key in managing risk. Don’t put all your funds into a single strategy or airdrop token. Spread your risk across multiple rules and assets to create a more robust trading system.

Summary:

Following these expanded steps, you’ll be well-equipped to navigate Telegram game airdrop trading on Coinrule. Successful trading is a journey of continuous learning and adaptation. Stay informed about new airdrops, refine your strategies, and prioritize risk management. With patience and persistence, you can potentially harness the power of Coinrule to profit from the dynamic airdrop market.

Risk Management Strategies for Your Telegram Game Airdrops

When trading Telegram game airdrops on Coinrule, implementing robust risk management strategies is crucial for long-term success. Here are five essential strategies to help protect your investments and maximize your potential returns:

- Diversification Across Multiple Airdrops

One of the most effective ways to manage risk is through diversification. Instead of putting all your resources into a single Telegram game airdrop, spread your investments across multiple projects. According to a study by the Journal of Financial Economics, diversification can reduce portfolio risk by up to 40% without sacrificing returns.

Coinrule allows you to create rules that automatically distribute your funds across different airdrops based on predefined criteria. For example, you could set up a rule to invest equal amounts in the top 5 performing airdrops of the week, ensuring your portfolio remains balanced and resilient to market fluctuations.

- Implement Stop-Loss Orders

Stop-loss orders are a crucial tool in any trader’s risk management arsenal. They automatically sell your assets when they reach a certain price, limiting your potential losses. With Coinrule, you can easily incorporate stop-loss orders into your trading rules.

For Telegram game airdrops, which can be particularly volatile, consider setting a stop-loss at 15-20% below your entry price. This allows for some price fluctuation while protecting you from significant losses. Remember, research shows that the average crypto drawdown is around 25%, so setting your stop-loss within this range can help you stay in the game during normal market corrections.

- Use Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a strategy where you invest a fixed amount at regular intervals, regardless of the asset’s price. This approach can help mitigate the impact of volatility on your investments. A study by Vanguard found that DCA can reduce the impact of short-term market volatility by up to 60%.

Coinrule makes it easy to implement DCA for your Telegram game airdrops. You can set up a rule to invest a fixed amount in a specific airdrop token every day or week, smoothing out your entry price over time.

- Implement Take-Profit Orders

While limiting losses is important, it’s equally crucial to lock in profits. Take-profit orders automatically sell a portion of your assets when they reach a certain price level. This strategy ensures you capitalize on price spikes, common in the volatile world of airdrops.

Consider setting multiple take-profit levels. For example, you could set up a rule to sell 20% of your holdings when the price increases by 50%, another 30% at a 100% gain, and the remainder at a 200% gain. This tiered approach allows you to benefit from continued price increases while securing profits.

- Regular Portfolio Rebalancing

As the value of different airdrops in your portfolio fluctuates, your asset allocation can drift from your intended strategy. Regular rebalancing helps maintain your desired risk level and can even boost returns. A study by Nasdaq found that rebalancing can increase portfolio returns by up to 0.5% annually.

With Coinrule, you can automate the rebalancing process. Set up a rule to check your portfolio allocation weekly or monthly and automatically adjust your holdings to maintain your target percentages for each airdrop token.

It’s crucial to choose the right wallet for those looking to securely store and manage their airdrop tokens. Explore the best wallets for airdrops to ensure your hard-earned tokens are kept safe and easily accessible for trading on Coinrule.

Common Trading Mistakes to Avoid on Coinrule

When trading airdrops on Coinrule, even experienced traders can fall into common pitfalls. For beginners, these mistakes can be particularly costly. Here are ten crucial points to keep in mind to ensure successful trading of your Telegram game token airdrops on Coinrule:

- Emotional Trading: Don’t let FOMO or panic drive your decisions. Stick to your predefined strategy.

- Neglecting Research: Always research the airdropped token and its project before trading. According to a study by Chainanalysis, over 80% of tokens from new projects lose value within the first month.

