SOL Price History Until Today

Solana (SOL) is a high-performance blockchain platform made for decentralized applications (dApps) and crypto projects. Launched in March 2020, it’s known for its incredible speed and low transaction fees, making it a favorite for developers in areas like decentralized finance (DeFi) and non-fungible tokens (NFTs). The network’s own currency, SOL, is used for paying transaction fees and for staking to keep the network secure.

Since its public launch, the price of SOL has been on a wild ride. It started at a modest $0.22 during its initial public auction in March 2020 and hit an all-time low of $0.51 in May of the same year. However, during the crypto boom of 2021, driven by massive interest in DeFi and NFTs, SOL’s price shot up by an astonishing 12,000%, reaching an all-time high of $259.96. The network’s popularity surged, with its market cap exceeding $74 billion in November 2021.

The market downturn in 2022 and the collapse of the FTX exchange, which held a significant amount of SOL, hit the token hard, causing its price to drop significantly. Despite these challenges and several network outages that raised questions about its stability, Solana has shown remarkable resilience. The price began a strong recovery in late 2023, and this upward trend continued into 2024 and 2025, supported by growing institutional adoption and a maturing ecosystem.

Solana Price Historical Data From 2020 to 2025

The price journey of SOL has been marked by extreme highs and lows, reflecting the volatile nature of the cryptocurrency market and the platform’s own set of triumphs and challenges. From its initial offering to its peak and subsequent recovery, the fluctuations tell a story of rapid growth and resilience.

The table below illustrates the price fluctuations from 2020 to 2025:

| Year | Lowest Price | Highest Price |

|---|---|---|

| 2020 | $0.51 | $4.79 |

| 2021 | $1.49 | $259.96 |

| 2022 | $8.14 | $178.52 |

| 2023 | $9.69 | $121.45 |

| 2024 | $79.31 | $209.78 |

| 2025 | $124.00 | $295.00 |

Latest Solana Price Prediction for February 2026

The price of Solana (SOL) is known for its significant swings, offering both opportunities and risks for traders. In early 2025, the token saw some impressive peaks, even touching the $295 mark, before entering a correction phase. Throughout the year, its value has been influenced by a mix of factors, including broader market trends, network performance, and growing interest from big-time investors. As of February 2026, SOL is trading in the $160-$180 range.

Several key elements can impact SOL’s price. Institutional adoption is a huge one, with major players like Visa and Google Cloud integrating Solana, and financial giants exploring tokenization on the platform. The Firedancer validator client, which promises to handle over 1 million transactions per second, is another major point of interest that could send the price upward.

On the flip side, network stability remains a concern, as past outages have shaken investor confidence. Regulatory pressure, particularly from the SEC’s classification of SOL as a potential security, and intense competition from Ethereum and its Layer-2 solutions are also factors that could hold its price back.

Here’s a look at what some analysts are predicting for Solana’s price in February 2026, showing a mix of caution and optimism for the month ahead.

| Analyst/Source | Prediction (Low) | Prediction (Average) | Prediction (High) |

|---|---|---|---|

| CoinCodex | $165.15 | $170.05 | $174.19 |

| Changelly | $179.60 | $178.33 | $177.05 |

| CoinDCX | $160.00 | $172.50 | $185.00 |

Best 5 SOL Price Predictions in 2026

Figuring out Solana’s price for 2026 is a hot topic, with forecasts all over the map. Some analysts are calling for a steady climb, while others see a rocket ship getting ready for launch. This wide range of predictions shows just how much the token’s future depends on a few big “what ifs.”

The general feeling is positive, but it’s tied to how well the Solana network performs, whether big-money investors keep showing up, and how the whole crypto market behaves.

A spot Solana ETF is one of the biggest factors stirring up excitement. If regulators give it the green light, it could open the floodgates for a lot of new investment. On the tech side of things, the Firedancer upgrade is expected to push Solana’s transaction capacity past 1 million per second, which would be a massive technical feat.

Some of the best SOL predictions in 2026 include:

1. Changelly

The team at Changelly offers a fairly stable outlook for Solana in 2026. Their analysis points to an average trading price of around $172.51 for the year. The maximum price they see it reaching is $179.19 towards the end of the year, with a minimum cost of about $155.58.

This prediction is grounded in a technical analysis of SOL’s price charts and historical performance. They note that while short-term indicators might show some bearish signs, the longer-term trend remains strong. This forecast suggests a year of consolidation and steady growth rather than a dramatic price explosion.

2. Wallet Investor

Wallet Investor presents a very bullish case for Solana. Their forecast suggests a strong upward trend, predicting SOL could move from its current levels to as high as $384.74 within the next year. This optimism is based on the increasing adoption of the Solana blockchain for dApps, DeFi, and NFTs.

