BNB Price History Until Today

BNB, which stands for “Build and Build,” is the cryptocurrency that powers the BNB Chain ecosystem. It was first introduced through an Initial Coin Offering (ICO) in 2017, where it was sold for about $0.10. Originally an ERC-20 token on the Ethereum network, it has since migrated to its own native blockchain, becoming a cornerstone of one of the world’s most active crypto environments.

Since its launch, BNB’s price journey has been nothing short of spectacular. After its humble beginning, the token quickly gained traction, its value growing in tandem with the rise of the Binance exchange. The token experienced a massive surge during the 2021 market-wide bull run, smashing previous records and establishing itself as a top-tier digital asset.

This growth wasn’t just a flash in the pan; it was supported by a deflationary token burn mechanism and an ever-expanding list of uses within its ecosystem. Despite market corrections and regulatory headwinds, BNB has consistently shown resilience, climbing to new all-time highs in 2026 and solidifying its position as the fifth-largest cryptocurrency by market capitalization.

BNB Price Historical Data From 2017 to 2025

BNB’s price history is a clear indicator of its growth from a simple exchange utility token to the backbone of a multi-billion-dollar ecosystem. Its valuation over the years reflects the extreme volatility and explosive growth potential inherent in the digital asset market.

| Year | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|

| 2017 | ~$8.50 | ~$0.10 |

| 2018 | ~$25.00 | ~$4.50 |

| 2019 | ~$39.50 | ~$6.00 |

| 2020 | ~$38.00 | ~$9.00 |

| 2021 | ~$690.00 | ~$38.00 |

| 2022 | ~$533.00 | ~$184.00 |

| 2023 | ~$337.00 | ~$203.00 |

| 2024 | ~$793.00 | ~$287.00 |

| 2025 | ~$859.00 | ~$512.00 |

This historical performance is directly tied to BNB’s expanding utility and strategic tokenomics. To get a better grip on the fundamentals driving these numbers, it’s useful to know what BNB is all about.

Latest BNB Price Prediction for February 2026

Entering the second half of 2026, BNB’s price has been consolidating after hitting a new all-time high above $850. The token has been trading in a range between $770 and $850, with a recent dip below the $800 mark. This type of correction is a standard market reaction following a significant rally and is often seen as a healthy sign of price discovery.

Volume analysis suggests that while institutional interest remains high, the market is currently in a holding pattern, awaiting a new catalyst to dictate the next major price move. Several key factors are influencing BNB’s price at this moment and will continue to shape its trajectory.

Some of these factors include:

- Deflationary Tokenomics: The BNB Auto-Burn system is a powerful driver of value. This mechanism automatically removes BNB from circulation every quarter based on the coin’s price and network activity. To date, more than 60 million BNB tokens have been permanently destroyed, reducing the total supply and creating deflationary pressure.

- Ecosystem Growth: The BNB Chain is a hive of activity, supporting over 2,000 projects and serving more than one million daily active users. The more that applications in DeFi, GameFi, and SocialFi build on the chain, the greater the demand for BNB to pay for transaction fees.

- Institutional Interest: Major corporate players are making significant moves into BNB. Nano Labs recently announced it holds 128,000 BNB ($108 million) and is working towards a billion-dollar reserve. Similarly, CEA Industries caused its stock to surge after announcing plans for a massive public BNB treasury.

- Network Enhancements: The BNB Chain is not standing still. The upcoming Pascal hard fork is set to dramatically increase the network’s capacity, targeting 100,000 transactions per second (TPS). This upgrade would make it one of the fastest and most scalable blockchains available.

- Utility on Binance: As the native token of the world’s largest crypto exchange, BNB enjoys built-in demand. Users get trading fee discounts, participate in exclusive token sales, and engage in various platform activities.

- Regulatory Climate: The digital asset space operates under a watchful eye. While Binance resolved a major case with U.S. authorities for $4.3 billion in 2023, ongoing regulatory discussions around the globe remain a persistent factor for all major cryptocurrencies, including BNB.

