Why is KuCoin known as the People’s Exchange?

KuCoin earned the nickname “The People’s Exchange” due to its user-centric approach, offering a wide range of cryptocurrencies and actively involving its community in decision-making processes. This reputation was solidified in 2017 when KuCoin proactively compensated users for losses related to a project delisting, demonstrating a strong commitment to its user base.

This provides a fertile ground for users to participate in and trade airdrops on KuCoin, offering a unique opportunity to benefit from these distributions potentially.

Top-performing Token AirdropsThat Might Soon be Available on KuCoin

As of July 2025, several exciting airdrops are on the horizon for KuCoin users:

- Vertus – 12th January, 2025

- Lost Dogs – 14th January, 2025

- Frog Farm – 21st January, 2025

- TapSwap – 23rd January, 2025

- PAWS – projected airdrop date: Late January, 2025

These Telegram game airdrops represent just a fraction of the opportunities available on KuCoin. In this comprehensive guide, we’ll explore the ins and outs of trading airdrops on KuCoin, covering essential topics such as the platform’s suitability for airdrops, key processes to reduce risks, profit-taking strategies for Telegram game tokens, and managing your airdrop profits effectively.

For those looking to maximize their airdrop potential, finding the best exchanges for redeeming airdrop tokens is crucial. KuCoin often ranks high on these lists due to its user-friendly interface and wide range of supported tokens.

Is KuCoin Good for Airdrops?

KuCoin has established itself as a premier destination for trading airdrop tokens, particularly those originating from Telegram games. The exchange’s commitment to quickly listing new and promising projects has made it a favorite among airdrop enthusiasts. In 2023 alone, KuCoin listed over 50 airdrop tokens, providing early access to potentially lucrative opportunities.

One of KuCoin’s strongest suits is its robust liquidity for newly listed tokens. This is crucial for airdrop participants looking to trade their tokens efficiently. The platform’s advanced trading features, including spot and futures markets, allow traders to implement various strategies to maximize their airdrop profits. Moreover, KuCoin’s low trading fees (often as low as 0.1%) make it an attractive option for frequent traders.

If you’re ready to dive into airdrop trading, consider creating an account on KuCoin. With its robust features and diverse token support, KuCoin offers a solid foundation for your airdrop trading journey.

7 Key Processes to Trade Airdrops on KuCoin and Reduce Risks

Trading airdrops on KuCoin can be a lucrative opportunity for crypto enthusiasts. Following these seven key processes can maximize your potential gains while minimizing risks. Let’s dive into the steps to help you navigate the exciting world of airdrop trading on KuCoin.

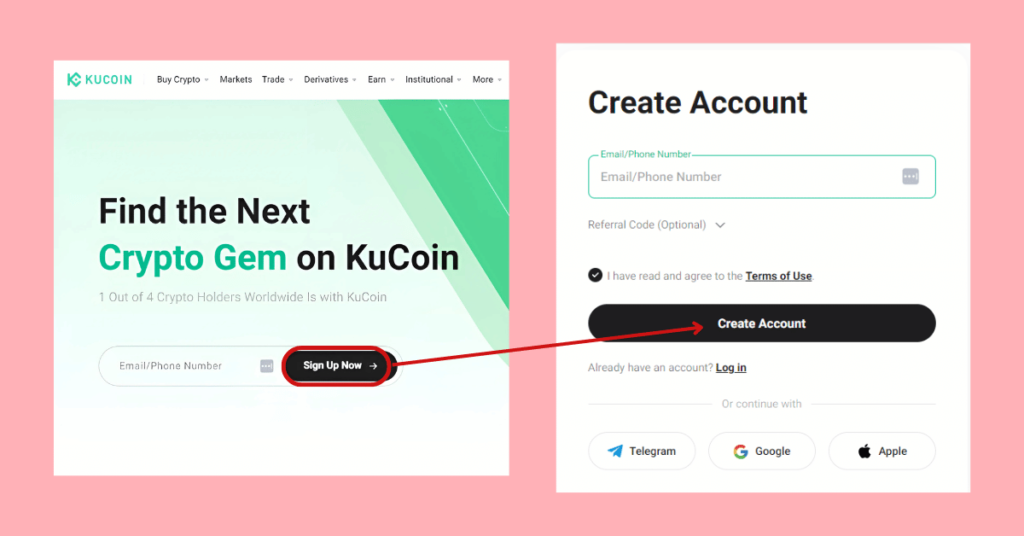

Step 1: Create a KuCoin Account

The first step in your airdrop trading journey is to set up a secure KuCoin account. Begin by visiting the official KuCoin website and clicking the “Sign Up” button. You must enter your email address or phone number to initiate the registration process. Once you’ve submitted your information, KuCoin will send a verification code to your email. Enter this code to confirm your account and proceed with the setup.

