Why is Shiba Inu Crashing Today? January 2026 SHIB Crash Explained

Shiba Inu’s story is one for the crypto history books. In 2021, a modest investment could have turned into a life-changing sum as SHIB skyrocketed to its all-time high of $0.00008845. Fast forward to today, January 2026, and the picture is quite different. The token is trading around 86% below its peak, and has seen its value drop by over 40% year-to-date. This isn’t a sudden, overnight crash but rather a prolonged period of struggle, influenced by a mix of market-wide issues and project-specific challenges.

The meme coin mania of 2021 has cooled, and while Shiba Inu still has a massive community, the viral hype that once drew in floods of new investors has significantly faded. Competition is fierce; established rivals like Dogecoin and newer meme tokens are all fighting for the same slice of the market. Beyond meme coins, investors are increasingly looking at projects with more obvious real-world applications, such as PayFi and AI tokens, which are pulling capital and attention away from SHIB.

Beyond the external market pressures, SHIB faces internal hurdles. The project’s tokenomics remain a major point of concern. With a circulating supply of approximately 589 trillion SHIB, a significant price increase requires an immense amount of capital. The token burn campaign, often touted as a solution, has had a minimal impact. While billions of tokens are burned, it’s a drop in the ocean compared to the total supply. The vast majority of burned tokens happened in 2021 when Ethereum’s co-founder destroyed his holdings. The community’s efforts since then have been insufficient to meaningfully reduce the supply and drive up the price.

Additionally, the launch of Shibarium, the Layer-2 network, hasn’t provided the expected boost. Despite processing over a billion transactions, its total value locked (TVL) remains extremely low compared to SHIB’s multi-billion dollar market cap.

Is Shiba Inu Dead?

Despite the persistent price drop and the challenges it faces, Shiba Inu is far from dead. The project’s current state is more of a difficult transition than a final chapter. While the price has struggled, the development team and its dedicated community, the “ShibArmy,” have been actively building an ecosystem to give the token more purpose beyond its meme origins. This effort to create genuine utility is what separates SHIB from many other meme coins that have faded into obscurity. The project is attempting to mature from a speculative asset into a functional platform.

The core of this effort is the expanding Shiba Inu ecosystem. This includes the ShibaSwap decentralized exchange (DEX), a collection of 10,000 NFTs called Shiboshis, and the “SHIB: The Metaverse” project. A key development is Shibarium, an Ethereum Layer-2 scaling solution designed to offer faster and cheaper transactions. While it hasn’t sparked a price increase, its continued operation and development demonstrate a long-term commitment. The team is also working on games like Shiba Eternity. These initiatives aim to create a self-sustaining environment where SHIB and its sister tokens (BONE and LEASH) have clear functions.

The project’s greatest strength remains its massive and loyal community. Data shows a remarkably high holder retention rate of over 96%, with more than three-quarters of investors holding their tokens for over a year. The project is also making strategic moves to stay relevant, such as expanding its presence in the Asian market and integrating with other technologies.

A recent partnership with Folks Finance, utilizing Chainlink’s technology, enabled SHIB to become the first meme coin available for cross-chain lending and borrowing. These steps, while not immediately reflected in the price, are laying the groundwork for potential future relevance and growth.

Will Shiba Inu Go Back Up? January 2026 Prediction

Shiba Inu’s price is currently in a tight spot, trading around the $0.000012 mark. The token has seen a significant downturn in 2025, and is showing little of the explosive energy that defined its past. This sideways movement has investors wondering if a comeback is on the cards for September or if more declines are ahead.

Here are some factors pointing to where SHIB might go next:

- Bullish Signals: The ecosystem is actively expanding. A new partnership with Folks Finance, powered by Chainlink, makes SHIB the first meme coin available for cross-chain lending and borrowing, potentially creating new demand. On the technical side, some analysts note a “double-bottom” pattern forming around the $0.00001183 support level, a setup that has previously led to a sharp rally.

- Bearish Headwinds: The token’s performance in January is shaky at best, with three of the last five years ending in losses. Daily trading volume has dwindled to around $150 million, a fraction of its peak, suggesting waning interest from new traders. Competition is also fierce, with newer meme coins and utility-focused projects attracting investor attention and capital that once might have flowed into SHIB.

- Community & Whales: The ShibArmy remains a dedicated base, with on-chain data showing a holder retention rate of over 96%. These long-term holders are not selling, which creates a stable floor. However, the project’s future is also heavily influenced by a few large players.