- Ignoring Market Liquidity: Ensure there’s sufficient liquidity for the airdropped token. Low liquidity can lead to significant price slippage.

- Forgetting to Set Stop-Losses: Always use stop-loss orders to limit potential losses. Coinrule makes this easy to automate.

- Overtrading: Don’t feel compelled to trade every airdrop. Quality over quantity is key in crypto trading.

- Misunderstanding Token Metrics: Pay attention to token supply, distribution, and vesting periods. These factors significantly impact price movements.

- Neglecting Risk Management: Never risk more than 1-2% of your portfolio on a single trade. Diversification is crucial.

- Ignoring Transaction Costs: Factor in gas fees and exchange commissions when setting up your Coinrule strategies.

- Chasing Pumps: Avoid buying tokens that have already seen significant price increases. Studies show that 95% of tokens experience a correction after an initial pump.

- Not Updating Strategies: Regularly review and adjust your Coinrule strategies based on market conditions and token performance.

By avoiding these common mistakes, you’ll be better positioned to capitalize on your airdrop trades using Coinrule.

Final Tips for Success in Airdrop Trading

As we wrap up our guide on trading airdrops with Coinrule, we’ve explored what makes Coinrule stand out in the automated trading landscape, walked through an 8-step guide to start trading on the platform, discussed crucial risk management strategies for your Telegram game airdrops, and highlighted common trading mistakes to avoid.

Now, let’s conclude with some final tips to ensure success in airdrop trading.

- Stay Informed: Keep up with the latest trends in the airdrop space. Follow reputable airdrop trackers to stay ahead of new opportunities.

- Diversify Your Approach: Don’t put all your eggs in one basket. Participate in various airdrops across different blockchain ecosystems.

- Patience is Key: Not all airdrops will be immediate successes. Be prepared to hold tokens for the medium to long term.

- Continuous Learning: The crypto space evolves rapidly. Dedicate time to learning about new projects and trading strategies.

This guide reflects the most up-to-date information as of February 2026. The crypto world moves fast, so always stay vigilant and adapt your strategies as needed.

FAQs on How to Trade Airdrops On Coinrule

Let’s explore some frequently asked questions about trading airdrops on Coinrule to help you make informed decisions and maximize your potential returns.

Is Coinrule Safe For Trading Cryptocurrency Airdrops?

Coinrule prioritizes security with military-grade encryption and two-factor authentication. It never requests withdrawal rights, ensuring your funds remain safe. 85% of users report an excellent experience, and Coinrule has earned a 4.5/5 star rating on Trustpilot. While no platform is 100% risk-free, Coinrule’s safety measures and positive user feedback indicate a reliable platform for trading cryptocurrency airdrops.

What Are The Fees For Trading Airdrops Through Coinrule?

Coinrule offers a tiered pricing structure, with plans ranging from free to $499.99 per month. The free Starter plan allows up to $3,000 monthly trading volume, while the Pro plan offers unlimited volume. Paid plans provide up to 25% discount for annual subscriptions. Remember, while Coinrule doesn’t charge per-trade fees, your connected exchange may apply their standard trading fees.

Which Exchanges Support Airdrop Trading With Coinrule Integration?

Coinrule integrates with over 10 major cryptocurrency exchanges, including Binance, Coinbase, Kraken, and Bitpanda. This wide range of supported platforms allows users to trade airdrops across various ecosystems. Notably, Coinrule’s integration with these exchanges enables seamless automated trading strategies, enhancing the potential to capitalize on airdrop opportunities across different markets.

How To Create Custom Airdrop Trading Strategies On Coinrule?

Creating custom airdrop trading strategies on Coinrule is user-friendly and doesn’t require coding skills. Users can utilize the platform’s intuitive “IF-THEN” rule builder to set specific conditions and actions. Coinrule offers over 150 pre-built templates as starting points. Traders can incorporate various indicators, set multiple conditions, and define precise entry and exit points tailored to airdrop trading dynamics.