Looking further out, they see this momentum continuing, with a potential five-year target of hitting an impressive $765. This prediction counts on Solana’s core strengths—its scalability and low transaction fees—continuing to attract a steady stream of developers and new projects, solidifying its position as a top platform in the crypto space.

3. CoinCodex

CoinCodex provides a data-driven forecast that sees Solana trading within a specific channel for 2026. Their algorithm predicts a price range between a minimum of $ 164.46 and a maximum of $195.88. This suggests a year of moderate but positive growth, with the potential for a nearly 23% return on investment from current prices.

Their analysis is based on technical indicators like the 50-day and 200-day Simple Moving Averages (SMAs) and the Relative Strength Index (RSI). While the current sentiment is neutral, the Fear & Greed Index shows “Greed,” indicating that investors are still confident. This prediction points to a good buying opportunity, assuming the market continues its steady upward movement.

4. Gov Capital

Gov Capital also has a positive outlook for Solana, projecting a one-year price target of $291.06. This forecast is driven by the strong momentum behind Solana’s DeFi and NFT ecosystems, which continue to draw in users and capital.

However, they also add a note of caution. While the potential is there, the crypto market is known for its quick shifts in sentiment, and price corrections are always a possibility. Their five-year prediction sees the price stabilizing around $375.67, suggesting that after a period of growth, the token will find a solid footing as the platform’s adoption and the overall blockchain market mature.

5. Bullish Scenario:

The most optimistic forecasts for Solana in 2026 see the token reaching as high as $750. This bullish scenario depends heavily on a few key catalysts. The approval of a spot Solana ETF is chief among them, as it would signal mainstream acceptance and bring a wave of institutional money into the ecosystem.

If the network can maintain stability and avoid major outages while these developments unfold, and if the broader crypto market remains healthy, a surge to the $400-$750 range is seen as a real possibility.

Is Solana a Good Investment

Solana has firmly established itself as a major contender in the blockchain world, often mentioned in the same breath as Ethereum. Its main selling point is performance. The network is designed for mass adoption, offering incredibly fast transaction speeds and fees that are a fraction of a penny. This makes it a go-to platform for applications that need to handle a lot of activity, such as high-frequency trading, gaming, and NFT marketplaces.

The technology behind Solana is what sets it apart. Its unique Proof-of-History (PoH) consensus mechanism works like a cryptographic clock, allowing the network to order transactions with remarkable efficiency. This, combined with its Proof-of-Stake (PoS) system, allows it to achieve its high throughput without sacrificing decentralization. With a growing list of major partnerships and a strong developer community, Solana is positioned as a key piece of infrastructure for the future of the decentralized internet.

The advantages of investing in Solana are clear. Its ability to process up to 65,000 transactions per second for an average fee of just $0.00025 gives it a significant edge over slower, more expensive networks. This has attracted a massive ecosystem of DeFi protocols, NFT marketplaces like Magic Eden, and a booming community of developers.

However, the risks are just as real. Solana’s biggest challenge has been its history of network outages, which have occurred 8 major times since its launch. These periods of downtime have raised serious questions about the network’s reliability and resilience under heavy load.

There is also the shadow of regulatory uncertainty. The U.S. Securities and Exchange Commission (SEC) has previously suggested that SOL could be classified as an unregistered security, which could create legal headaches down the road. Finally, Solana faces fierce competition from Ethereum, especially with the growth of Layer-2 scaling solutions, as well as from other high-performance blockchains.

So, is Solana a good investment? The answer is yes, but it comes with a healthy dose of risk. The platform’s technical strengths and growing ecosystem give it massive long-term potential. However, as an investor, you need to be aware of the network stability issues and the unpredictable regulatory landscape. For those with a high-risk tolerance who believe in its technology, Solana could offer significant returns, but it’s likely to be a bumpy ride.

For those ready to get started, here are the basic steps to invest in SOL:

- Select a Cryptocurrency Exchange: Choose a reputable platform that lists SOL, focusing on security features and low fees.

- Create and Verify Your Account: Sign up with your personal details and complete the Know Your Customer (KYC) process by providing identification.

- Fund Your Account: Deposit money into your exchange wallet using a bank transfer, debit/credit card, or another cryptocurrency.

- Buy SOL: Find the SOL trading pair that matches your deposited currency (e.g., SOL/USD) and place your order.

How to Buy SOL?

Once your exchange account is funded, buying SOL is straightforward. Go to the trading section of the platform and search for the SOL ticker. You’ll see different trading pairs, like SOL/USD or SOL/BTC. Pick the one that matches the currency you deposited.

