Getting ready for a token listing on a major exchange like CEX.IO can feel like prepping for a raid boss – you need a solid strategy. Knowing the right moves beforehand can make all the difference between epic loot and a total wipe.

These tips are designed to help you navigate the hype and potential pitfalls of a CEX.IO debut. Whether you’re a trader, investor, or just crypto-curious, preparation is your best gear.

From understanding market dynamics to managing risk, we’re breaking down key strategies for February 2026. Let’s get started on how you can approach the CEX.IO listing like a pro, backed by data and analysis.

To get more information on the CEX.IO game, check out our comprehensive CEX.IO Guide and CEX.IO Airdrop articles.

Why the CEX.IO Exchange Listing Is Important

A listing on a well-established platform like CEX.IO is often seen as a major milestone for any crypto project. It’s not just about bragging rights; it signifies increased visibility and potential access to a much wider audience of traders and investors, potentially boosting the project’s legitimacy.

Landing on CEX.IO instantly ramps up a token’s liquidity. This makes it easier for traders to buy and sell without causing massive price swings, attracting more participants and potentially stabilizing the market somewhat after the initial volatile listing phase.

Historically, CEX listings trigger significant price action. While the data shows an average pump of 54% across major exchanges, the specific impact varies. Getting listed on a regulated and globally recognized exchange like CEX.IO can drive substantial initial interest and trading volume.

This article dives deep into everything surrounding a CEX.IO exchange listing, providing the latest information as of February 2026. We’ll cover crucial aspects including the potential ‘cex.io exchange listing date’ factors, the ‘top exchanges to trade cex.io tokens’ post-listing, ‘exchange listing price predictions for cex.io’, ‘7 steps to prepare for the cex.io exchange listing’, insights into ‘trading cex.io currencies’, potential ‘cex.io upcoming partnerships and promotions’, and a ‘summary of the cex.io exchange listing and news’.

CEX.IO Exchange Listing Date

Pinpointing the exact CEX.IO exchange listing date before the official announcement can be tricky, as projects and the exchange usually coordinate this internally. However, this date is critical because it typically marks the peak of volatility and requires traders to have their strategies firmly in place. Being prepared both before and after the listing goes live is crucial for navigating the expected market turbulence effectively. Check CEX.IO’s official announcements for the latest listing news.

Here’s what players should keep in mind:

- Before Listing: Research the project thoroughly, assess your risk tolerance, and set clear entry/exit price targets based on potential scenarios discussed in resources like CEX listing effect studies.

- On Listing Day: Be prepared for extreme volatility. Use limit orders instead of market orders if possible to control your entry/exit prices.

- Avoid FOMO: Chasing the initial pump can be risky, as 37% of tokens hit their ATH at listing and decline afterward.

- Post-Listing: Monitor the price action closely. Remember that 89% of CEX-listed tokens dump on average, so have a plan for taking profits or cutting losses.

- Stay Informed: Keep track of project updates and overall market sentiment, as these factors influence post-listing performance.

Top Exchange Platforms to Trade CEX Tokens

Are you looking for the best platforms to trade tokens fresh off the Centralized Exchange (CEX) listing? It is a smart move to think about where the action happens after the initial hype. The CEXP tokens are projected to be listed on major Exchange platforms when they are finally listed. Different exchanges offer varied liquidity, fees, and listing effects, impacting your trading game. Some of these platforms are listed below.

CEXP on Binance

Binance is in the big leagues, no doubt. Data shows listings here get the most explosive pumps – an average surge of 87%! But hold your horses, ’cause what goes up often comes down harder on Binance. A whopping 98% of tokens listed on Binance eventually dump, dropping an average of 70% from their listing price. It’s high risk, high reward. If you’re chasing that initial pump, Binance has the volume, but be ready to jump ship before the inevitable dump hits. Plus, 46% of tokens hit their ATH at listing here, meaning peak excitement often happens immediately.

