Berachain Airdrop: The Nuts & Bolts

If you’ve been anywhere near the crypto gaming or DeFi space, you’ve probably heard about Berachain and its rather unique approach to blockchain mechanics, especially its Proof-of-Liquidity (PoL) system.

Berachain is not just another chain; it has tried to build a strong community from the outset, starting with its meme-inspired NFT origins and the Bong Bears. The first airdrop itself was a significant event, aiming to reward those who engaged with the ecosystem in various ways before and during its mainnet launch.

This article provides a concise overview of the Berachain project. We’ll review the key facts of the Berachain airdrop, explore ways you might maximize your BERA airdrop tokens, and discuss how to approach future opportunities.

We’ll also cover the Berachain airdrop criteria, consider what the Berachain airdrop price looked like in early 2026, and provide the latest Berachain airdrop update. All the information here is current as of January 2026.

Berachain Airdrop Key Facts & Statistics

The Berachain airdrop and its surrounding activities involve community engagement and strategic token distribution. From funding rounds to specific percentages for different participants, the data tells a story.

Here’s a breakdown of some of the most interesting figures associated with the Berachain airdrop:

- Berachain secured a significant $142 million in total funding across multiple rounds, with $42 million from a Series A and $100 million from a Series B round.

- The total genesis supply of BERA tokens was set at 500,000,000.

- The initial airdrop allocated 15.8% of the total BERA supply, which amounted to 79,000,000 tokens.

- At the time of the airdrop announcement, based on pre-launch futures, this allocation was valued at approximately $632 million.

- The broader community, including the airdrop and future initiatives, was earmarked to receive 48.9% of the total BERA supply.

- Holders of the original Bong Bears NFTs and their subsequent rebase collections received the largest single slice of the airdrop, amounting to 34,500,000 BERA, or 6.9% of the total supply.

- Participants in Berachain’s public testnets, Artio and bArtio, were allocated 8,250,000 BERA, representing 1.65% of the supply.

- A special allocation of 10,000,000 BERA tokens, or 2% of the supply, was designated for Binance BNB holders through the HODLer Airdrops campaign.

- The Boyco launch program participants, who deposited capital, were set to receive 10,000,000 BERA (2%).

- Active social media contributors on platforms like X (Twitter) and Discord were allocated 1,250,000 BERA (0.25%).

- Before its mainnet launch, the Berachain testnet processed over 100 million transactions, indicating substantial community testing and interest.

- An additional Bitget Wallet campaign offered a prize pool of $80,000 in BERA tokens for engaging with ecosystem projects.

- The Berachain faucet required users to have at least 0.001 ETH on the Ethereum mainnet to request testnet BERA, with a drip available every 8 hours.

- All non-public airdrop token allocations are subject to a vesting schedule that includes a 1-year cliff, after which 1/6th unlocks, followed by linear vesting of the remaining 5/6ths over the subsequent 24 months.

- The Ooga Booga surprise airdrop on Berachain provided a baseline distribution of at least 2,900 $OOGA to every eligible user.

- Investors in Berachain were allocated 34.3% of the total BERA supply.

- Initial core contributors and advisors received 16.8% of the BERA supply.

- A portion amounting to 20% of BERA was set aside for ecosystem development and R&D. Exploring these top airdrop opportunities can provide further context on how projects structure their distributions.

- The Berachain mainnet officially launched on February 6, 2025, with the airdrop checker going live a day earlier on February 5, 2025.

7 Ways to Maximize Your $Bera Airdrop Tokens

So, you got your hands on some $BERA tokens from the airdrop – nice one. Now, it’s about making those tokens work a bit harder for you in the crypto market.

1. Stake Your BERA for BGT Rewards

One of the core activities on Berachain is staking your BERA tokens. When you stake $BERA, you’re not just letting it sit idly; you’re actively participating in the network’s Proof-of-Liquidity consensus. In return for this, you earn BGT (Berachain Governance Token). BGT is important because it’s what you use to vote on proposals that shape the future of the Berachain network.

However, the utility of BGT extends beyond governance. You can also burn BGT in a 1:1 ratio to mint new BERA tokens. This creates a direct loop: stake BERA, earn BGT, and then decide whether to use that BGT for governance or convert it back into more BERA, effectively compounding your holdings. It’s a fundamental way the ecosystem is designed to reward long-term participants and those who contribute to network security and governance.

Keep an eye on the BGT emission rates and their distribution, as these can change based on validator allocations and governance decisions. For instance, BGT emissions to various applications and their reward vaults can be adjusted, impacting potential returns.