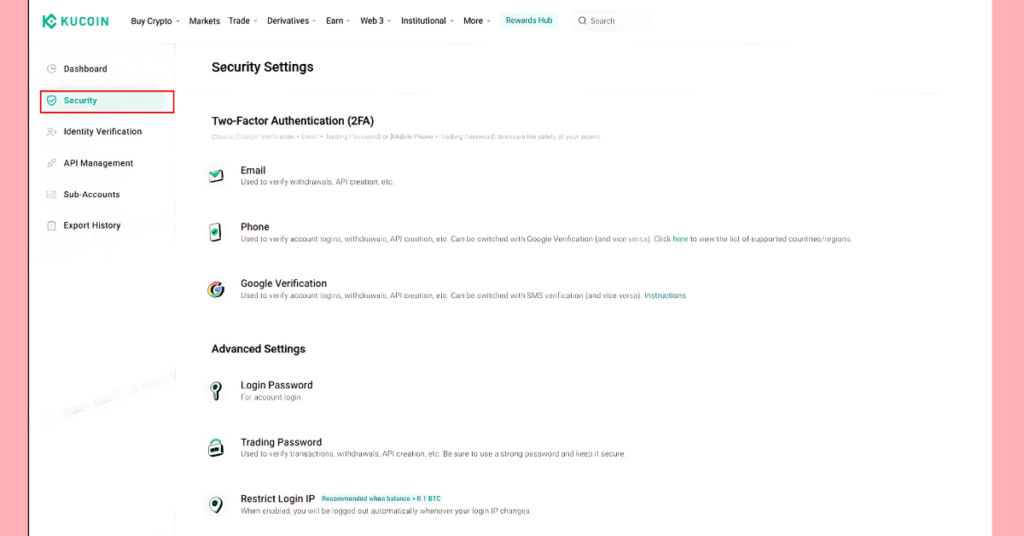

Enabling Google 2FA is crucial for an extra layer of security. This two-factor authentication method adds a significant barrier against unauthorized access to your account. After setting up 2FA, you must complete the Identity Verification (KYC) process.

This typically requires submitting a government-issued ID, proof of address, and a selfie. The KYC process usually takes 1-3 business days to complete, so plan accordingly.

To further secure your KuCoin account, set a strong trading password, enable SMS authentication, and make it a habit to update your security settings regularly. As of August 31, 2023, all new users must complete Identity Verification to use KuCoin’s products and services. This policy update aims to enhance compliance with legal requirements and improve overall account security.

Step 2: Claim Airdrop Tokens

The most profitable way to claim airdrops is through actively playing Telegram games. These games, especially those with daily combos, often offer the best airdrop opportunities. Some players have reported earnings of up to $100-$200 worth of tokens daily from popular games. This significant reward potential makes Telegram games an attractive option for airdrop hunters.

You must join these Telegram game channels and actively participate in their activities to get started. Many games require you to complete daily tasks, solve puzzles, or engage in community discussions to earn tokens.

Staying active and consistent is important to maximize your airdrop potential. Giveaway Listing’s Tap2Earn Games page has a comprehensive list of the most popular games with daily combos, which can serve as an excellent starting point for your airdrop journey.

Step 3: Checking Airdrop Eligibility

Ensure you meet all eligibility criteria before participating in an airdrop. Many airdrops have specific requirements that participants must fulfill. For instance, some may require holding a minimum balance of certain tokens in your KuCoin account. This requirement is often in place to ensure that participants have a vested interest in the project.

Trading volume criteria is another common eligibility factor. Some airdrops may target active traders, requiring a certain level of trading activity on the platform within a specified period. This criterion encourages engagement with the exchange and rewards active users.