Will Shiba Inu Crash Again in 2026?

The Shiba Inu team is not standing still. Recent updates are focused on building out the ecosystem’s utility beyond its meme origins. A major development is the integration with Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which now allows SHIB to be used for lending and borrowing on DeFi platforms like Folks Finance. This move opens up new avenues for holders to earn yield on their tokens.

The team is also planning an expansion into Asian markets, targeting crypto-heavy regions like Japan and South Korea to drive new user adoption. Additionally, the upcoming LEASH v2 upgrade aims to address supply issues and establish a more sustainable token model. At the same time, the team continues to issue security warnings about scams to protect its user base.

Despite these efforts, many analysts remain cautious about SHIB’s price outlook for the remainder of the year. Critics argue that without a dramatic increase in utility or a colossal burn event, SHIB’s value relies too heavily on market sentiment and hype, which has noticeably faded since the 2021 bull run. The project also struggles with a lack of institutional interest, evidenced by the absence of any spot ETF applications in the U.S.

Some technical analysts see potential for a breakout if SHIB can overcome key resistance levels, with some projecting a possible rally of over 100%. However, many others believe the token is more likely to continue its sideways trend or even break down further if broader market conditions sour.

New trends in the crypto space, such as the rise of PayFi and utility-focused AI tokens, are drawing investors away from traditional meme coins. This market rotation puts pressure on projects like Shiba Inu to prove they offer more than just a recognizable brand. For more detailed technical analysis and future price targets, you can find a complete SHIB price prediction that breaks down the short-term and long-term outlook.

So, will Shiba Inu crash again in 2026? A full-blown crash seems unlikely as long as its dedicated community continues to hold and the team keeps building. However, the token’s high volatility means sharp price drops are always a possibility. Its future price action will depend heavily on the success of its new utility-focused projects and its ability to recapture the attention of a market that is constantly looking for the next big thing.

5 Reasons Why Shiba Inu is Down in 2026– SHIB News

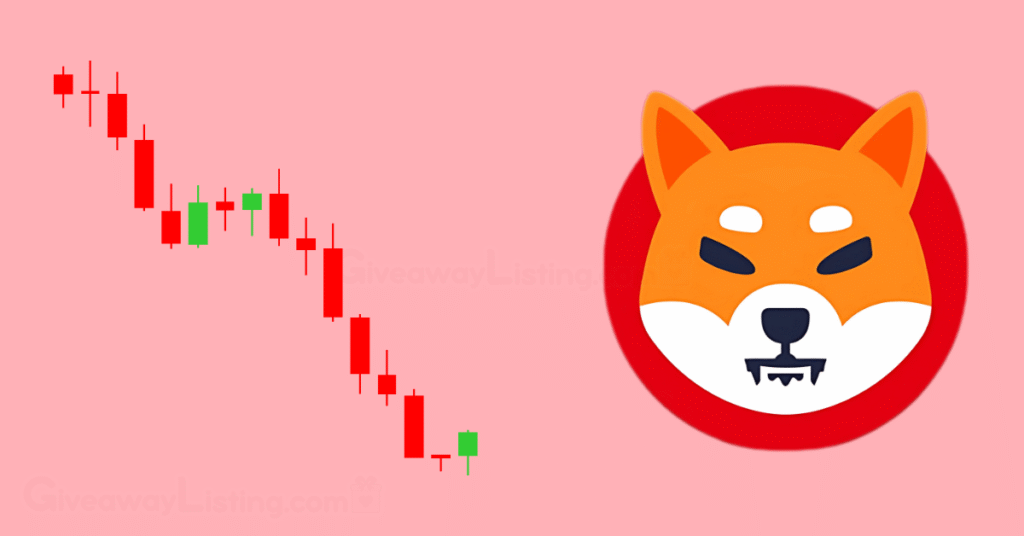

Shiba Inu has experienced a significant downturn in 2026. The token, which traded around $0.000032 in December 2024 following a market rally, is now struggling to maintain its position around the $0.000012 mark. This performance is a stark contrast to the explosive gains in 2021 and has left many questioning its future trajectory.

Here are five key factors behind SHIB’s recent struggles:

1. Fierce Competition in the Meme Coin Arena

The meme coin market is more crowded than ever. While Shiba Inu once enjoyed the spotlight as the “Dogecoin killer,” it now faces a new wave of rivals that have captured significant investor attention and capital. This increased competition has diluted SHIB’s market share and drawn away the speculative interest that previously fueled its rallies.

