Solana Airdrop 2026: An In-depth Guide

Solana has quickly become the bustling frontier for airdrop hunters, and for good reason. It’s not just about the network’s lightning-fast speed and low transaction fees, though that certainly helps. It’s about a growing ecosystem where projects are actively rewarding users for their participation, turning everyday DeFi actions into potential paydays. If you’ve been on the sidelines, 2026 is the year to get in the game.

This article provides an in-depth look at all the details you need, as of January 2026. We’ll cover key Solana airdrop statistics, farming tips, and top Solana airdrop projects. Also, we’ll make sure to direct you to the best Solana airdrop checker tool and highlight the top Solana airdrop Telegram bots to help you stay ahead.

Solana Airdrop Key Statistics of January 2026

The numbers behind some of Solana’s airdrops show massive user growth and some of the most valuable token distributions in recent memory. While Solana has had some significant events, it’s always interesting to see how they compare to the best airdrops from other networks.

- The Jupiter exchange airdropped 4 billion JUP tokens, representing 40% of its total supply, with a value exceeding $2 billion based on market prices.

- Solana’s network can theoretically handle over 65,000 transactions per second, making large-scale token distributions fast and cheap.

- The meme coin Bonk kicked off a major wave of community engagement by airdropping 50% of its total supply to Solana community members, developers, and artists.

- The data oracle Pyth Network allocated 600 million PYTH tokens for its airdrop campaign to reward users of dApps that relied on its data feeds.

- Solana’s Total Value Locked (TVL) in liquid staking saw explosive growth, jumping from $1.7 billion to $8.3 billion in under a year.

- The gaming-focused SVM chain, Sonic, secured $12 million in funding, signaling strong investor interest in new projects likely to reward early users.

- The Solayer airdrop successfully distributed tokens to over 200,000 individual wallets, demonstrating the scale of these events.

- Backpack, a key wallet and exchange in the ecosystem, raised a total of $37 million, with many users farming its platform for a potential future token drop.

- Projects are dedicating significant portions of their token supply to rewards, with lending platform Kamino allocating 3.5% of its tokens for its Season 2 airdrop.

- The AI project KRAIN offers users a simple way to earn points, giving 5,000 points just for creating an account and another 3,000 for confirming an email address.

8 Profitable Solana Airdrop Farming Tips

The buzz around Solana isn’t just about its speed; it’s about the constant stream of projects dropping tokens to active users. This has created a vibrant scene for airdrop farming, where interacting with the ecosystem can yield significant rewards.

To farm successfully in 2026, you need a smart approach. Below are eight solid tips to help you get in on the action and increase your chances of catching the next big Solana airdrop.

1. Always Use a “Burner” Wallet

This is rule number one for a reason. A burner wallet is a separate, secondary crypto wallet you create specifically for interacting with new dApps and chasing airdrops. Think of it as your public-facing account, completely separate from the wallet where you store your main crypto holdings. This is your single most important security practice.

Connecting your primary wallet to a malicious site, even by accident, can put all your assets at risk. By using a burner, you isolate that risk. Fund it with just enough SOL to cover transaction fees and the minimum capital needed for the farming activity. If something goes wrong, you only stand to lose what’s in that specific wallet, not your entire portfolio.

2. Be an Active DeFi Participant

The days of receiving airdrops for simply holding a token are largely behind us. Today’s projects reward active participation. This means you need to use the platforms. The most common activities that projects track for retroactive airdrops are swapping tokens on decentralized exchanges (DEXs), lending and borrowing assets, and providing liquidity to pools.

You can make a habit of using key protocols. Even small, consistent activity is often better than one large, isolated transaction. Projects use snapshots to record user activity at specific points in time, so regular engagement shows you’re a genuine user of the Solana ecosystem.

3. Get into Liquid Staking

Liquid staking has become a cornerstone of the Solana DeFi scene. Instead of just locking up your SOL with a validator, liquid staking protocols like Jito or Sanctum give you a liquid staking token (LST) in return, such as JitoSOL (jSOL) or JupSOL. This LST represents your staked SOL but remains usable across other DeFi applications.