Here are some of the top algorithm-based price predictions for BNB for February 2026, keeping in mind that these are automated forecasts and can change with market conditions.

| Source/Platform | Predicted Average Price (February 2026) |

|---|---|

| Prediction 1 | $802.73 |

| Prediction 2 | $800.28 |

| Prediction 3 | $811.17 |

| Prediction 4 | $610.33 |

Best 5 BNB Price Predictions in 2026

Predicting the future price of any digital asset is a data-driven art, not an exact science. A mix of bullish fundamentals and persistent market risks shapes BNB’s outlook for 2026. On one hand, the coin’s value is supported by its deflationary token burn mechanism, which systematically reduces supply, and its central role in a rapidly growing ecosystem of applications. The increasing adoption of BNB by institutional players also adds a strong vote of confidence.

On the other hand, the crypto market is famously volatile. BNB’s price is tied to the success and reputation of the Binance exchange, and it faces a complex global regulatory landscape. Competition from other high-performance blockchains is also a constant factor.

The predictions that follow are based on a mix of algorithmic analysis and expert opinion, reflecting the different potential paths BNB could take. These forecasts should be seen as informed perspectives rather than financial certainties.

1. Standard Chartered

In a notably bullish forecast, multinational bank Standard Chartered has projected a very bright future for BNB. Analysts at the bank see BNB’s price more than doubling in 2026, with an even more aggressive long-term target of $2,775 by 2028. This optimistic outlook is grounded in the idea that BNB will maintain a strong correlation with the broader crypto market leaders, like Bitcoin and Ethereum, while also benefiting from its own unique ecosystem drivers.

The bank’s analysis points to the BNB Chain’s established position in the market and its ability to capture a significant share of the value in the expanding digital asset economy. This prediction is one of the most positive from a mainstream financial institution, signaling a growing acceptance of BNB as a key asset in the crypto space.

2. CoinCodex

The algorithm-based forecasting platform CoinCodex offers a detailed, data-driven prediction for BNB in 2026. Their model anticipates BNB trading within a wide channel, with a potential low of $740.04 and a high of $1,192.05 by the end of the year. The projection suggests a significant upside, with an average price target that would represent a substantial return for current holders.

This forecast is generated by analyzing historical price data, trading volume, and key technical indicators. The model points to a generally bullish sentiment, citing factors like consistent green-day performance and a market sentiment index reflecting “Greed.” The wide range in the prediction also accounts for the market’s inherent volatility, providing both a conservative floor and an optimistic ceiling.

3. Changelly

The analysis from Changelly offers a more restrained outlook for BNB in 2026. Their technical analysis suggests an average trading price of around $676.31, with a potential low of $574.03 and a high of $625.17. This forecast appears to place more weight on potential market headwinds and technical resistance levels.

This more conservative prediction serves as a useful counterpoint to more bullish forecasts. It reflects a scenario where BNB might face challenges in breaking past previous resistance or where the broader market might experience a cooling-off period. It’s a reminder that not all analyses point to immediate and explosive growth, and that a range of outcomes is always possible.

4. DigitalCoinPrice

DigitalCoinPrice provides another algorithm-driven forecast, which points toward continued upward momentum for BNB. While their long-term predictions are exceptionally high, their more immediate analysis for 2026 suggests a steady climb. Their models, which take into account historical volatility and market trends, align with a broader consensus that BNB is on a positive trajectory.

The platform’s predictions are rooted in a technical framework that identifies prevailing trends. For 2026, the outlook remains positive, supported by the strong foundational elements of the BNB ecosystem, such as its ongoing development and high user activity, which continue to drive demand for the token.