2. Provide Liquidity on BEX

BEX is Berachain’s native decentralized exchange. If you’re comfortable with the concept of liquidity provision, this is another avenue to explore. By adding your BERA tokens to liquidity pools on BEX, you become a liquidity provider (LP).

As an LP, you earn a share of the trading fees generated by that pool. More importantly, within the Berachain ecosystem, providing liquidity in specific whitelisted pools on BEX also rewards you with BGT emissions. This is a direct application of the Proof-of-Liquidity model, where actively providing liquidity is incentivized at the protocol level.

Remember that providing liquidity comes with its own set of considerations, such as impermanent loss. Therefore, it’s best to understand these concepts before proceeding. Check the available pools, their current BGT emission rates, and the trading volumes to gauge potential returns and activity.

3. Engage with Native DeFi Lending: BEND

Berachain didn’t just launch a chain; it came with a suite of in-house DeFi applications, and BEND is its native lending and borrowing platform. If you have BERA tokens or other supported assets, such as HONEY, WETH, or WBTC, you can supply them to BEND. By supplying assets, you earn interest from borrowers.

Conversely, you can also use your assets as collateral to borrow other assets, typically HONEY. This can be a way to access liquidity without selling your BERA, perhaps to participate in other opportunities within the ecosystem. Engaging with BEND, by supplying or borrowing, was also one of the suggested activities during the testnet phase to potentially qualify for the airdrop.

The interest rates on BEND are dynamic, based on supply and demand within each asset pool. Consistent interaction with core protocols like BEND can sometimes be a factor in ongoing or future ecosystem rewards, beyond just the interest earned.

4. Explore Leveraged Trading with BERPS

For those with a higher risk appetite and experience in derivatives, BERPS, Berachain’s native perpetual futures trading platform, offers another way to grow your capital potentially. You can use assets like HONEY to open leveraged long or short positions on various crypto assets.

BERPS also featured vaults where users could stake HONEY. These vaults play a role in the platform’s mechanics and often provide their own yield. During the testnet, trading on BERPS and staking in its vaults were highlighted activities. While direct trading profits depend on market movements and your trading skill, participation in such platforms can sometimes come with additional incentives or multiplier effects in broader ecosystem reward programs.

Leveraged trading carries significant risk, including the potential for rapid liquidation, so it’s crucial to approach it with caution and a solid understanding of how it works.

5. Hunt for Yield in Ecosystem Reward Vaults

Berachain’s Proof-of-Liquidity system extends beyond just BEX and BEND. The ecosystem is designed to have numerous “reward vaults” associated with various decentralized applications (dApps) built on Berachain. These vaults are whitelisted smart contracts that receive BGT emissions, which are then distributed to users who stake specific tokens or participate in those dApps.

At one point, Berachain highlighted the launch of 37 new reward vaults across the ecosystem. These vaults can support a wide range of stakable tokens, from liquidity pool (LP) tokens to single assets, and cover activities such as swapping, staking, providing liquidity in third-party dApps, and even in-game activities. New vaults can receive BGT emissions and begin distributing incentives, often with a ramp-up period for the Annual Percentage Yield (APY).

Staying updated on new dApps launching on Berachain and checking for associated reward vaults can open up fresh avenues for earning BGT. The distribution of BGT emissions to these vaults can even change as frequently as every 5 hours based on validator allocations.

6. Actively Participate in Governance with BGT

While not a direct trading strategy, using your earned BGT for governance is a way to contribute to the long-term health and value of the Berachain ecosystem, which can indirectly benefit your BERA holdings. BGT holders can vote on key protocol parameters, upgrades, and how BGT emissions are allocated across different reward vaults.

By participating in governance, you have a say in decisions that could make the Berachain network more efficient, secure, or attractive to users and developers. A thriving ecosystem typically leads to increased demand and utility for its native tokens, such as BERA. Additionally, some protocols in the broader cryptocurrency space have, in the past, rewarded active participation in governance.

7. Stay Alert for New Campaigns and Incentives

The crypto space, and particularly new ecosystems like Berachain, are dynamic. After the initial airdrop and mainnet launch, projects often introduce new campaigns, incentive programs, or even subsequent smaller airdrops to encourage specific behaviors or boost activity on new features or partner protocols.