This creates a powerful “double-dipping” opportunity. You earn staking rewards on your SOL while also using the LST to farm points on other protocols. For example, you can take your jSOL and deposit it into a lending platform to earn lending interest and airdrop points from that platform, all while still being eligible for any rewards from the liquid staking provider itself. It’s an efficient way to make your capital work harder for you.

4. Hunt for New and Testnet Projects

The biggest rewards often go to the earliest adopters. Getting involved with a project before it has a token or is widely known can put you in a prime position for a future airdrop. One of the best ways to do this is by participating in testnets. Developers need users to test their applications for bugs and usability before launching on the leading network.

Follow Solana-focused accounts on X and join the Discord or Telegram communities of new projects. This is where you’ll find announcements about testnet phases. Participating might involve using a faucet to get free testnet tokens and then performing specific actions on the platform. It costs you nothing but time and can be a great way to qualify for rewards when the project goes live.

5. Spread Your Bets with Multiple Wallets

Many dedicated airdrop farmers use multiple wallets to interact with protocols. The logic is simple: if a project allocates a set amount of tokens per eligible wallet, having more eligible wallets could mean a larger total reward. This can be an effective way to increase your potential outcome, especially for airdrops that don’t weigh allocations heavily based on the volume of capital used.

However, proceed with caution. Projects are becoming increasingly better at detecting Sybil attacks, where one person uses hundreds or thousands of wallets to manipulate the system. They use sophisticated methods to identify and disqualify wallets that appear to be controlled by a single entity.

If you choose to use multiple wallets, ensure they are visually distinct. Fund them from different sources if possible, and vary your interaction patterns and timing to avoid leaving an obvious footprint.

6. Focus on Volume and Consistency

A single $10 swap is unlikely to get you a significant airdrop. Many projects now use point systems that heavily favor sustained activity and transaction volume. Jupiter’s airdrop, for example, had tiers based on total swap volume, with users who traded over $1,000 or even $20,000 receiving much larger allocations.

Instead of performing numerous small, random transactions, focus your efforts. It can be more effective to build up a respectable transaction volume on a few key protocols you believe in. Consistency is also important. Interacting with a platform on a weekly or monthly basis over several months appears more organic than a flurry of activity right before a potential snapshot.

7. Participate in Governance

Decentralization is a core tenet of crypto, and many projects aim to hand over decision-making to their communities through governance tokens. A great way to demonstrate your commitment is to participate in this process. This means using a project’s tokens to vote on proposals.

If you receive tokens from one airdrop, don’t just sell them immediately. Consider staking some and using them to vote on the platform’s governance forum. Some projects have made governance participation a specific criterion for future airdrop rounds or other rewards. It demonstrates your commitment to the project’s long-term success, not just a quick profit.

8. Master the Combo Play

Advanced airdrop farming involves creating a chain of interactions that allows you to earn points from multiple protocols simultaneously with the same capital. This is a step beyond the simple liquid staking combo and requires a bit more planning.

For example, a user might supply USDC to a lending protocol like Loopscale and borrow against it. Then, they could take the borrowed USDC and provide it as liquidity on a stablecoin-focused DEX like Perena.

Another combination involves taking a liquid staking token, such as jitoSOL, restaking it on a platform like Fragmetric to obtain fragSOL, and then providing that fragSOL as liquidity on a yield trading protocol like RateX. This way, a single pile of capital is actively generating points and eligibility across two or three different projects simultaneously.

Top Solana Airdrop Projects List

Solana has been home to some of the most talked-about token distributions in crypto history. The Jupiter (JUP) airdrop was a monster event, dropping 40% of its total supply to early users, with an initial market value in the billions.

Similarly, Jito (JTO) rewarded its early liquid stakers with a valuable token that gave them a say in the protocol’s future. Even the meme coin Bonk made waves by dropping 50% of its supply to the community, single-handedly reviving engagement across the network during a market lull.

These events set the tone, rewarding genuine on-chain activity, such as trading, staking, and providing liquidity, rather than simple social media tasks. They proved that interacting with the ecosystem could be incredibly rewarding and helped establish Solana’s reputation as a hotspot for some of the best airdrops available. The current season of farming is built on the success of these past giants.