You can then choose between a market order, which buys SOL at the current price instantly, or a limit order, which lets you set a specific price you’re willing to pay. After you’ve bought your SOL, you can either keep it on the exchange or move it to a personal wallet for better security.

How to Sell SOL?

Selling your SOL is just as simple. In your exchange account, go to the same trading section where you bought it. This time, you’ll be placing a sell order. Just like buying, you can opt for a market order to sell immediately at the current market price or set a limit order to sell only when the price hits a target you’ve chosen.

After you confirm the sale, the equivalent amount in your chosen currency, like USD or BTC, will be credited to your exchange account, ready to be withdrawn or used for other trades.

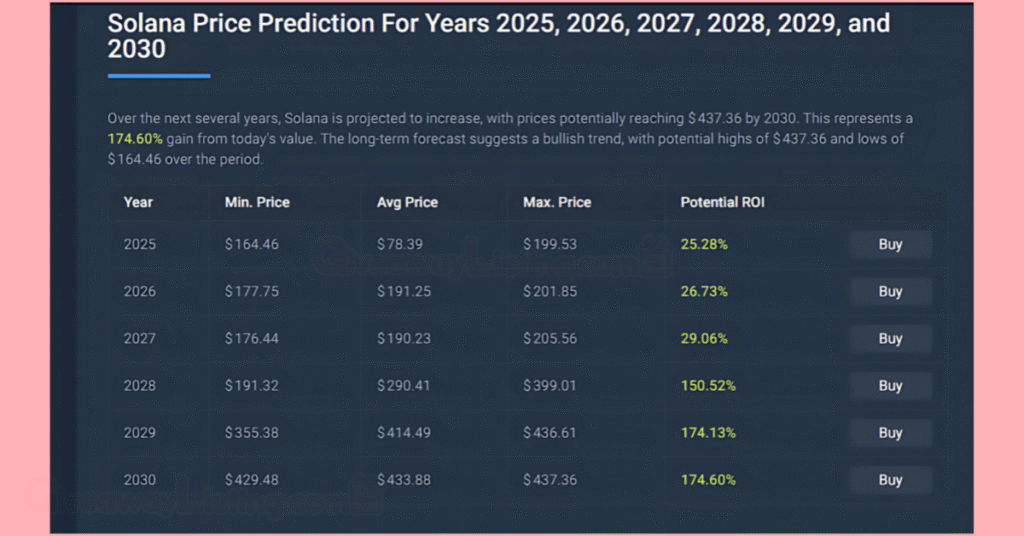

Solana Forecast After 2026

Solana’s price story is a classic crypto rollercoaster, marked by a meteoric rise, a staggering crash, and a comeback that has caught the attention of the entire market. After launching in 2020 for less than a dollar, SOL exploded in 2021 to an all-time high of nearly $260.

For 2026, many analysts see Solana continuing its upward trend, with price targets generally falling between $248 and $382. This assumes that the network will have ironed out its stability issues and that major upgrades like Firedancer will be fully operational. The continued growth of its dApp ecosystem, particularly in gaming and DeFi, is expected to be a primary driver. A successful Solana ETF launch could also provide a significant tailwind, pushing the price toward the higher end of that range.

By 2027, predictions get even more bullish. With the crypto market potentially in another bull cycle, some forecasts place SOL in the $460 to $550 range. At this point, Solana would likely be handling a massive volume of transactions, and its integration with major institutional players could be much deeper. Its role as a backbone for Internet Capital Markets would be more established, making its token increasingly valuable for securing and using the network.

In 2028, many experts believe SOL could be trading between $690 and $820. This level of growth would depend on Solana solidifying its position as a top-three blockchain platform. Widespread adoption of Solana Pay for everyday transactions and the success of its mobile initiatives, like the Saga smartphone line, would be critical factors in reaching these higher valuations.

Heading into 2030, the predictions for Solana’s price are truly impressive, with many analysts seeing it crossing the $1,000 mark. Conservative estimates place it in the $1,004 to $1,258 range, while more optimistic scenarios see it reaching as high as $1,849. A valuation this high would mean Solana has become an indispensable part of the digital economy. However, reaching such a target depends heavily on navigating the ever-changing regulatory landscape and staying ahead of the competition.

Trading Strategies for Solana

Given SOL’s history of significant price fluctuations, entering without a plan is a recipe for a bad time. A solid trading strategy is key to managing risk and making the most of opportunities in this fast-moving market. Whether you’re in it for the long haul or just looking to make a quick buck, your approach will determine how you handle the inevitable ups and downs.

Different strategies cater to different goals, risk appetites, and levels of commitment. Some traders thrive on the daily chaos, while others prefer to set it and forget it. Understanding the various methods can help you pick the right one for your style.