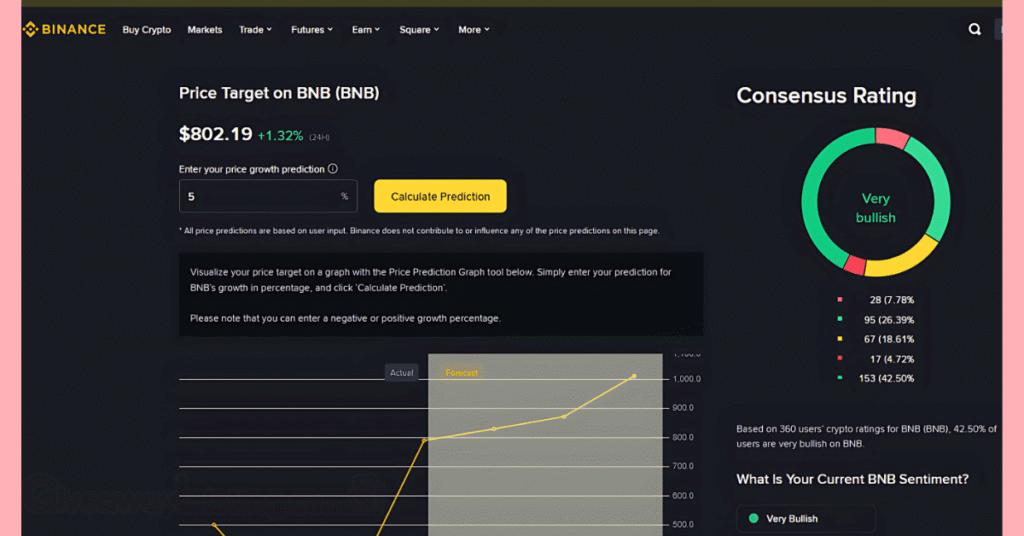

5. Binance User Consensus

The price prediction feature on the Binance exchange itself provides a unique look into the collective sentiment of its users. Based on the input of thousands of traders on the platform, the consensus rating for BNB is currently “Very Bullish.” For 2026, users collectively forecast an average price of $802.19.

This prediction is less about complex algorithms and more about the “wisdom of the crowd.” It reflects the confidence that the platform’s own user base has in the token’s future performance. While driven by sentiment, it’s a powerful indicator of how the most engaged participants in the BNB ecosystem view its potential.

Is BNB a Good Investment?

BNB has firmly established itself as more than just a speculative digital token; it is a utility-rich asset at the heart of a massive and functional blockchain ecosystem. Its primary role is to fuel operations on the BNB Chain, where it’s used to pay for transaction fees, participate in network governance, and interact with thousands of decentralized applications (dApps) spanning DeFi, gaming, and more. This built-in utility creates a constant and organic demand for the token.

Beyond its function as a gas for the network, BNB’s investment case is strengthened by its deflationary tokenomics. Binance’s quarterly Auto-Burn mechanism permanently removes a portion of BNB from circulation. This shrinking supply is designed to increase the scarcity and, potentially, the value of the remaining tokens over time. When combined with its deep integration into the world’s largest cryptocurrency exchange for fee discounts and access to token sales, BNB presents a multi-faceted investment profile.

However, no investment is without its risks, and BNB is no exception. The token’s fate is closely linked to the reputation and operational success of Binance, making it susceptible to any negative news or events surrounding the exchange. The regulatory environment is perhaps the most significant uncertainty. While Binance settled a major case with U.S. authorities, the global regulatory framework for digital assets is still taking shape, and future rulings could impact BNB’s market.

The BNB Chain has also faced criticism regarding centralization due to its relatively small number of 21 validators, which some argue makes it less resilient than more decentralized networks. Finally, intense competition from other Layer 1 and Layer 2 blockchains, all vying for developers and users, means BNB must constantly innovate to maintain its market position.

So, is BNB a good investment? For investors who believe in the long-term growth of the BNB Chain ecosystem and are comfortable with the inherent risks of the crypto market, the answer is yes. The combination of strong utility, a deflationary supply, and a massive, active user base provides a solid foundation for potential appreciation. Its performance has historically outpaced many competitors, and growing institutional interest adds another layer of validation. However, it is not a low-risk asset. Its value can be volatile, and regulatory pressures are a real and ongoing concern.

Investing in BNB requires a belief in its ecosystem’s ability to continue expanding and attracting users and developers.

Here are the basic steps to follow for those looking to invest in BNB:

- Do Your Research: Fully understand what BNB is, its use cases, and the risks involved.

- Choose an Exchange: Select a reputable cryptocurrency exchange that lists BNB, such as Binance, Kraken, or Coinbase.

- Create and Verify Your Account: Sign up for an account and complete the necessary identity verification (KYC) process.

- Fund Your Account: Deposit fiat currency (like USD, EUR) via bank transfer, credit card, or other available payment methods.

- Purchase BNB: Go to the trading section, find the BNB pair (e.g., BNB/USD), and place an order to buy the desired amount.

- Secure Your BNB: For long-term holding, consider moving your BNB off the exchange and into a personal wallet for greater security.

How to Buy BNB?