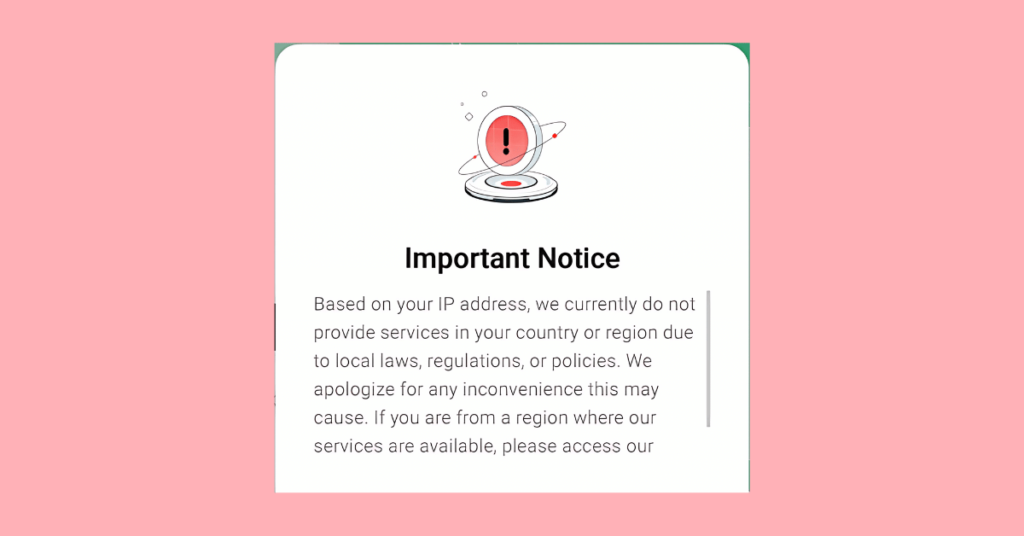

Knowing that some airdrops may not be available in all countries is important. Geographical restrictions are often put in place due to regulatory considerations. Always check the terms and conditions of each airdrop to ensure you’re eligible based on your location.

Failing to meet any of these criteria could result in disqualification from the airdrop, so it’s essential to thoroughly review and comply with all requirements before participating.

Step 4: Transfer Claimed Airdrop Tokens to KuCoin

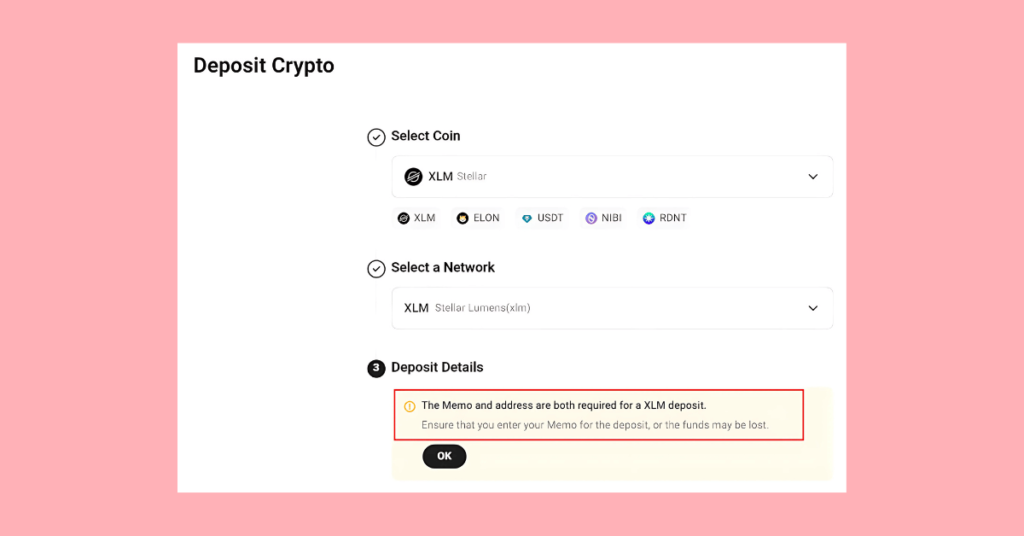

Once you’ve successfully claimed your airdrop tokens from a Telegram game, the next step is to transfer them to your KuCoin account. Start by verifying your account within the game platform. This often involves linking your Telegram account or completing additional verification steps specific to the game.