CEXP on Gate.io

Gate.io wasn’t specifically analyzed in the provided CEX listing effects study comparing the top 6 CEXs like Binance or Bybit. However, Gate.io is known for listing a wide variety of tokens, often including newer or lower-cap coins before they hit the absolute giants like Binance. This can mean getting in early, but liquidity might be thinner compared to top-tier exchanges, potentially leading to higher slippage during volatile listing periods. You’ll want to check their specific fees and token availability for anything you’re eyeing.

CEXP on Bitget

Similar to Gate.io, Bitget wasn’t part of the specific pump-and-dump study data provided. Bitget has grown significantly, especially in derivatives trading, but also offers a decent spot market. They often list trending tokens. When trading newly listed tokens here, keep an eye on their liquidity pools and maker/taker fees to understand your potential costs and execution quality. As with any exchange, DYOR (Do Your Own Research) on the specific token’s listing details and Bitget’s platform features is crucial.

CEXP on Bybit

Bybit comes in strong, second only to Binance in terms of listing impact according to the study. Tokens listed on Bybit pump 61% on average. Interestingly, Bybit boasts the highest percentage of tokens hitting their All-Time High (ATH) right at listing – a staggering 60%. This suggests massive initial hype. However, the party doesn’t last forever; 92% of these tokens dump post-listing, with an average price fall of 63%. It’s another platform where timing is everything if you’re playing the listing game.

Exchange Listing Price Predictions for CEX.IO

Predicting exact listing prices on exchanges like CEX.IO is like trying to predict the final circle in a battle royale – tough! Market sentiment, project hype, and overall crypto conditions play huge roles. However, analyzing past data gives us clues. Studies show CEX listings, on average, pump token prices by 54% initially, but 89% face a significant dump afterward, dropping 52% from their peak. Understanding these patterns in CEX listing effects is key for traders.

CEX.IO Exchange Rates in Fiat Currencies

When dealing with fiat on CEX.IO, it’s less about predicting exchange rates and more about understanding the costs involved. CEX.IO provides detailed info on deposit/withdrawal commissions and limits, which vary by method. Using Visa or Mastercard, for instance, has deposit commissions ranging from 0.49% to 4.99% + service charge, with daily deposit limits starting at $20 and going up based on verification. Bank transfers like SWIFT have their own fee structures and minimums (e.g., $300 min deposit, 0.1% fee min $10). Always check the latest fee schedule directly on CEX.IO, as these can change.

CEX.IO Fiat Deposit/Withdrawal Fees & Limits (Examples)

| Payment Method | Daily Deposit Limit (Min to Max) | Daily Withdrawal Limit (Min to Max) | Deposit Commissions | Withdrawal Commissions |

|---|---|---|---|---|

| Visa | $20 to Unlimited | $20 to $50,000 | 0.49% – 4.99% + service charge | 0.49% — 4.99% + service charge |

| Mastercard | $20 to Unlimited | $20 to $2,500 | 0.49% — 4.99% + service charge | 0.49% — 4.99% + service charge |

| SWIFT | $300 to Unlimited ($5,000 min daily for U.S. residents) | $300 to Unlimited ($5,000 min daily for U.S. residents) | 0.1%, min $10 | 0.3% + $25 (min $50) |

| Domestic Wire Transfer (ACH) | $20 to $100,000 | $20 to $100,000 | $2.99 | $2.99 |

| PayPal | $20 to $1,000 | $20 to $100,000 | 3.99% + $5 | 3.99% + $5 |

CEX.IO Exchange Rates in Cryptocurrencies

For crypto-to-crypto trades on CEX.IO, the “exchange rate” is influenced by market supply and demand, plus the platform’s trading fees. CEX.IO uses a maker-taker fee model based on your 30-day trading volume (calculated daily in USD). For newbies or low-volume traders (≤ $10,000 monthly volume), the taker fee is 0.25% and the maker fee is 0.15%. As your volume increases, these fees decrease significantly, potentially reaching 0.00% for high-volume makers. Crypto withdrawal fees also apply and vary depending on the specific cryptocurrency and network load.

