What is Bitcoin Cash? BCH Explained – March 2026

Bitcoin Cash is a cryptocurrency that branched off from the original Bitcoin blockchain. It was created in August 2017 by a group of Bitcoin developers, miners, and investors who held differing views on the best way for the digital currency to grow. As Bitcoin’s popularity surged, its network began to face challenges with transaction times and rising fees, making small, everyday payments impractical. The creators of Bitcoin Cash aimed to solve this problem by sticking to the original vision of Bitcoin as a “Peer-to-Peer Electronic Cash System.”

Bitcoin Cash is designed for daily use. Its primary function is to serve as a fast, cheap, and reliable payment network. People use it for everything from online shopping and paying for services to sending money across borders with minimal costs. Merchants are also drawn to it as an alternative to traditional payment systems that often come with high processing fees and the risk of chargebacks.

With transaction fees often costing less than a penny and confirmation times measured in seconds, BCH presents a practical option for real-world commerce. This focus on being a functional, daily-use currency is what defines Bitcoin Cash in the crypto landscape.

Why is Bitcoin Cash Unique? BCH Features

Bitcoin Cash is more than just a simple copy of Bitcoin; it incorporates several key technical modifications designed to make it a more effective and efficient payment system. These adjustments address the scalability problems that its predecessor faced, staying true to its goal of becoming a global electronic money.

The most significant distinction of Bitcoin Cash is its approach to on-chain scaling through an increased block size. While Bitcoin’s blocks are limited to 1 megabyte (MB), the Bitcoin Cash network supports blocks up to 32 MB. This larger block size allows the network to process a much higher volume of transactions directly on its main blockchain. As a result, Bitcoin Cash can handle more than 100 transactions per second (TPS). This means less network congestion and a smoother experience for users, even during periods of high activity.

The larger block size directly contributes to two of the network’s most praised features: consistently low fees and fast transaction confirmations. With more available space in each block, there’s less competition among users to have their transactions included, which keeps costs down. This makes BCH suitable for micropayments, like tipping content creators or making small online purchases.

Beyond simple payments, Bitcoin Cash has also broadened its capabilities to support more advanced functions. Through network upgrades, it has introduced smart contract functionality and the ability to issue new tokens. The introduction of CashTokens in May 2023 enables developers to create both fungible tokens (such as stablecoins) and non-fungible tokens (NFTs) directly on the BCH blockchain. This development opens up possibilities for decentralized applications (dApps) and decentralized finance (DeFi) protocols to operate on the network. These features are the foundation of Bitcoin Cash’s position as a practical digital currency.

Bitcoin Cash History, Facts & Statistics

The story of Bitcoin Cash begins with a major disagreement within the Bitcoin community back in 2017. On one side, the Bitcoin Core developers favored implementing solutions like Segregated Witness (SegWit) and second-layer networks like the Lightning Network to handle the load.

Another group, which included influential developers, miners, and early investor Roger Ver, argued for a more direct solution: increasing the block size. They believed this was the best way to stay true to Satoshi Nakamoto’s original whitepaper vision of a “peer-to-peer electronic cash system.”

When the two sides were unable to reach an agreement, the dissenters initiated a “hard fork” on August 1, 2017. This split the Bitcoin blockchain in two, and Bitcoin Cash was born, initially with an 8MB block size. The project itself has continued to evolve, with its block size now at 32MB. It also experienced its own internal splits, leading to the creation of Bitcoin SV (BSV) in 2018 and eCash (XEC) in 2020.

Bitcoin Cash Key Facts & Statistics

- Bitcoin Cash was created from a hard fork of the Bitcoin blockchain on August 1, 2017.

- The maximum supply of BCH is capped at 21 million coins, the same as Bitcoin.

- The block size for Bitcoin Cash is up to 32 MB, significantly larger than Bitcoin’s 1 MB limit.

- BCH can process around 100-200 transactions per second (TPS).