Keep an eye on official Berachain announcements, their social media channels (their X account had over 950,000 followers around launch), and the communications from prominent dApps within the ecosystem. Sometimes, campaigns are short-lived or have limited spots, like the “69 Hours of Beramas NFT Campaign” or specific staking campaigns with partners like StakeStone, which offered STO tokens to the first 10,000 participants meeting certain requirements. The Bitget Wallet phase also offered an $80,000 BERA prize pool for completing tasks.

Being proactive and informed allows you to jump on these opportunities as they arise. This could involve trying out new dApps, participating in trading competitions, or minting special NFTs that might offer future benefits.

How to Use the Berachain Airdrop Checker?

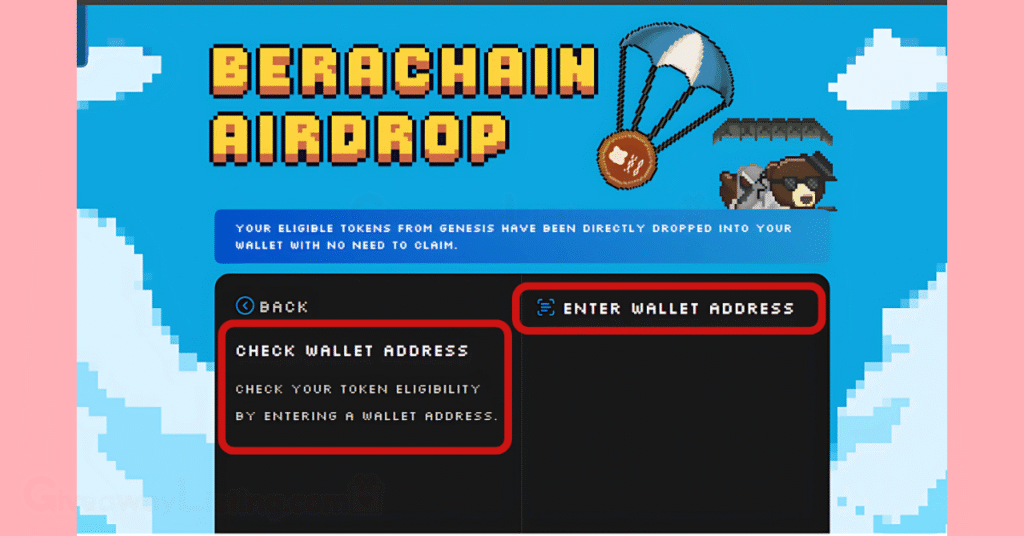

The Berachain Airdrop Checker was a web-based tool provided by the Berachain Foundation for users to verify their eligibility for the BERA token airdrop that occurred around the mainnet launch in February 2025. If Berachain or prominent ecosystem projects decide to conduct future token distributions or reward programs, it’s plausible that a similar checker tool, or an updated version of the original, might be made available. Understanding how these checkers generally work can be helpful.

Typically, an airdrop checker allows you to connect your cryptocurrency wallet, such as MetaMask or Rabby Wallet, or input your public wallet address to see if you qualify for any tokens. For the Berachain airdrop, the checker had two primary methods to verify: by wallet address, especially for NFT-related allocations, or by testnet activity tracked on-chain, and by social login, for allocations tied to X (such as Twitter handles or Discord accounts, as seen in the social airdrop or Request for Brobosal recipients).

If a future checker is released, the process would likely involve visiting the official checker webpage—always triple-check you’re on the legitimate site to avoid phishing scams. Once there, you’d connect your wallet or provide the necessary identifier.

The tool would then query its database based on snapshots and eligibility criteria, displaying whether you’re eligible and, if so, for how many tokens. For instance, for the February 2025 airdrop, users could view their allocations for categories such as Testnet Users (8,250,000 BERA pool), Bong Bears NFT holders (34,500,000 BERA pool), or Boyco depositors (10,000,000 BERA pool).

It’s crucial only to use links from official Berachain channels. The crypto space is rife with scams, especially around popular airdrops. The checker typically informs you of eligibility; the actual claiming process may be accessed on a separate, linked portal.

For those interested in staying ahead of such events, keeping tabs on resources that list upcoming airdrop opportunities is quite essential.

Steps to Claim the Next Berachain Airdrop

The Berachain airdrop that rolled out around its mainnet launch on February 6, 2025, was well-structured. Users first got to see what they were in for when the official airdrop checker went live on February 5, 2025. This tool allows individuals to view their allocation based on various activities, such as testnet usage or holding specific NFTs.