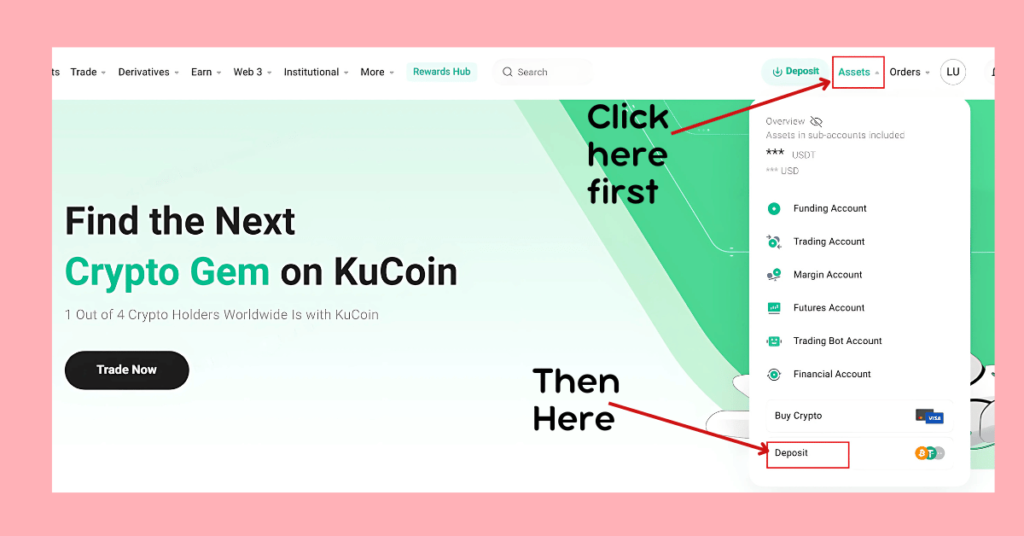

Next, you’ll need to find the relevant KuCoin wallet address for your specific token. KuCoin provides unique deposit addresses for different cryptocurrencies, so ensure you’re using the correct one for your airdrop token. You can usually find this in the “Deposit” section of your KuCoin account under the specific cryptocurrency you’re transferring.

Connecting your KuCoin account with the game might be necessary for some airdrops. This process varies depending on the game, but it typically involves entering your KuCoin account details or wallet address within the game’s interface.

When you’re ready to transfer, initiate the withdrawal from the game platform to your KuCoin wallet address. Understanding gas fees and transfer times is crucial, as these can vary significantly, especially during peak network times. Gas fees are transaction costs on the blockchain and can fluctuate based on network congestion.

Be prepared for potential delays during busy periods, and always double-check the wallet address before confirming the transfer to avoid costly mistakes.

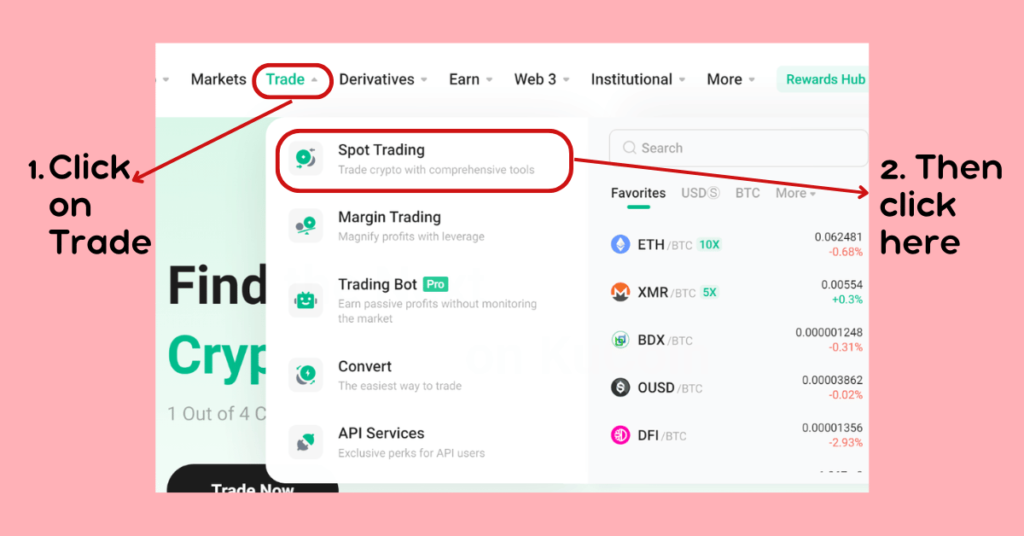

Step 5: Study KuCoin’s Trading Interface

Familiarizing yourself with KuCoin’s trading platform is essential for successful airdrop trading. Start by exploring the KuCoin Dashboard, which is your central hub for all trading activities. Review the main sections, including the markets overview, your account balance, and recent transactions.