Here is a list of some of the top projects that have conducted airdrops or are running ongoing rewards programs:

- Kamino: A leading lending and borrowing platform on Solana that has moved to a seasonal points system. Users earn points for supplying assets, borrowing, and using leveraged “multiply” vaults. Season 3 is currently active after two successful token distributions.

- Sanctum: A liquid staking protocol that gamified the process with ‘Pets,’ where holding different Liquid Staking Tokens (LSTs) earns XP. After a successful Season 1 and CLOUD token launch, the community is eagerly awaiting the start of Season 2.

- Marginfi: One of the oldest lending protocols on Solana, marginfi has a long-running points program. Users earn points for lending assets (1 point per dollar per day) and borrowing (4 points per dollar per day), with borrowing being weighted more heavily.

- Perena: A stablecoin-focused protocol backed by prominent investors. It’s building a hub for stablecoin swaps and collateralized debt positions. Users can earn points by providing liquidity to their pools now.

- Fragmetric: A liquid restaking platform built on Jito’s model that has attracted significant capital. Users can stake various LSTs to earn both restaking yield and points toward a future airdrop.

- Backpack: More than just a wallet, Backpack is also a centralized exchange with deep roots in the Solana ecosystem. Users have been actively trading on the exchange to farm rewards in anticipation of a massive, highly-rumored token airdrop.

- Meteora: A dynamic liquidity protocol for DeFi that is a key part of the Jupiter ecosystem. It is running an ongoing points campaign where users earn rewards for providing liquidity to its dynamic pools.

How to Participate in the Krain Solana Airdrop?

Krain is carving out a unique niche in the intersection of AI and crypto. It’s an AI agent platform and marketplace where anyone can create and launch their own AI agents that come equipped with crypto wallets.

These agents can perform tasks, interact with other agents, and handle transactions on the Solana network. The project’s goal is to build a massive, searchable marketplace of AI agents, each with its own profile page, making it easy to find and hire them for specific jobs.

Here’s a step-by-step guide to participating and earning Krain points:

- Create an Account: Head over to the Krain airdrop page and sign up. This first step will net you a cool 5,000 points right off the bat.

- Connect Your Wallet: You’ll need a Solana wallet for this. Connecting one of the best wallets for airdrops, like Phantom or Backpack, to your Krain account adds another 1,000 points to your total.

- Link Socials: Connect your X (formerly Twitter) account for an additional 2,000 points.

- Confirm Your Email: Add and confirm your email address. This is a crucial step that not only secures your account but also gives you a bonus of 3,000 points.

- Use Your Referral Link: Share your unique referral link with friends. For every person who signs up using your link, you’ll get 1,000 points. There’s no stated cap on referrals, so this is a great way to boost your score.

- Engage on Telegram: Krain recently added a way to earn points through daily Telegram activity. You can earn up to 1,000 points daily by sending messages in the main Krain Telegram group and another 1,000 points for commenting on posts in their announcements channel.

What is the Best Solana Airdrop Checker Tool?

Trying to manually keep track of every potential Solana airdrop you might be eligible for is a quick way to lose your sanity. That’s why a good airdrop checker is an essential tool for any serious farmer.

Here are some of the best Solana airdrop checker tools you can use:

SonarWatch

SonarWatch is more than a simple checker; it’s a full-fledged Solana dashboard. Its biggest selling point is security and convenience: you can check any wallet’s eligibility simply by pasting the public address, without requiring a wallet connection. This completely removes the risk of connecting to a malicious site.

Beyond its dedicated airdrop checker, the tool gives you a complete picture of what’s happening in a wallet. You can see token balances, all active DeFi positions (like lending or liquidity pools), staked assets, and NFTs held. This makes it incredibly useful for not only spotting potential airdrops but also for getting a quick overview of your entire on-chain portfolio without compromising your security.

Drops.bot

Drops.bot is a specialized tool built for the dedicated airdrop hunter. Like SonarWatch, it operates on a security-first principle, allowing you to check eligibility for any wallet address without connecting it. The platform tracks a huge number of airdrops not just on Solana but across multiple other blockchains, making it a great multi-chain tool.