The actual claim process started the next day for most, with a separate date of February 10, 2025, for those who qualified through social engagement or the Request for Brobosal (RFB) program. To claim, eligible participants needed to visit the official airdrop claim website, which was separate from the checker site.

The primary steps involved connecting a Berachain-compatible wallet, such as MetaMask, or using WalletConnect if others like Bitget Wallet were used. This process also offered extra BERA rewards for claiming through their platform. Next, the allocation was verified again on the claim portal, and then a transaction was approved on the Berachain network.

This transaction, naturally, incurred a small gas fee. For some allocations, such as those tied to Bong Bears NFTs, an extra step was required; users had to bridge their NFTs from Ethereum to Berachain before they could claim the associated BERA tokens.

If Berachain decides to bless the community with another airdrop down the line, the process would likely mirror some of these past steps, with a strong emphasis on security and official channels.

Here’s a general idea of what you might expect:

- Stay Officially Informed: Keep your ears to the ground by following Berachain’s official channels. This is where news about a potential future airdrop, including eligibility and claim details, will first be announced.

- Verify Eligibility Securely: If an airdrop is announced, there will likely be an official verification tool. Only use the link provided directly by Berachain. Bookmark the official site if you can. Be highly cautious of links shared on unofficial social media platforms or through direct messages.

- Prepare Your Wallet: Ensure you have a wallet that is compatible with the Berachain network and that you control the private keys. Make sure it’s funded with a small amount of BERA or the network’s gas token at the time to cover transaction fees for claiming.

- Connect to the Official Claim Portal: Once eligibility is confirmed and the claim period is open, navigate only to the official claim website link provided by Berachain.

- Follow On-Screen Instructions: The claim portal will guide you through the process. This usually involves connecting your wallet and then initiating a “claim” transaction.

- Approve the Transaction: Your wallet will ask you to approve the claim transaction. Review the details and confirm.

- Check Your Wallet: After the transaction is confirmed on the blockchain, the new tokens should appear in your wallet on the Berachain network. If they don’t show up immediately, you might need to manually add the token contract address to your wallet’s token list.

What are the Berachain Airdrop Criteria?

The Berachain airdrop that took place in February 2025 wasn’t a free-for-all; it was targeted to reward various segments of its community and early supporters who contributed to the ecosystem’s growth leading up to the mainnet launch. The Berachain Foundation laid out specific categories for eligibility, with different allocations for each.

Here’s a rundown of the key criteria used to determine who got a piece of the 79,000,000 BERA token airdrop:

- Testnet Users: A significant allocation of 8,250,000 BERA (1.65% of total supply) was set aside for users who actively participated in Berachain’s public testnets. This involved interacting with native dApps and performing unique activities such as minting HONEY, claiming fees, posting incentives for reward vaults, converting BGT to BERA, and delegating BGT. A small boost was even given to Binance Web3Wallet users who participated in the testnet.

- Request for Brobosal (RFB) Recipients: Teams and community groups that successfully applied through the Request for Application (RFA) or Request for Community (RFC) programs were allocated 11,730,000 BERA (2.35%). For RFA, this rewarded groups who deployed apps on testnets, with a portion of their allocation required to be used for mainnet initiatives and another portion to reward their own testnet users.

- Boyco Participants: Users who deposited capital into the Boyco launch program, either directly or through pre-deposit vaults, received a share of 10,000,000 BERA (2%). Rewards were based on the Total Value Locked (TVL) contributed and the specific markets chosen, with incentives distributed 30 or 90 days post-launch, depending on the market. The Boyco program itself attracted an impressive $3 billion in capital.

- Social Airdrop: Active community members who posted constructive commentary about Berachain on X or engaged in discussions on the official Berachain or Bong Bears NFT Discords were recognized with a pool of 1,250,000 BERA (0.25%).

- Ecosystem NFTs: Holders of various NFTs associated with the wider Berachain ecosystem (around 80 different collections) were allocated 1,250,000 BERA (0.25%). Scoring was based on a composite value derived from the floor price and trading volume of each collection. Snapshots for NFT holdings and pricing/volume were taken on January 4, 2025, and January 14, 2025, respectively.

- Binance HODLers Airdrop: In a notable collaboration, 10,000,000 BERA (2%) were allocated for distribution to Binance users holding BNB, as part of Binance’s HODLer Airdrops program. This was for users who subscribed their BNB to Simple Earn products between January 22 and January 26, 2025.

- Strategic Partners: Key infrastructure partners whose technology was used to build Berachain’s inbuilt primitives like Morpho for lending and Balancer for BeraSwap, or provide essential launch services like Clique for the airdrop infrastructure, received 2,000,000 BERA (0.4%).