Buying BNB is a straightforward process on most major cryptocurrency exchanges. First, you’ll need to create an account on a platform that supports BNB trading. This typically involves providing an email address, creating a password, and completing an identity verification process as required by regulations.

Once your account is set up and verified, you can deposit funds using a variety of methods, including credit/debit cards, bank transfers, or by transferring other cryptocurrencies you may own. After your account is funded, find the BNB market, specify the amount you wish to purchase, and confirm the transaction. The BNB will then be credited to your exchange wallet.

How to Sell BNB?

Selling BNB is just as simple as buying it. If your BNB is stored in a personal wallet, you’ll first need to transfer it to an exchange that supports BNB trading. Once the BNB is in your exchange wallet, you can go to the trading interface and place a sell order.

You can choose to sell your BNB for a fiat currency like USD or trade it for another cryptocurrency like Bitcoin or a stablecoin like USDT. After the sale is executed, the funds will be available in your exchange account, from where you can withdraw them to your bank account or use them for other trades.

BNB Forecast After 2026

BNB’s history is a story of explosive growth punctuated by the sharp corrections typical of the digital asset market. From its ICO price of just over ten cents, the token has climbed to valuations hundreds of thousands of percent higher, creating immense value for early backers.

This ascent included the prolonged crypto winter of 2018 and other significant downturns that tested the resilience of the entire market. Yet, through each cycle, BNB has emerged stronger, driven by the expansion of its ecosystem and its deflationary tokenomics.

Comparing the current price to five years ago puts this growth into stark perspective. In mid-2020, BNB was trading for well under $40. As of 2026, the token is trading in a range of $770-$850, which is an increase of over 2,000% in just half a decade. This performance has consistently placed it among the top-performing large-cap digital assets, turning it from a simple exchange utility token into a foundational piece of the Web3 infrastructure. The question now is whether this momentum can be sustained in the years to come.

BNB Price Forecast for 2026

Entering 2026, most predictive models suggest continued positive momentum for BNB, though the exact figures vary. Some algorithm-based forecasts place BNB in a trading range between a conservative low of around $862 and a potential high of $1,284. Other, more bullish analyses suggest the year could see BNB push toward $1,588.

The primary drivers for this expected growth remain the deflationary pressure from token burns and the continued expansion of the BNB Chain ecosystem. If the network successfully implements its scalability upgrades and attracts more high-volume applications, these price targets could be well within reach.

BNB Price Forecast for 2027

By 2027, the price predictions for BNB begin to diverge more significantly, highlighting the long-term uncertainty of the market. Some technical analyses point to a potential trading range between $1,945 and $2,300. These forecasts assume that the BNB Chain will have solidified its position as a leading smart contract platform and that the broader crypto market will be in a positive cycle. A key factor will be how well the “One BNB” paradigm, which integrates storage, computation, and scaling solutions, is adopted by developers building next-generation dApps.

BNB Price Forecast for 2028

The year 2028 is a key focal point for one of the most optimistic long-term predictions from a major financial institution. Standard Chartered Bank has set a target of $2,775 for BNB by the end of 2028. This forecast is based on BNB maintaining a strong correlation with Bitcoin and Ethereum while also capturing value from its own ecosystem’s growth.

In contrast, some automated prediction models offer a more conservative outlook, with figures closer to the $2,900 to $3,344 range. The actual outcome will likely depend heavily on the global regulatory climate for digital assets and BNB’s ability to fend off fierce competition.

BNB Price Forecast for 2029

Looking ahead to 2029, the forecasts become even more speculative, with a very wide range of potential outcomes. More aggressive prediction models see BNB potentially reaching a high of $5,001, assuming a sustained bull market and successful execution of the BNB Chain’s long-term roadmap.

These predictions are based on the compounding effect of token burns and exponential growth in on-chain activity. A more moderate forecast places the token in a range between approximately $4,129 and $5,001.

BNB Price Forecast for 2030

By the end of the decade, forecasts for BNB’s price are extremely varied. Some models predict a potential high of over $7,227, while others offer a more grounded but still bullish range between $6,203 and $7,227.

Reaching such valuations would require the BNB Chain to become an indispensable piece of the Web3 economy, with millions of daily users and a thriving developer community. Factors like the success of its Layer 2 scaling solutions (opBNB) and decentralized storage (BNB Greenfield) will be critical in determining if these long-range targets are met.