Its standout feature is the premium alert system. Premium users can set up real-time Telegram alerts for their tracked wallets. The moment a new airdrop is announced and your wallet is eligible, you get a notification. This gives you a serious edge, ensuring you never miss a claim deadline. The platform also provides verified, safe links for claiming, which helps protect you from common phishing scams.

Step Finance

Step Finance is a popular portfolio tracker in the Solana ecosystem that doubles as an excellent airdrop management tool. It pulls all your on-chain data, tokens, liquidity pool positions, yield farms, and staked assets from all your wallets into a single, clean dashboard. This alone makes it invaluable for seeing your entire Solana footprint in one place.

Where it shines for airdrop hunters is its “Claimable Rewards” feature. The dashboard automatically scans all the protocols you’ve interacted with and aggregates any claimable tokens or rewards into one section. This saves you the hassle of visiting every single dApp individually to see if you have tokens waiting. It’s perfect for finding those smaller, forgotten rewards that can add up over time.

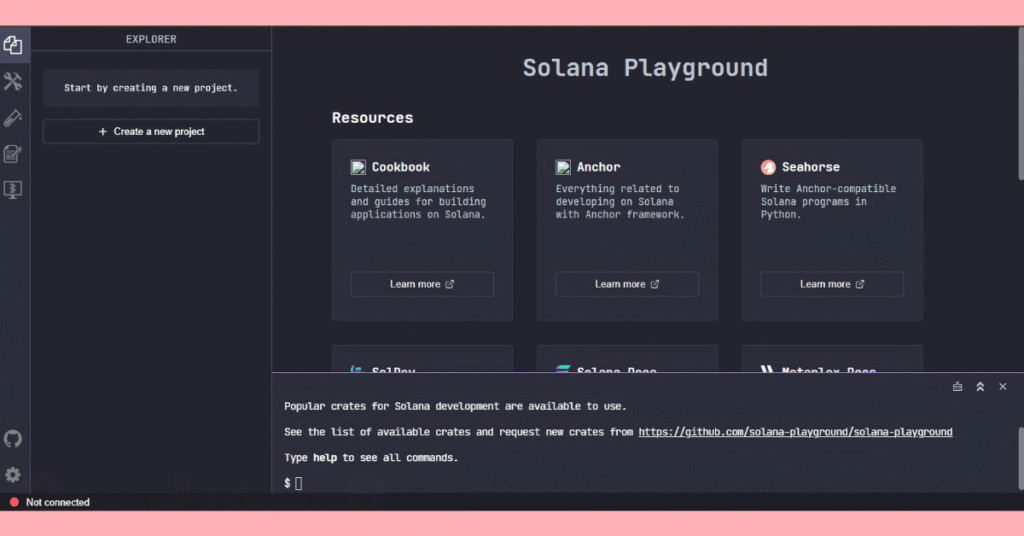

How to Get Solana Airdrop Devnet?

Obtaining Devnet SOL is a crucial first step for anyone looking to build, test, or experiment with applications on the Solana network without risking real money. The Devnet is a playground, a testing environment that mirrors the main network, but its tokens have no financial value.

The most common method for developers is to use the Solana Command Line Interface (CLI). After installing the CLI, you can request a test SOL with a simple command: solana airdrop 2. This will send 2 Devnet SOL to your configured wallet address.

It’s essential to note that these faucets have rate limits in place to prevent abuse, so you can’t request an unlimited supply. Typically, you can request a small amount of SOL every few hours. You need to ensure that your CLI is set to the Devnet cluster by using the command solana config set-- url https://api.devnet.solana.com.

For those who prefer a graphical interface or aren’t comfortable with command lines, web-based faucets are the easiest option. Several websites, including one run by the Solana Foundation.

You visit the site, enter your Devnet wallet address, and request the tokens. Some may have a simple captcha to complete. Another user-friendly option is through Discord communities. Developer-focused communities, such as LamportDAO, have bots that allow you to request Devnet SOL by running a simple command in a specific channel, such as/drop <your-wallet-address> <amount>.