- Transaction fees on the Bitcoin Cash network are consistently low, often costing less than a single penny.

- The all-time high for BCH was reached in December 2017, when its price soared to $3,785.82.

- Its all-time low occurred in December 2018, when the price fell to $76.93 during a market crash.

- Like Bitcoin, BCH uses the SHA-256 Proof-of-Work hashing algorithm.

- The network undergoes a “halving” event approximately every four years, which halves miner rewards, with the most recent one occurring in May 2024.

- Major payment platforms like PayPal and Venmo have enabled support for buying, selling, and holding Bitcoin Cash.

- A May 2023 network upgrade introduced “CashTokens,” enabling the creation of tokens and decentralized applications (dApps) directly on the BCH blockchain.

- Bitcoin Cash is often ranked among the top 20 cryptocurrencies by market capitalization.

It is important to remember that BCH, like all cryptocurrencies, is a speculative asset subject to significant market volatility and regulatory uncertainty.

BCH Price Predictions. Is Bitcoin Cash Going to Crash or Moon in 2026?

Digital currencies are known for their price volatility, and Bitcoin Cash is no exception. Its history is marked by sharp rallies and steep corrections, offering both opportunities and risks for traders. The coin’s value can change dramatically in a short period, influenced by a mix of market sentiment, technological developments, and broader economic trends. This dynamic nature is clear when looking at its price history.

BCH recorded its peak price of $3,785.82 in December 2017 during a massive crypto bull run. Just a year later, in December 2018, it hit its lowest point of $76.93 amid a widespread market downturn. These extreme highs and lows show just how quickly the fortunes of a digital asset can turn, making price predictions a challenging but closely watched field.

In 2026, market analysts offer a generally positive but varied outlook for Bitcoin Cash. The consensus points toward potential growth, though the exact figures differ. Some of the more moderate forecasts place BCH in a range between $650 and $850.

Other experts are more bullish, projecting that Bitcoin Cash could test resistance levels well above the $1,000 mark. Some optimistic scenarios even place the coin’s peak value for 2026 as high as $1,300, assuming favorable market conditions and successful network upgrades that expand its capabilities. For a deeper look into these figures, you can check out this Bitcoin Cash price prediction article for more analysis.

Several key factors will likely shape the price of Bitcoin Cash, including the following:

- User and merchant adoption: If BCH becomes a preferred payment method on more e-commerce sites or is integrated into more payment processors, its real-world use and demand could see a significant lift.

- Technological progress: The successful implementation of upgrades, such as the CashTokens feature that supports a DeFi ecosystem, can attract developers and new projects, thereby adding value to the network.

- The broader crypto market: A strong bull market for Bitcoin would likely create a positive environment for BCH to rally. Conversely, regulatory news, competition from other payment-focused cryptocurrencies, and shifts in miner activity can also introduce downward pressure.

Bitcoin Cash Risks, Scams, and Hacks

The crypto space is rife with scams that target both new and experienced users. Investment scams are particularly common, often starting with an unsolicited message on social media promising guaranteed, high returns on your BCH. These can involve fake “investment managers” who direct you to a convincing but fraudulent platform. Once you deposit your BCH, you may find it impossible to withdraw.

Another popular tactic is the impersonation scam. They might create a sense of urgency, claiming your account is compromised and that you must move your funds to a “secure” wallet they provide, which they actually control.

The history of Bitcoin Cash is also marked by controversy that can confuse newcomers. Following its split from Bitcoin in 2017, a fierce debate over which chain represented the “real” Bitcoin began. Proponents of BCH secured the Bitcoin.com domain, leading many new users to mistakenly buy BCH instead of BTC when they intended to buy BTC.

This branding conflict has been labeled a “scam” by critics, highlighting the importance of thorough research. The decentralized nature of crypto also means that once a transaction is confirmed on the blockchain, it’s irreversible. If you send BCH to a scammer’s address, the money is gone for good.

How to Avoid Bitcoin Cash Risks, Scams and Hacks?