CEX.IO Maker-Taker Trading Fees (Based on 30-Day USD Volume)

| 30-Day Trading Volume, USD | Taker Fee | Maker Fee |

|---|---|---|

| ≤ 10,000 | 0.25% | 0.15% |

| ≤ 100,000 | 0.23% | 0.13% |

| ≤ 500,000 | 0.19% | 0.09% |

| ≤ 1,000,000 | 0.17% | 0.07% |

| ≤ 2,500,000 | 0.15% | 0.05% |

| > 5,000,000,000 | 0.01% | 0.00% |

7 Steps to Prepare for the CEX.IO Exchange Listing

Alright, buckle up! A token listing on CEX.IO isn’t just another Tuesday. It’s a high-stakes event where fortunes can be made or lost in minutes. Being prepared means more than just having funds ready; it’s about having a game plan based on solid research and understanding market patterns. Think of these steps as your pre-raid checklist to maximize your chances of success when that new token drops.

1. Learn About Trading Tips

Before diving into the frenzy of a new listing, arm yourself with knowledge. Understand concepts like order books, liquidity impact, and common chart patterns; this foundation helps you make informed decisions, not just guesses based on hype or fear.

Mastering risk management is non-negotiable; learn about setting stop-losses and take-profit levels. Familiarize yourself with different order types like market, limit, and especially stop-limit orders available on CEX.IO to control your entries and exits more effectively during volatile periods.

2. Create and Verify an Exchange Account

Don’t wait until the listing announcement drops to sign up for CEX.IO. Registering your account early gives you time to navigate the platform and, crucially, complete the necessary verification steps required for trading and funding.

CEX.IO adheres to strict KYC (Know Your Customer) and AML (Anti-Money Laundering) policies, mandated by its numerous licenses (over 30 in the U.S. alone). Get your identity and potentially address verified well in advance to avoid delays when you need to act fast on listing day.

3. Connect Your Wallet

To trade on CEX.IO, you need funds readily available in your CEX.IO account wallet, not an external DeFi wallet connected directly for trading. Think of this step as prepping your inventory by loading up your CEX.IO balance before the action starts.

You can fund your CEX.IO wallet by depositing fiat currency via methods like bank transfers or cards, or by transferring existing cryptocurrency (like USDT or BTC) from an external wallet. Ensure deposits are made ahead of time so funds are settled and ready for trading.

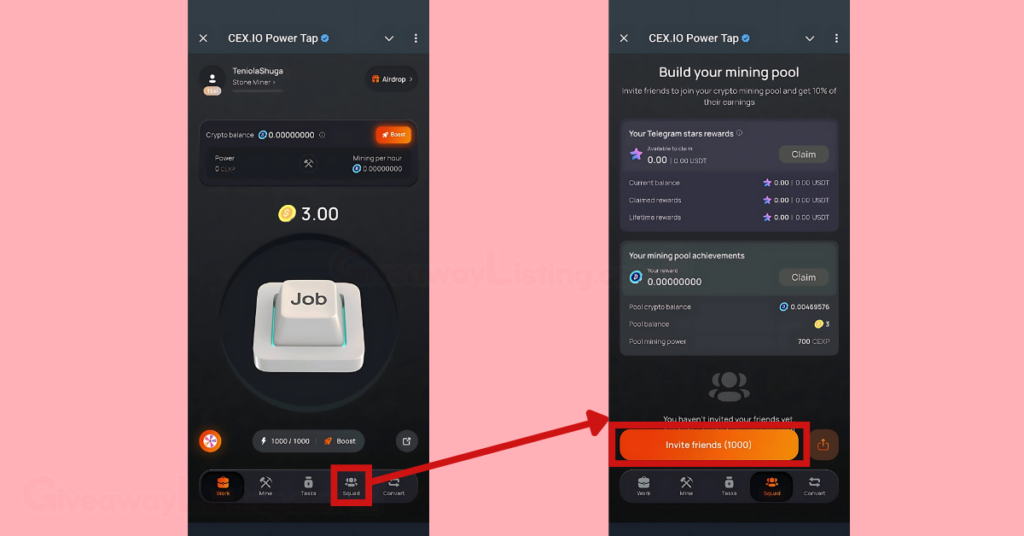

4. Refer Friends to Increase Your Earnings

While not a direct trading preparation, utilizing CEX.IO’s referral or affiliate programs can be a smart side-hustle. Bringing friends to the platform might earn you commission or bonuses based on their activity, adding extra funds to your account over time.