The next crucial step is to locate your airdrop tokens. Head to your account’s “Assets” section, where you’ll find a list of all the cryptocurrencies in your KuCoin wallet. Your newly transferred airdrop tokens should appear here once the transaction is confirmed.

Understanding how to read market charts and order books is vital for making informed trading decisions. KuCoin provides detailed price charts with various timeframes and technical indicators. The order book displays current buy and sell orders, giving insight into the market depth and potential price movements.

For Telegram game tokens specifically, pay close attention to key metrics such as trading volume, market cap, and recent price movements. These indicators can provide valuable insights into the token’s liquidity and overall market interest. High trading volumes often indicate active interest in the token, while market cap can give you an idea of the token’s overall valuation compared to other cryptocurrencies.

Step 6: Executing Your First Trade

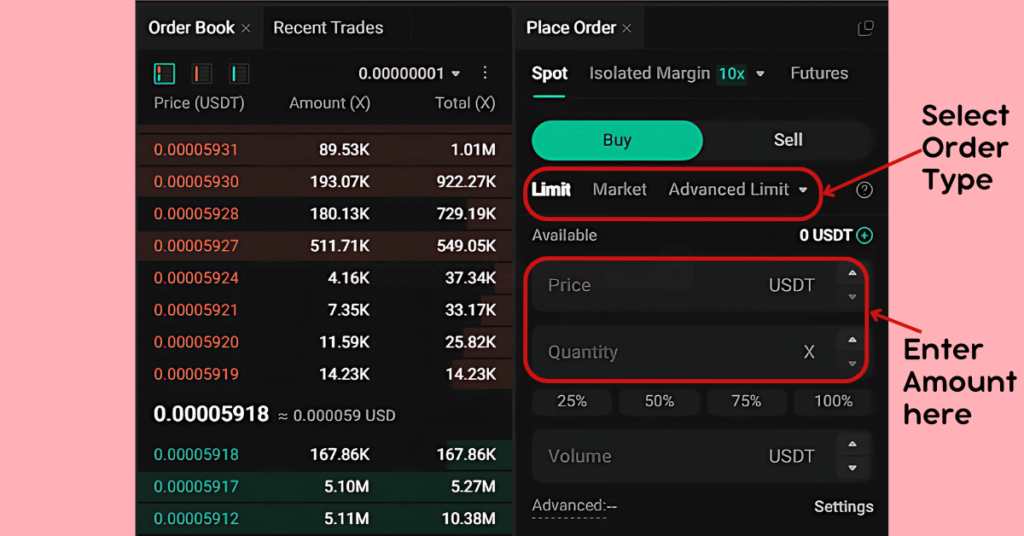

Now that you’re familiar with the platform, it’s time to execute your first trade.

Begin by choosing the right trading pair for your airdrop token. You’ll most often trade against USDT (Tether) or BTC (Bitcoin), common base currencies on KuCoin.

KuCoin offers several types of orders to suit different trading strategies.

- Market orders execute immediately at the best price, which is ideal for quick trades but potentially subject to slippage in volatile markets.

- Limit orders allow you to set a specific price for your trade, giving you more control but requiring the market to reach your specified price.

- Stop-limit orders combine features of both, allowing you to automate trades at predetermined price points, valid for implementing more complex trading strategies.

Navigate to your chosen trading pair to place a buy or sell order. Enter the amount of tokens you wish to trade and the price (for limit orders), then review the details carefully before confirming your trade. Remember, trades cannot be undone once executed, so double-check all information before submission.

After placing your order, it is important to monitor your open orders and trade history. KuCoin provides a dedicated “Orders” section where you can track the status of your current trades and review past transactions.

This information is crucial for managing your trading strategy and keeping track of your portfolio’s performance.