Staying safe requires a healthy dose of skepticism and a proactive approach to security. Here are some key things to watch for:

- “Guaranteed” Profits Are a Red Flag: No legitimate investment can guarantee profits, especially in the volatile crypto market. Be wary of anyone promising high returns with little to no risk.

- Impersonation Is Common: Legitimate businesses and government agencies will never contact you unexpectedly to demand payment, especially not in cryptocurrency.

- Beware of Romance Scams: If a new online love interest quickly starts giving you crypto investment advice or asks for money, it is almost certainly a scam.

- Verify Before You Trust: Always double-check website URLs, email sender addresses, and social media accounts. Scammers create convincing fakes of popular exchanges and wallets to steal your login information.

- Do Your Own Research: Don’t make financial decisions based on unsolicited tips from strangers online. Research any project or platform thoroughly before investing.

How to Secure Your BCH?

Protecting your Bitcoin Cash is your responsibility. Taking a few extra security steps can make a massive difference in keeping your assets safe.

- Use a Hardware Wallet: For storing any significant amount of BCH, a hardware wallet (or cold wallet) is the top choice. These devices keep your private keys offline, making them immune to online hacking attempts.

- Enable Two-Factor Authentication (2FA): Turn on 2FA for every crypto exchange or service you use. This adds an essential layer of security beyond just a password.

- Protect Your Seed Phrase: Your wallet’s recovery phrase (or seed phrase) is the master key to your funds. Write it down and store it in a secure, offline location. Never store it digitally or share it with anyone for any reason.

- Use Strong, Unique Passwords: Avoid reusing passwords across different platforms. A unique, complex password for each account makes it harder for a breach on one site to affect your others.

- Be Cautious of Public Wi-Fi: Avoid accessing your crypto wallets or exchange accounts when connected to public Wi-Fi networks, as they can be insecure.

Always get your information and software updates from the official sources listed on the main Bitcoin Cash website. Be extremely careful about connecting your wallet to third-party applications and never click on suspicious links sent via email or direct message.

Latest News on Bitcoin Cash

Since its creation in 2017, Bitcoin Cash has continued to develop its network with a clear focus on becoming a practical peer-to-peer electronic cash system.

Here are some of the most recent changes and development in the network:

- Recent Price Movement: BCH has shown strong performance, recently hitting a 17-month high of over $650. It currently has a market capitalization of approximately $12 billion.

- 2024 Halving Event: In April 2024, Bitcoin Cash underwent its scheduled block reward halving. The reward for miners was reduced from 6.25 to 3.125 BCH per block, an event that periodically reduces the rate of new supply entering the market.

- Growing Institutional Interest: In a sign of increasing mainstream acceptance, EDX Markets, a crypto exchange backed by major financial firms like Fidelity and Charles Schwab, listed BCH upon its launch in June 2023. Additionally, Coinbase Derivatives began offering cash-settled futures contracts for BCH in April 2024.

- Network Upgrades and Adoption: The introduction of CashTokens aims to boost the network’s utility beyond simple payments. Meanwhile, BCH continues to focus on merchant adoption, with its low transaction fees (often less than a penny) making it a viable option for everyday purchases.

To stay up-to-date with the fast-paced world of BCH, it’s best to follow both official and community-run channels. For those wanting to stay on top of every development, keep a close eye on Bitcoin Cash news. You can also get information from these trusted sources:

How to Get Started With Bitcoin Cash?

Jumping into Bitcoin Cash is a pretty direct process. Since it was created for everyday use, the community has put a lot of effort into making it accessible. You don’t need to be a tech wizard to get your hands on some BCH and start using it.