These earned funds could potentially be used to bolster your trading capital for events like new listings. Check CEX.IO’s specific program details to see how you can leverage your network to potentially enhance your trading resources passively.

5. Study CEX.IO Tokenomics

To clarify, CEX.IO is the exchange platform; it doesn’t have its own single “CEX.IO token” with specific tokenomics you need to study for a listing. Instead, focus intensely on the tokenomics of the specific token being listed on CEX.IO – this is a critical part of your pre-listing research.

Analyze the listed token’s utility within its ecosystem, its total and circulating supply, inflation/deflation mechanisms, and the vesting schedules for team or early investors. These factors heavily influence post-listing price pressure and long-term viability beyond the initial hype.

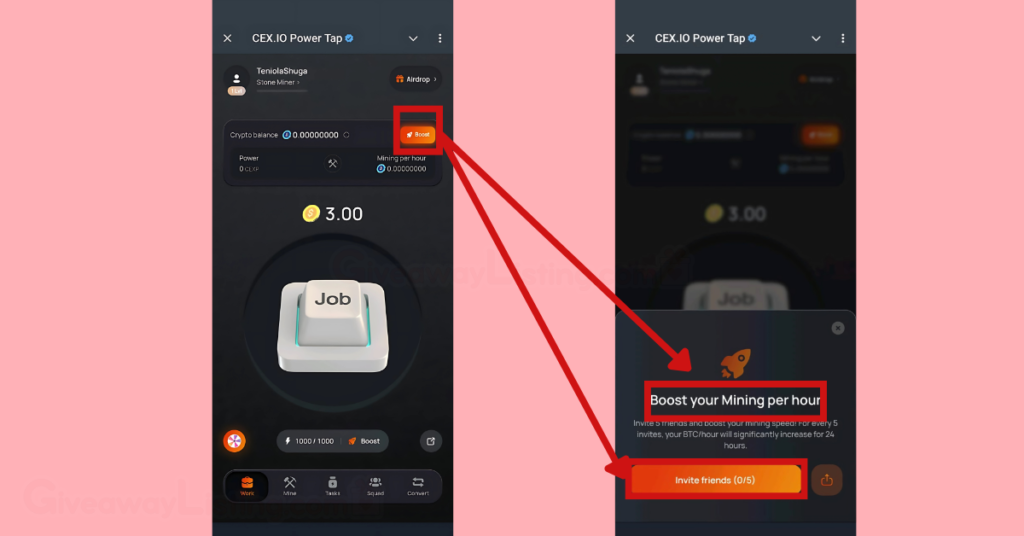

6. Make Use of Boosters

Think of “boosters” in this context as CEX.IO’s various promotions and features that can give your trading an edge. CEX.IO frequently runs trading competitions, cashback offers (like 6% cashback on Instant Buy during promos), or reduced fee events that can lower your trading costs.

Also, consider utilizing CEX.IO Earn services like Savings or Staking (where available) for assets you hold long-term. Generating passive yield can help grow your overall capital base, giving you more firepower for future trading opportunities like new listings.