Step 7: Portfolio Management and Withdrawals

Effective portfolio management is key to long-term success in airdrop trading. Utilize KuCoin’s portfolio tools to track the performance of your Telegram game token investments.

Review your holdings regularly, assessing factors such as token price movements, project developments, and overall market trends. This ongoing analysis will help you decide when to hold, sell, or potentially acquire more tokens.

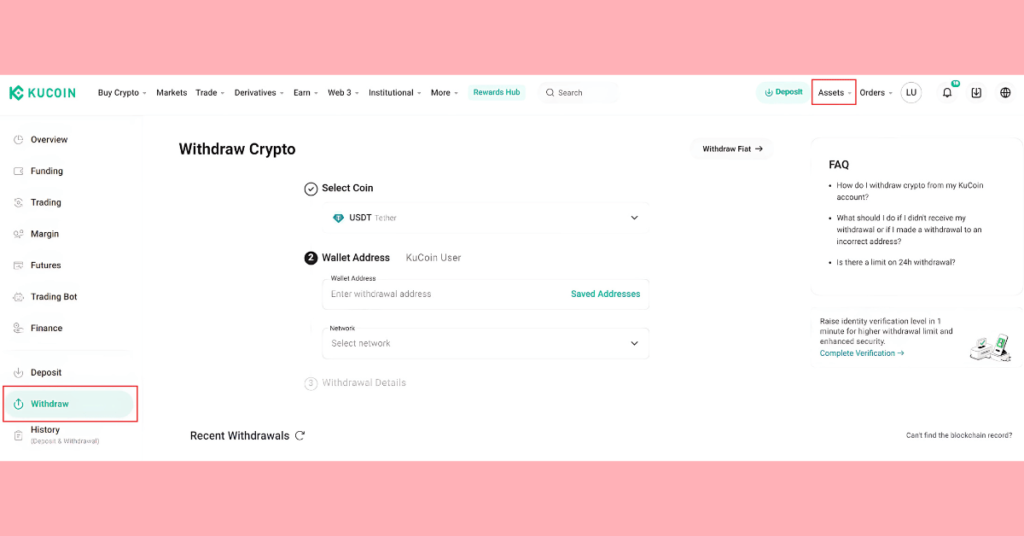

The process of withdrawing funds or tokens from KuCoin is straightforward but requires attention to detail. Begin by setting up withdrawal addresses for each cryptocurrency you plan to withdraw. This step is crucial, as sending crypto to an incorrect address can permanently lose funds. Always double-check addresses and consider sending a small test amount before large transfers.

Understanding withdrawal fees and processing times is important, as these can vary by token and network congestion. Some cryptocurrencies have higher withdrawal fees or longer processing times than others.

KuCoin typically displays this information during withdrawal, but it’s wise to familiarize yourself with these details in advance. During high network activity periods, fees and processing times can increase significantly.

The world of airdrop trading on KuCoin offers exciting opportunities for those willing to put in the time and effort to understand the market dynamics. Each step is crucial to your potential success, from setting up a secure account to managing your portfolio. As of 2023, the cryptocurrency market cap stands at over $1 trillion, highlighting the significant potential in this space.

Remember to use Kucoin’s educational resources and community forums to continually enhance your trading knowledge. You can turn your airdrop tokens into valuable assets with patience, diligence, and a strategic approach.

Profit-Taking Strategies for Telegram Game Tokens

Employing the right strategies can make a significant difference when maximizing profits from Telegram game tokens. Let’s explore some of the most effective approaches:

Long-Term Trading (HODLing)

Long-term holding, or “HODLing,” can be profitable for Telegram game tokens. HODLing can yield significant returns if the token’s value appreciates over time. For instance, some early adopters of popular Telegram games have increased token values by 1000% or more over several months. This strategy requires patience and a strong belief in the project’s long-term potential.

To identify potential long-term winners, look for games with strong communities, active development teams, and unique features that set them apart. Analyze the game’s roadmap, tokenomics, and the team’s track record. Projects with clear use cases for their tokens and a growing user base are often good candidates for long-term holding.

Consider using hardware wallets to enhance the security of your long-term holdings. These physical devices store your private keys offline, providing an extra layer of protection against hacking attempts. You can find the best wallets to redeem your airdrop tokens here.