2. Fading Hype and Shifting Investor Sentiment

The initial excitement that propelled Shiba Inu to its all-time high has cooled. The token’s value was heavily tied to social media trends, celebrity mentions, and a passionate community. While the community remains large, the hype has diminished.

On-chain data reflects this waning interest, with the number of addresses withdrawing SHIB from exchanges hitting a one-year low of just 452. This indicates a lack of new buyers willing to hold tokens in self-custody for long-term purposes.

3. Ineffective Token Burn Mechanism

One of the community’s primary hopes for a price increase has been the token burn strategy, designed to reduce the massive circulating supply. Since 2021, over 410 trillion SHIB tokens have been burned, but this has had a negligible impact on the price. With a current circulating supply of approximately 589 trillion tokens, the pace of burns is too slow to create the supply shock needed for a substantial price appreciation.

4. Macroeconomic Headwinds and Regulatory Uncertainty

The broader economic climate has not been favorable for speculative assets like SHIB. Global financial instability, coupled with ongoing tariff wars and fears of recession, has led many investors to shift away from high-risk cryptocurrencies. Furthermore, the evolving regulatory landscape in places like the United States adds another layer of uncertainty. While progress has been made on crypto regulation, the lack of a clear framework for meme coins has made institutional investors wary and kept significant capital on the sidelines.

5. Delays in Ecosystem Development and Leadership Concerns

Shiba Inu’s leadership has been working to build a robust ecosystem beyond its meme origins, with projects like the Shibarium Layer-2 network, ShibaSwap, and SHIB: The Metaverse. However, progress has been slower than many expected. Shibarium, for instance, experienced a significant drop in daily transactions after its initial launch, raising concerns about its long-term viability. The project’s leadership has also faced criticism for a lack of transparency and for missing project deadlines, which has eroded some investor confidence.

Looking ahead, technical analysis presents a mixed picture. Some analysts point to a potential bullish reversal, with one predicting a possible 163% rally to the $0.00003 region. However, other technical patterns, such as a descending channel, suggest the price could continue to decline. The token’s future performance will heavily depend on the successful delivery of its promised ecosystem upgrades and a favorable shift in overall market sentiment. For now, Shiba Inu remains a high-risk, speculative asset.

Best Strategies for a Shiba Inu Bear Market

A bear market is a period when prices in a financial market consistently fall over an extended time. In the crypto world, this often means a drop of 20% or more from recent highs, accompanied by negative investor sentiment and low confidence. These periods are marked by high volatility and can be challenging for even seasoned investors.

The Shiba Inu bear market has been particularly pronounced. After reaching an all-time high of $0.00008845 in October 2021, the value of SHIB has fallen dramatically. For investors, navigating this period requires a shift from chasing quick gains to employing more defensive and strategic approaches.

Here are some tips to follow:

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the asset’s price. Instead of trying to “time the market” by buying at the absolute lowest point, which is nearly impossible, you average out your purchase price over time. During a bear market, this method can be particularly effective. As the price of SHIB drops, your fixed investment amount buys more tokens, lowering your average cost per token.

This approach removes emotion from the investment process and reduces the risk of making a large investment right before a significant price drop. When the market eventually recovers, having a lower average cost basis can lead to more substantial gains. For a volatile asset like Shiba Inu, DCA can be a disciplined way to build a position without taking on excessive risk at any single price point.

Staking and Earning Yield

Staking is a way to utilize your crypto holdings and earn passive income. By locking up your tokens in a staking pool, you help support the network’s operations and security. In return, you receive rewards, typically in the form of more tokens. Shiba Inu’s ecosystem offers staking through its decentralized exchange, ShibaSwap, where users can “BURY” their SHIB to earn rewards in BONE, another token within the ecosystem.

This strategy is especially useful during a bear market. While the price of your SHIB holdings may be decreasing, staking allows you to accumulate more tokens. This can offset some of the price depreciation and increase the size of your holdings, which could become much more valuable when the market turns bullish again. It provides a way to grow your assets even when the market is stagnant or declining.

Short Selling

Short selling is an advanced trading strategy for experienced investors who believe the price of an asset will continue to fall. In this strategy, a trader borrows an asset (like SHIB) and sells it on the open market. The goal is to buy the same asset back later at a lower price, return the borrowed amount, and keep the difference as profit. Many cryptocurrency exchanges offer derivatives like futures and options that allow traders to take short positions.