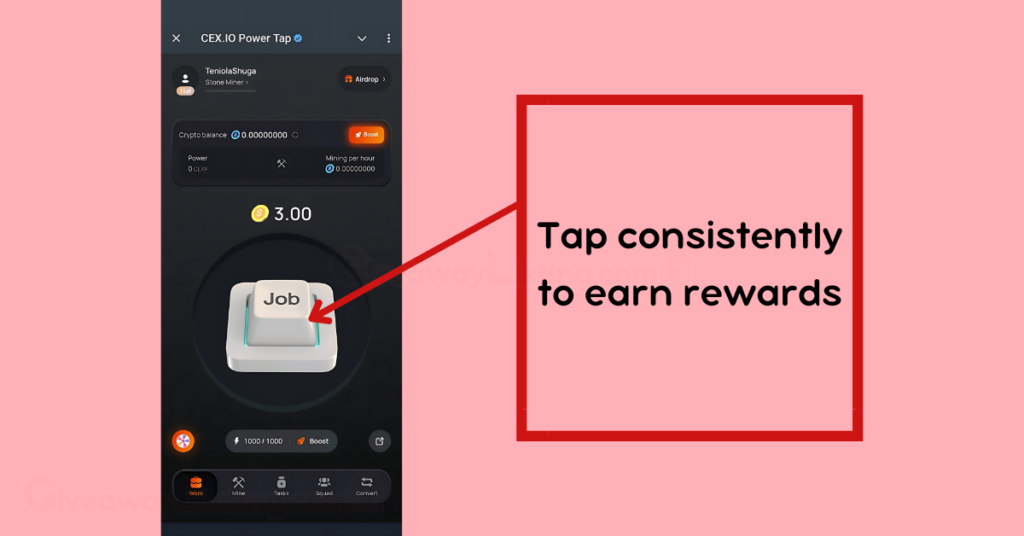

7. Tap Consistently

“Tapping consistently” translates to staying actively engaged and monitoring the market, especially around the listing time. Prices can move incredibly fast during the first few minutes or hours, so consistent attention is key if you plan to trade the initial volatility.

Set up price alerts if available, keep the CEX.IO trading terminal open, and be ready to execute your pre-planned strategy quickly. For advanced users, consistent monitoring might even involve using the CEX.IO API to automate actions or gather real-time data feeds without constant manual checks.

Trading CEX.IO Currencies

Once a token is listed on CEX.IO, trading it involves interacting with the platform’s order book using various order types. Whether you’re looking to buy into the hype, secure profits, or acquire tokens for long-term holding, understanding the mechanics of buying, selling, and withdrawing on CEX.IO is essential. The process is streamlined through their Spot Trading platform or the simpler Convert service.

How to Buy CEXP Tokens

Buying a newly listed token (let’s call it CEXP for example) on CEX.IO usually involves using a quote currency like USDT, USD, EUR, or BTC that you’ve already deposited. You can place different order types depending on your strategy.

- Navigate to the CEX.IO Spot Trading page.

- Select the correct trading pair (e.g., CEXP/USDT or CEXP/USD) from the market selector.

- Choose the ‘Buy’ option.

- Select your desired order type:

- Market Order: Enter the total amount of quote currency (e.g., USDT) you want to spend. The order fills instantly at the best available price.

- Limit Order: Enter the amount of CEXP you want to buy and the maximum price (Limit Price) you’re willing to pay per CEXP. The order executes only if the market price reaches your limit price or lower.

- Stop Limit Order: Set a Stop Price (trigger) and a Limit Price. When the market hits the Stop Price, a Limit Order is placed at your specified Limit Price.

- Review the estimated amount and fees.

- Click ‘Place Buy Order’ and confirm.

How to Sell CEXP Tokens

Selling your CEXP tokens follows a similar process, whether you’re taking profits or cutting losses. You’ll receive the quote currency (USDT, USD, etc.) in return.

- Go to the CEX.IO Spot Trading page.

- Ensure the correct CEXP pair (e.g., CEXP/USDT) is selected.

- Choose the ‘Sell’ option.

- Select your order type:

- Market Order: Enter the amount of CEXP you want to sell. The order fills instantly at the best current market price.

- Limit Order: Enter the amount of CEXP to sell and the minimum price (Limit Price) you want to receive per CEXP. The order executes only if the market price reaches your limit price or higher.

- Stop Limit Order: Set a Stop Price (trigger) below the current price and a Limit Price (usually slightly lower than the Stop Price). If the market drops to the Stop Price, a Limit Order to sell is placed at your Limit Price.

- Review the estimated proceeds and fees.

- Click ‘Place Sell Order’ and confirm.

How to Withdraw CEXP Tokens

If you want to move your CEXP tokens off CEX.IO to a personal wallet or another platform, you’ll need to perform a withdrawal. Ensure the receiving wallet supports the CEXP token and the correct blockchain network.

- Navigate to the ‘Wallet’ section on CEX.IO (or ‘Finance’ > ‘Send Funds’).