Short-Term Trading

Short-term trading can capitalize on the often volatile nature of Telegram game tokens. This strategy involves taking advantage of price fluctuations over shorter periods, ranging from a few hours to a few days. Monitor social media channels and game announcements for potential catalysts affecting token prices. News about updates, partnerships, or major events can cause significant price movements in the short term.

Technical analysis is a crucial tool for short-term traders. Use indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) to identify potential entry and exit points. These tools can help you spot trends and potential reversals in the market.

Setting stop-losses and take-profit levels is essential in short-term trading to protect your capital and lock in gains. A common practice is setting stop-losses at 5-10% below your entry price. This helps limit potential losses if the market moves against your position. Similarly, set take-profit levels to sell when your desired profit target is reached automatically. This disciplined approach can help manage emotions and prevent impulsive decisions.

Day Trading

Day trading Telegram game tokens requires discipline, quick decision-making, and a deep understanding of market dynamics. It involves buying and selling financial instruments within the same trading day to profit from short-term price movements.

Telegram game tokens can experience price swings of 20-30% or more within a single day, creating opportunities for skilled traders. However, this volatility also increases risk, so proper risk management is crucial.

Understanding intraday price action is key to successful day trading. Study price patterns, support and resistance levels, and trading volume to identify potential entry and exit points. Pay attention to the token’s liquidity, as low liquidity can lead to slippage and difficulty in executing trades at desired prices.

When considering entry points, look for support and resistance levels on shorter timeframes. These levels often act as barriers where price may reverse or breakthrough, providing potential trading opportunities. Consider using limit orders to enter positions at desired prices, giving you more control over your entry point.

Exit strategies are equally important in day trading. Set clear profit targets and stick to them. Many day traders aim for 3-5% gains per trade on volatile tokens. Having a predetermined exit plan for losing trades is crucial to limiting potential losses.

Managing emotions and maintaining discipline are perhaps the most challenging aspects of day trading. Use a trading journal to track your decisions and learn from successes and mistakes. This can help you identify patterns in your trading behavior and refine your strategy over time.

Portfolio Diversification

Diversifying your Telegram game token portfolio can help manage risk and potentially increase overall returns. Spread your investments across multiple games and genres to reduce the impact of poor performance from any token.

Consider allocating a portion of your portfolio to more established cryptocurrencies for stability, balancing the higher risk associated with newer game tokens.

Regularly rebalance your portfolio to maintain your desired risk profile. This involves periodically adjusting your holdings to align with your target allocation. For example, if one token significantly outperforms others, you might sell some of it and reinvest in underperforming assets or new opportunities.

Keep in mind that the Telegram game token market is still relatively new and evolving. Stay informed about industry trends, new game launches, and technological developments that could impact the value of your holdings. Engage with community forums and official channels to gather insights and stay ahead of potential market movements.

Managing Token Airdrop Profits

Managing your airdrop profits effectively is crucial to maximize your gains and minimize risks in the volatile crypto market. As you navigate the exciting world of airdrops on KuCoin, it’s essential to have a solid strategy for handling your newly acquired tokens. Let’s explore some key aspects of managing your airdrop profits:

Converting to Stable Coins

One popular strategy for managing airdrop profits is converting them to stablecoins. Stablecoins, such as USDT or USDC, can lock in your gains and protect you from market volatility.

On KuCoin, you can easily convert your airdropped tokens to stablecoins using the spot trading feature. This process involves selling your airdropped tokens for a stablecoin trading pair. For example, if you received Token $X as an airdrop, you might trade it for USDT using the X/USDT trading pair.

Converting to stablecoins can be particularly beneficial if you believe the airdropped token’s value might decrease in the short term. It allows you to secure your profits while giving you the flexibility to reinvest in other cryptocurrencies or wait for better market conditions.

KuCoin Spotlight and Safeguard Programs

KuCoin’s Spotlight and Safeguard programs offer unique opportunities for managing and potentially growing your airdrop profits. These programs are designed to support promising blockchain projects and give users early access to new tokens.

- The Spotlight program allows users to participate in token sales of new projects directly on the KuCoin platform. As of 2024, KuCoin has launched over 30 projects through its Spotlight program, with an average return on investment (ROI) of over 500%. This can be an excellent way to reinvest your airdrop profits into new, potentially high-growth projects.