Trading Strategies for BNB

Given its high liquidity and significant daily trading volume, BNB is a popular asset for traders. However, its price can be subject to sharp and sudden movements, making it essential to approach the market with a clear plan.

Trading without a strategy is akin to gambling; it leaves you exposed to emotional decision-making and unnecessary risk. A well-defined strategy helps you set clear entry and exit points, manage your capital, and stay disciplined, whether the market is trending up, down, or sideways.

Here are some trading strategies you should consider:

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging is one of the most accessible and disciplined ways to build a position in an asset like BNB. The approach is simple: you invest a fixed amount of money at regular intervals, such as weekly or bi-weekly, regardless of the coin’s price at that moment. For example, you might decide to buy $50 worth of BNB every Friday. When the price is high, your $50 buys fewer tokens, and when the price is low, it buys more.

This method smooths out your average purchase price over time, reducing the risk of investing a large sum at a market peak. It’s a powerful tool for taking emotion out of the equation; instead of trying to “time the market,” you commit to a consistent investment schedule. Many exchanges offer recurring buy features that can automate this process, making it a “set and forget” strategy that is perfect for beginners and long-term investors alike.

Swing Trading

Swing trading is a strategy designed to capture price movements, or “swings,” over a few days to several weeks. Unlike day trading, you aren’t closing your positions at the end of each day. Instead, you’re looking to profit from the larger waves of market momentum. Swing traders often rely on technical analysis to identify potential entry and exit points.

A common swing trading approach for BNB might involve buying the token when it bounces off a key support level and selling it as it approaches a known resistance level. Another popular technique is to use moving average crossovers; for example, a trader might enter a long position when a shorter-term MA (like the 50-day) crosses above a longer-term MA (like the 200-day), signaling a potential uptrend. This strategy requires more active management than DCA but can be effective in markets with clear trends.

HODLing

HODL is crypto slang for holding on for the long haul, and as a strategy, it’s rooted in fundamental conviction. A HODLer buys BNB not to profit from short-term price swings, but because they believe in the long-term value and growth potential of the BNB Chain ecosystem. This approach requires patience and the ability to withstand significant market volatility without panic selling.

The focus for a HODLer is not on daily price charts but on the underlying fundamentals of the project. This includes tracking growth in daily active users, the number of dApps being built on the network, advancements in the technology, and the effectiveness of the token burn mechanism.

The thesis is that as the ecosystem grows and the token supply decreases, the value of BNB will naturally increase over a multi-year time horizon. For this strategy, secure storage is critical, and many HODLers move their assets off exchanges to personal hardware wallets.

Futures Trading

BNB Futures trading is an advanced strategy that allows you to speculate on the future price of BNB without owning the token itself. This is done through derivative contracts that track BNB’s price. The main feature of futures trading is the ability to use borrowed funds to open positions that are much larger than your own capital. This can amplify profits, but it also dramatically increases the risk of significant losses. A 10x position, for instance, means a 10% market move can either double your money or wipe out your entire position.

Futures traders can go “long”, betting the price will go up, or “short”, betting the price will go down, making it possible to profit in any market condition. This also makes futures a powerful tool for hedging. For example, if you hold a large amount of BNB in a spot wallet, you could open a short futures position to protect your portfolio against a potential price drop.

Due to the high risks involved, futures trading is generally recommended only for experienced traders who have a deep understanding of the market and strong risk management practices.

How to Learn More About BNB?

The BNB ecosystem is vast and multi-layered, which can make it a complex world for newcomers to get to grips with. The token is more than just a tradable asset; it’s a utility tool for paying fees, a governance instrument for voting on the network’s future, and the lifeblood of thousands of applications.

Getting a handle on all these moving parts is key to making informed trading or investment decisions, as the token’s value is tied to this entire ecosystem’s health and growth.

For those looking to build a solid foundation of knowledge, there are several excellent places to start. These resources range from beginner-friendly explainers to deep technical documentation, catering to all levels of interest and expertise.

- Binance Academy: This is the official educational platform from Binance and is arguably the best starting point for anyone new to crypto. It offers a huge library of articles, videos, and glossary terms that break down everything from basic blockchain concepts to complex DeFi strategies. The content is well-organized and designed to be easily digestible for beginners, with quizzes and “learn and earn” campaigns that reward you with small amounts of crypto for learning.