Top Solana Airdrop Telegram Bots

Telegram bots enable you to trade, snipe new token launches, and manage your portfolio directly within the Telegram app, providing a fast and mobile-friendly alternative to traditional web-based exchanges. Beyond just trading, interacting with these bots has become a popular method for airdrop farming, as many bot projects reward their active users with a share of their fees or future token drops.

Some top Solana Telegram bots include the following:

- Trojan on Solana: Trojan, which was previously known as Unibot on Solana, is one of the most feature-rich trading bots on the network. It’s a favorite among serious traders for its advanced capabilities, including the ability to snipe liquidity pools for new tokens the moment they launch, copy trade successful wallets, and set up complex orders like limit buys and sells.

- BONKbot: Using BONKbot is not just for trading; it’s a way to engage with the wider BONK ecosystem. The bot has a revenue-sharing model tied to the BONK token, and general activity within the Solana community is often a factor for airdrops. By being an active BONKbot user, you signal your participation in one of Solana’s most vibrant communities, which could make you eligible for future rewards tied to BONK or its partner projects.

- Snorter Bot: This is another Telegram-based trading tool that has gained attention specifically for its straightforward airdrop campaign. It provides a suite of trading functions, including sniping, wallet tracking, and limit orders, all designed for speed and efficiency. Users earn SNORT points for free simply by using the bot’s features and, most importantly, by referring other traders to the platform.

Upcoming Solana Airdrop News in 2026

The Solana airdrop scene in 2026 isn’t slowing down; it’s just getting more refined. After successful token launches, platforms like Sanctum, Drift, and Kamino are already rolling out their next reward seasons. Kamino has moved into its third season of points farming, while the community is hotly anticipating the second season for Sanctum’s staking rewards and Drift’s trading-based incentives.

Beyond the established players, a fresh batch of well-funded, tokenless projects is on the horizon. Sonic, an SVM chain focused on gaming, recently raised $12 million and is expected to launch its token in 2025, making its testnet a prime farming ground.

The DePIN (Decentralized Physical Infrastructure) sector is also heating up, with projects like Grass and Nodepay rewarding users for sharing unused internet bandwidth. Finally, AI-related projects are joining the fray; Kaito AI, for example, is running a social campaign where users earn “yap points” for engagement, which is widely expected to convert into a token airdrop.

Wrapping Up With Solana Airdrops in 2026

This guide has walked you through everything you need to know to get in on the Solana airdrops. We’ve examined the key statistics driving the hype, eight profitable farming tips, and a list of top projects to watch.

We also provided you with a specific playbook for the Krain airdrop, reviewed the best airdrop checker tools, explained how to obtain Devnet SOL for testing, highlighted the top Telegram trading bots, and covered the latest news.

To cap it all off, here are some of the most interesting takeaways:

- The Jupiter exchange distributed over $2 billion worth of JUP tokens in one of the largest airdrops in crypto history.

- The meme coin Bonk gave away 50% of its entire supply to the community, helping to kickstart a wave of network activity.

- Borrowing assets on the lending platform marginfi can earn you points 4 times faster than just supplying them.

- The AI project Krain gives new users 5,000 points just for creating an account, making for a very low-barrier entry.

- Solana’s Total Value Locked (TVL) in liquid staking exploded from $1.7 billion to over $8.3 billion in less than a year.

- Trading bot project Snorter Bot has allocated 10% of its total token supply for its user airdrop campaign.

This information is current as of our last update in January 2026. Good luck and happy farming.

Solana Airdrop FAQs

Here are answers to some frequently asked questions about Solana airdrops 2026:

How High Will Solana Get In 2025?

Various forecasts suggest Solana could challenge its past all-time high of nearly $260. Some bullish projections for 2026 see SOL reaching between $400 and $600, driven by ecosystem growth. This depends on continued adoption of its network, which is capable of processing over 65,000 transactions per second.

Can Solana Reach 5000 Dollars?

For Solana to hit $5,000, its market capitalization would need to exceed $2.3 trillion. This figure is nearly double Bitcoin’s peak market cap of around $1.3 trillion, making it an extremely ambitious target. While not impossible in the distant future, it would require a massive expansion of the entire crypto market.