Here’s a simple breakdown of the steps to get you going:

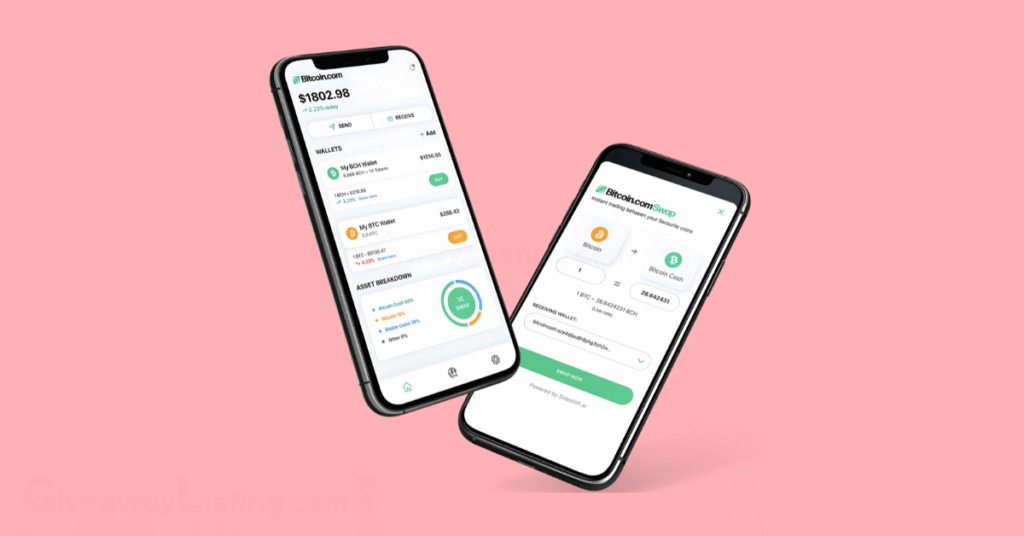

- Pick a Crypto Wallet. Before you can buy any BCH, you need a place to store it. You have a few options here. Software wallets are apps for your computer or phone, and they’re often free and easy to set up.

- Buy Some BCH. The most common way to get Bitcoin Cash is through a cryptocurrency exchange. Major platforms like Binance, Coinbase, and Kraken all list BCH. The process typically involves creating an account, confirming your identity, and then funding your account with regular money via a bank transfer or card payment. Once your account is funded, you can buy BCH.

- Secure Your Funds. After buying BCH on an exchange, it’s a good practice to move it to the personal wallet you set up in step one. Leaving your coins on an exchange means you don’t have full control over them.

- Start Using It. With BCH in your wallet, you’re ready to go. You can send it to friends anywhere in the world, or use it to pay for goods and services. A growing number of online merchants accept BCH due to its speed and low transaction costs.

The information in this guide is current as of March 2026.

What is Bitcoin Cash FAQs?

Here are answers to some frequently asked questions about Bitcoin Cash in 2026:

How Does Bitcoin Cash Work?

Bitcoin Cash operates on a Proof-of-Work blockchain, similar to Bitcoin. Its main feature is a large 32 MB block size, allowing it to process over 100 transactions per second. This design keeps confirmation times quick and fees extremely low, often under one cent, making it practical for everyday digital cash transactions.

Is Bitcoin Cash a Good Investment?

Investing in Bitcoin Cash involves significant risk due to its high volatility. It reached an all-time high of $3,785.82 in 2017 but has experienced major price corrections since. Its primary purpose is to be a functional payment system, which is a different investment case than a pure store of value asset.

What’s the Difference Between Bitcoin and Bitcoin Cash?

The key difference is block size; Bitcoin Cash has a 32 MB limit versus Bitcoin’s 1 MB. This makes BCH faster and cheaper for transactions, positioning it as ‘digital cash’ for daily use. Bitcoin, on the other hand, is generally seen as ‘digital gold,’ a store of value where security is prioritized.

What is the Downside to Bitcoin Cash?

Its network is less secure than Bitcoin’s because it has a smaller number of miners. BCH also has lower adoption and brand recognition, affecting its liquidity and market position. The project has also experienced multiple contentious hard forks, like the split that created Bitcoin SV, which has created division and uncertainty.