- Find CEXP in your list of assets and click ‘Send’ (or ‘Withdraw’).

- Enter the recipient’s CEXP wallet address carefully. Double-check it!

- Select the correct blockchain network for the transfer (if multiple options exist). Using the wrong network can result in lost funds.

- Enter the amount of CEXP you wish to withdraw.

- Review the withdrawal fees and the net amount that will be received. Crypto withdrawal fees vary by asset and network congestion.

- Confirm the withdrawal, likely involving 2FA verification (Authenticator app or SMS code).

- Wait for the transaction to be processed on the blockchain. Withdrawal times vary depending on network speed.

Okay, let’s keep the momentum going. We’ve covered the prep, now let’s peek into what might be next on CEX.IO’s radar and wrap this whole thing up.

CEX.IO Upcoming Partnerships and Promotions

In the fast-paced crypto arena, partnerships and promotions are like power-ups and special events in a game. Partnerships often mean new integrations, broader utility for tokens, or enhanced platform features, while promotions like giveaways, trading competitions, and cashback offers are used to engage the community, celebrate milestones, or boost activity around new listings. They’re key tools exchanges use to stay competitive and reward their user base.

CEX.IO has a strong track record of running frequent promotions, often tied to new asset listings (like the $3,000 SHIB Giveaway or $5,000 AVAX Staking Festival in the past) or celebrating anniversaries (like their 10th Birthday Giveaway). Expect similar events in the future – keep an eye on their official Giveaways and Contests page and social channels for announcements, especially around holidays or significant platform updates planned for 2025.

Looking at recent collaborations like those with Wigwam (for Web3 wallet integration) and CYBERA (for fraud prevention), future CEX.IO partnerships might continue bridging CeFi and DeFi ecosystems, potentially integrating more analytical tools, expanding payment options, or teaming up with new blockchain projects to enhance utility within the CEX.IO ecosystem. Their relaunched Listings program also suggests ongoing efforts to bring new, vetted projects onto the platform.

Given their history of staking and savings promotions (like the “Hot Season of Crypto Staking” or doubling rewards for new Savings additions like XRP and LTC), expect CEX.IO to continue incentivizing participation in their Earn services. The recent launch of their Ambassador Program also signals a focus on community growth, likely involving rewards for active participants who help spread the word about CEX.IO.

Summary of the CEX.IO Exchange Listing and News

Wrapping it all up, securing a listing on a major platform like CEX.IO is undeniably a big deal for any crypto project, bringing increased exposure and much-needed liquidity. However, as the data clearly shows, these events often follow a predictable, volatile pattern – a sharp pump followed by a significant dump – making them a double-edged sword for traders and investors alike.

Preparation, strategy, and a healthy dose of caution are your best allies when navigating a CEX.IO listing. Understanding the typical price dynamics, knowing the platform inside-out, managing risk effectively, and staying informed about partnerships and promotions can help you make more calculated decisions in this high-speed environment. This article aimed to cover the essentials: ‘cex.io exchange listing date’ factors, ‘top exchanges to trade cex.io tokens’, ‘exchange listing price predictions for cex.io’, the ‘7 steps to prepare for the cex.io exchange listing’, basics of ‘trading cex.io currencies’, potential ‘cex.io upcoming partnerships and promotions’, and this ‘summary of the cex.io exchange listing and news’.

Here are some key takeaways and stats:

- On average, CEX listings pump token prices by 54%.

- However, a staggering 89% of tokens dump post-listing, with an average price drop of 52% from their peak.

- Binance listings show the strongest pump (+87%) but also the most severe dump (-70%), with 98% of listed tokens eventually dumping.

- 37% of tokens hit their All-Time High (ATH) right at the moment of their CEX listing.

- CEX.IO requires KYC/AML verification for users and holds numerous licenses, including over 30 in the U.S.

- CEX.IO’s Spot Trading platform offers Market, Limit, and Stop Limit orders.

- Trading fees on CEX.IO start at 0.15% maker / 0.25% taker and decrease with higher trading volume.

- CEX.IO frequently runs promotions like giveaways, trading competitions, and cashback offers.

This content was last updated in February2026.