- Bong Bears NFTs and Rebases: The largest single allocation, 34,500,000 BERA (6.9%), went to holders of the original Bong Bears NFTs and their subsequent rebase collections. To claim, these NFT holders needed to bridge their NFTs to the Berachain mainnet. A portion of this (25,000,000 BERA) was unlocked at launch, with the remaining 9,500,000 BERA subject to the same vesting schedule as insiders.

Berachain Airdrop Price in January 2026

Following the BERA token airdrop and mainnet launch in early February 2025, the price of BERA experienced some initial volatility, which is typical for newly launched tokens, especially those distributed via a large-scale airdrop. Perpetual futures data on platforms like Aevo indicated a price of around $8 per BERA token just before the launch.

Post-launch, there were reports of the price initially opening around $15 on some exchanges, then surging to a peak of approximately $14.83 before experiencing a correction and settling into a lower range, at one point dropping to around $7.68.

By late February 2025, some sources indicated that the price was hovering around $5.86. Price predictions for later in 2025 and beyond varied, with some analysts suggesting potential stabilization and growth depending on ecosystem development and market conditions.

Berachain (BERA) Market Snapshot

| Metric | Value |

|---|---|

| Price (USD) | $2.61 |

| 24h Change | +5.05% |

| Market Cap | $313.07M |

| Unlocked Market Cap | $306.3M |

| Volume (24h) | $64.8M |

| Fully Diluted Val. | $1.31B |

| Vol/Mkt Cap (24h) | 20.74% |

| Total Supply | 502.39M BERA |

| Circulating Supply | 119.87M BERA |

| All-Time High | $14.99 |

| % from ATH | -82.61% |

| All-Time Low | $1.00 |

| % from ATL | +160.73% |

| 24h Low | $2.47 |

| 24h High | $2.64 |

The Latest Berachain Airdrop Update

We’ve covered a significant amount of ground on the Berachain airdrop, examining key facts, potential ways to maximize your BERA token benefits, the functionality of the airdrop checker, the steps involved in claiming, the eligibility criteria, and the BERA price in early 2026.

It’s clear that Berachain’s approach, from its meme origins to its Proof-of-Liquidity model, has garnered considerable attention. If you’re keen on exploring other tap-to-earn games and potential airdrops, check out this comprehensive Tap2Earn games list, which could be a good next step.

Here are some standout points to take home from our discussion:

- Berachain’s initial airdrop distributed 79,000,000 BERA tokens, which was 15.8% of the total supply.

- The project raised a substantial $142 million in funding before its mainnet launch.

- Holders of Bong Bears NFTs and their rebases received the largest single airdrop allocation of 34,500,000 BERA.

- Over 100 million transactions were processed on the Berachain testnet, showing strong community engagement.

- The Boyco liquidity program attracted around $3 billion in capital.

- Claiming the airdrop involved using an official checker and then a separate claim portal, emphasizing security.

- Eligibility was broad, covering testnet users, NFT holders, social contributors, and even Binance BNB holders.

- The BERA token price saw initial figures around $8-$15 before settling into a more volatile pattern post-launch.

This information is up-to-date as of January 2026. The cryptocurrency world moves quickly, so always stay up-to-date with official project communications for the latest information.

Berachain Airdrop FAQs

Here are answers to some frequently asked questions about the Berachain airdrop in 2025.

Is Berachain Airdrop Confirmed?

Yes, the Berachain airdrop was confirmed and took place. Approximately 15.8% of the 500 million initial BERA token supply, or 79 million tokens, was distributed. This significant event happened alongside the mainnet launch, rewarding a wide range of community participants.

How Do I Claim Berachain Airdrop?

Participants claimed their BERA tokens by visiting the official claim website, airdrop.berachain.com. They connected a compatible wallet and approved a transaction. Some testnet and NFT allocations were sent directly, while social and RFB claims opened on February 10th, 2025.

Is Berachain Launched?

Yes, Berachain’s mainnet went live on February 6, 2025. This event marked the official start of the EVM-identical Layer 1 blockchain. The launch allowed for the BERA token distribution and the operation of its Proof-of-Liquidity system.

How to Check Bera Eligibility?

Eligibility for the Berachain airdrop was verified using the official checker tool at checker.berachain.com. Users could input their wallet address or connect social media accounts to see their allocated tokens. This checker became available on February 5th, 2025.