- On the other hand, the Safeguard program is designed to protect users’ interests in high-risk projects. It provides a safety net by offering compensation in case of project failures or significant losses. While not directly related to airdrops, this program can be a valuable tool for managing overall risk in your crypto portfolio.

Tax Considerations for International Users

Understanding the tax implications of your airdrop profits is crucial, especially for international users. Tax laws regarding cryptocurrency vary significantly from country to country, and failing to comply with local regulations can lead to severe consequences.

In many jurisdictions, receiving an airdrop is considered a taxable event. The fair market value of the tokens at the time of receipt is often treated as income for tax purposes. Subsequently, when you sell or trade these tokens, you may be subject to capital gains tax on any increase in value.

For example, the IRS treats crypto airdrops as ordinary income in the United States. If you’re a U.S. taxpayer using KuCoin, you’ll need to report the value of your airdropped tokens as income, even if you haven’t sold them yet.

It’s important to keep detailed records of all your airdrop receipts and subsequent transactions. KuCoin provides transaction history reports that can be helpful for tax reporting purposes. However, given the complexity of international tax laws, consulting with a tax professional familiar with cryptocurrency regulations in your jurisdiction is highly recommended.

Remember, while KuCoin operates globally, you must ensure compliance with local tax laws. Staying informed and proactive about tax considerations can help you avoid potential legal issues and maximize the benefits of your airdrop profits.

Trade Airdrops on KuCoin: Key Takeaways

As we conclude our comprehensive guide on trading airdrops on KuCoin, let’s recap some key points we’ve covered. We’ve explored whether KuCoin is suitable for airdrops, outlined seven key processes to trade airdrops on the platform while minimizing risks, discussed profit-taking strategies for Telegram game tokens, and delved into managing token airdrop profits.

Two additional important points to note about trading airdrops on KuCoin:

- KuCoin’s advanced trading features, such as trading bots, can be handy for managing airdrop tokens in volatile market conditions.

- Always be cautious of potential scams. While KuCoin itself is a reputable platform, the world of crypto airdrops can attract fraudulent actors. Always verify the legitimacy of an airdrop before participating.

Here are some interesting facts from our discussion:

- KuCoin offers over 800 digital assets and services to 30 million users in more than 200 countries.

- The platform’s Spotlight program has launched over 30 projects with an average ROI of over 500%.

- In many jurisdictions, receiving an airdrop is considered a taxable event, with the fair market value of tokens treated as income.

The crypto landscape is ever-evolving; this information is current as of July 2025. Stay informed, trade responsibly, and always prioritize the security of your digital assets.

Trade Airdrops On Kucoin FAQs

Can Beginners Trade Airdrops On Kucoin Successfully?

Yes, beginners can trade airdrops on KuCoin successfully with proper research and caution. KuCoin offers a user-friendly interface and supports over 800 cryptocurrencies, making it accessible for newcomers. The platform provides educational resources and a demo trading account to practice risk-free. However, beginners should start with small amounts and be aware of the high volatility in crypto markets.

How Do I Identify Promising Airdrops To Trade On Kucoin?

To identify promising airdrops on KuCoin, research the project’s team, technology, and community engagement. Look for airdrops with clear utility and strong backing. KuCoin’s Spotlight program has launched over 30 projects with an average ROI of 500%, offering potential opportunities. Monitor KuCoin’s official announcements and community forums for upcoming airdrops. Always conduct due diligence before participating in any airdrop.

How Do I Claim Airdrops On Kucoin Before Trading Them?

To claim airdrops on KuCoin, first ensure you meet the eligibility criteria, which often involves holding specific tokens or completing tasks. KuCoin typically distributes airdrops directly to users’ accounts, requiring no action. Follow the project’s instructions to claim tokens for external airdrops, then deposit them to your KuCoin account. Always verify the legitimacy of airdrop claims to avoid scams.

Are There Any Community Groups Focused On Trading Airdrops On Kucoin?

Yes, there are community groups dedicated to trading airdrops on KuCoin. The official KuCoin Telegram group has over 150,000 members and often discusses airdrop opportunities. Reddit communities like r/kucoin and r/CryptoAirdrops also share information. Additionally, KuCoin’s social media channels and the KuCoin blog regularly announce new airdrops and trading opportunities. Always verify information from multiple sources before participating.