- BNB Chain Documentation: For those who want to go beyond the basics and understand the technology that powers BNB, the official BNB Chain documentation is the definitive source. This is a more technical resource that details the architecture of the BNB Smart Chain, opBNB, and BNB Greenfield. It’s the go-to place for developers, but it’s also valuable for investors who want to understand the specifics of the consensus mechanism, governance model, and future technical upgrades.

- Data Aggregators like CoinGecko and CoinMarketCap: These platforms are indispensable tools for any crypto investor. They provide real-time price data, historical charts, market capitalization rankings, and trading volumes. More importantly, they serve as portals to the broader ecosystem.

- Reputable Crypto News Outlets: The crypto market moves fast, and staying informed is critical. Following major news platforms like Giveaway Listing, CoinDesk, and Decrypt will keep you updated on market-wide trends, regulatory news, and major developments that can impact BNB’s price. Tracking the latest developments is a crucial part of any sound investment strategy, and it’s always a good idea to stay on top of the most current BNB news.

- Community Forums and Social Media: Platforms like Reddit, specifically the r/binance subreddit and X (formerly Twitter), can be great for gauging real-time market sentiment and engaging in discussions with other investors. You can find valuable insights and analysis from experienced traders. However, these platforms must be approached with caution. They are also rife with misinformation, scams, and hype. Always be critical of the information you find and never act on financial advice from anonymous online accounts.

- TradingView: For anyone interested in the technical analysis side of trading, TradingView is an essential tool. It offers advanced charting software that allows you to analyze BNB’s price action with a full suite of indicators, drawing tools, and chart patterns. The platform also has a social component where traders share their analyses and market outlooks. .

This guide has provided a detailed look at BNB, from its historical price performance to the key factors that influence its value. We’ve explored a range of expert price predictions for 2026 and beyond, offering a balanced view of the token’s potential future. Additionally, we’ve outlined the core arguments for and against investing in BNB and detailed several popular trading strategies that can be adapted to different risk appetites and goals.

By combining this information with your own ongoing research, you can build a well-rounded perspective on BNB’s role in the market. The information provided in this guide is current as of February 2026.

BNB Price Prediction FAQs

Here are answers to some frequently asked questions about the BNB price prediction in 2026:

How Much Will 1 BNB be Worth in 2026?

Analyst predictions for the end of 2026 vary, with many placing BNB’s value between $926 and $1,292. After hitting an all-time high of $859.01 earlier in the year, its price is influenced by continued token burns and the growth of its ecosystem, which now supports over 2,000 projects.

Can BNB Hit $10,000?

Reaching $10,000 is a very long-term possibility that would require massive market growth. This would give BNB a market cap of over $1 trillion. Some ultra-long-term forecasts for the 2030s see prices climbing into five figures, but this depends on sustained adoption and the deflationary token burns continuing to reduce supply toward the 100 million target.

Is BNB Worth Buying?

BNB’s value is supported by its utility for paying fees on the world’s largest exchange and within its ecosystem of over 2,000 dApps. Its deflationary token burns have removed over 60 million tokens from circulation, creating scarcity. However, investors should be aware of regulatory risks and the token’s close connection to the Binance platform’s performance.

Which is Better, BNB or Ethereum?

Choosing between them involves a trade-off. The BNB Chain offers faster and cheaper transactions, with a block time of just 3 seconds. Ethereum, on the other hand, is widely considered to be more decentralized. The better choice depends on whether a user prioritizes speed and low cost or a higher degree of network decentralization.

Is BNB or Solana Better?

This depends on user priorities. Solana is often recognized for its very high transaction speeds, but it has faced network outages. The BNB Chain has a more established ecosystem with over one million daily active users and a larger number of active dApps. The choice is between Solana’s raw speed and BNB Chain’s more mature and currently larger ecosystem.

Is BNB Being Phased Out?

There is no evidence that BNB is being phased out; in fact, its ecosystem is actively expanding. The development roadmap includes the Pascal hard fork, which aims for a capacity of 100,000 transactions per second. The token’s rebranding to “Build and Build” and its ongoing deflationary mechanics signal a strong focus on future growth, not decline.