This is a high-risk strategy and is not suitable for beginners. If the price of SHIB goes up instead of down, the potential losses from a short position are theoretically unlimited. However, for those with a strong understanding of technical analysis and risk management, shorting can be a way to profit directly from a bear market.

Focus on Diversification

Diversification is a core principle of sound investing, and it’s even more critical during a bear market. Instead of concentrating all your funds in a single high-risk asset like Shiba Inu, spreading your investments across different types of cryptocurrencies and even other asset classes can help cushion the impact of a downturn. This could mean allocating funds to more established cryptocurrencies like Bitcoin and Ethereum, which have historically been more resilient during bear markets.

Beyond crypto, you might also consider investing in traditional assets like stocks, bonds, or real estate to create a more balanced portfolio. The idea is that losses in one area may be offset by gains in another. This approach helps manage overall risk and reduces your portfolio’s dependence on the performance of a single, highly speculative asset like a meme coin.

How to Prepare for the Next SHIB Crash?

Shiba Inu has been struggling to break out of a tight trading range. Technical charts have been flashing some warning signs, including bearish patterns and dwindling trading volume, which suggests that downward momentum could continue.

Here are some practical steps to get ready for potential downturns in the market:

- Have a Game Plan: The worst time to make a decision is in the middle of a panic. Before you invest, figure out your goals. Set clear price targets for taking profits and decide on a point where you’ll cut your losses. Having a pre-determined strategy helps you act logically instead of emotionally when the market gets chaotic.

- Spread Out Your Bets: Putting all your money into a single, high-risk asset, such as SHIB, is a recipe for stress. A diversified portfolio is more resilient. By spreading your investments across different types of assets, other cryptocurrencies, stocks, or even real estate, you reduce the risk that a crash in one area will wipe out your entire portfolio.

- Automate Your Buys with Dollar-Cost Averaging (DCA): Trying to “time the market” by buying at the absolute lowest point is nearly impossible. A less stressful and often more effective method is dollar-cost averaging. This means investing a fixed amount of money at regular intervals, regardless of the price. When the price is low, you get more SHIB for your money; when it’s high, you get less. Over time, this averages out your purchase cost and minimizes the damage from volatility.

- Keep an Eye on Developments: Stay updated on what’s happening within the Shiba Inu ecosystem. Progress on projects like Shibarium, updates on token burns, and new partnerships can all affect the token’s long-term prospects. Being informed helps you understand whether a price drop is a temporary blip or a sign of deeper issues.

- Secure Your Profits: When the market is booming, it’s easy to get greedy. A smart move is to periodically take some profits off the table. Selling a small portion of your holdings when the price is high secures your gains and gives you cash on hand to reinvest during a dip.

- Use Stop-Loss Orders: If you’re actively trading SHIB, a stop-loss order is a critical tool. It’s an instruction to your exchange to automatically sell your tokens if the price falls to a specific level. This acts as a safety net, protecting you from catastrophic losses if the market suddenly turns against you.

Define your entry, exit, and stop-loss points before making an investment. Only invest money you’re prepared to lose and keep your portfolio diversified.

Why is Shiba Inu Crashing FAQs

Here are answers to some frequently asked questions about the Shiba Inu fall in 2026:

Why is Shiba Inu Dropping?

SHIB’s price is down due to a mix of factors, including intense competition from other meme coins and fading market hype. The broader crypto market’s instability has also negatively affected speculative assets. This has resulted in the token’s value dropping by over 40% in 2026, with its massive supply of 589 trillion tokens creating a constant challenge for price growth.

Will Shiba Ever Go Back Up?

A recovery for SHIB is possible but not certain, depending on the success of its ecosystem and overall market conditions. The Shibarium network is a key factor, having already processed over 1 billion transactions. Some analysts point to technical patterns that could signal a rally of more than 160%, though meme coin prices remain highly unpredictable.

Will Shiba Inu Ever Hit $1?

Reaching $1 is extremely unlikely because of the token’s huge supply. For SHIB to be worth $1, its market cap would need to hit $589 trillion, a value far greater than the entire global economy. Even with ongoing token burns, the scale of supply reduction needed makes the $1 target nearly impossible to achieve.

Is it Worth Keeping Shiba?

Deciding to hold SHIB is a personal choice based on risk appetite, as it remains a highly speculative investment. The project has a very loyal base, with over 76% of holders keeping their tokens for more than a year. Its future performance is tied to the utility of its ecosystem and a rebound in market interest.