Day Trading

Day trading is simple: buy and sell SOL within the same day to profit from small, short-term price movements. Day traders are glued to their screens, using technical analysis tools like the Relative Strength Index (RSI) and moving averages to predict which way the price will tick in the next few hours or even minutes.

This strategy isn’t for the faint of heart. It requires a deep understanding of market dynamics, a cool head under pressure, and a lot of time. Because profits on each trade are often small, day traders rely on making many trades throughout the day. This also means that choosing an exchange with very low trading fees is absolutely essential, as high fees can quickly eat away at any potential gains.

Swing Trading

If day trading sounds too intense, swing trading might be more your speed. This strategy involves holding onto your SOL for a bit longer—typically a few days to a few weeks—to catch bigger price “swings.” Swing traders aim to profit from the larger waves in the market, rather than the tiny ripples that day traders focus on.

Swing trading still requires a good amount of analysis. Traders use both technical charts to identify trends and fundamental analysis to understand the bigger picture of what’s driving the price. It’s a good middle-ground approach that doesn’t require constant monitoring but still allows you to take advantage of market movements actively.

HODLing

HODLing—a term born from a famous typo in an old Bitcoin forum—is the classic long-term investment strategy. The idea is to buy SOL and hold onto it for months or even years, with the belief that its fundamental value will increase over time. HODLers aren’t worried about the day-to-day price fluctuations; they’re betting on Solana’s long-term success.

This approach is less about trading and more about investing in the technology. A HODLer’s conviction is based on factors like Solana’s growing ecosystem, its technological advantages, and its potential for widespread adoption. It’s a passive strategy that requires patience and a strong belief in the project’s future, but it has proven to be very effective for many early crypto investors.

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging is one of the simplest and most effective strategies, especially for beginners. Instead of trying to time the market and buy at the absolute lowest price, you invest a fixed amount of money in SOL at regular intervals—say, $50 every week—no matter what the price is.

This approach takes the emotion out of investing and helps to smooth out the effects of volatility. When the price is low, your fixed investment buys you more SOL, and when the price is high, it buys you less. Over time, this averages out your purchase price and reduces the risk of making a big investment right before a market downturn. It’s a disciplined way to build up your holdings without the stress of trying to predict the unpredictable.

Futures Trading

Futures trading is for the more experienced traders who are comfortable with high risk. Instead of buying SOL directly, you’re trading contracts that speculate on its future price. You can go “long” if you think the price will go up, or “short” if you think it will go down.

The big draw of futures is leverage, which allows you to control a much larger position with a small amount of capital. For example, with 10x leverage, a 5% price increase can turn into a 50% profit. However, leverage is a double-edged sword; that same 5% price move in the wrong direction can wipe out your entire initial investment.

How to Learn More About Solana?

Getting into Solana can feel like a lot at first. The technology is packed with unique ideas like Proof-of-History, and its ecosystem of apps, wallets, and tokens is growing at a dizzying pace. But with the right resources, you can get up to speed on how the network operates and make more informed decisions about trading or investing in SOL.

Here are some of the best places to build your Solana knowledge:

- Official Solana Website and Docs: This should be your first stop. The official site offers a wealth of information, from beginner-friendly guides that break down the basics to in-depth technical documentation for those who want to understand the nuts and bolts. The “Learn” section is especially useful for grasping core concepts without getting lost in jargon.

- The Solana Whitepaper: For those interested in the technical details, the original whitepaper by Anatoly Yakovenko serves as the foundational text. It outlines the core problem Solana was designed to solve—scalability—and explains the thinking behind its Proof-of-History mechanism.

- Developer and Community Channels: Joining Solana’s official Discord or Telegram channels, or browsing its community forums, can be incredibly insightful. These are the places where developers, validators, and hardcore fans hang out. By lurking or asking questions, you can get real-time information about network updates, new projects, and general market sentiment.

- Crypto News and Educational Platforms: Websites like Giveaway Listing, CoinDesk, Decrypt, and the educational sections of major exchanges like Binance Academy or Coinbase Learn are great for staying current.

- Block Explorers: Tools like Solscan or Solana Beach are invaluable for seeing what’s happening on the network in real time. A block explorer lets you look up any transaction, check wallet balances, and see which dApps are getting the most traffic.

Ultimately, getting familiar with Solana involves a mix of reading up on the theory and getting hands-on with its ecosystem. From its high-speed, low-cost transactions to the vibrant activity in its DeFi and NFT markets, the platform has a lot to offer.

As you learn more, you’ll be better equipped to find your place, whether that’s by trading, investing for the long term, or even just exploring the innovative applications being built every day.

This guide has walked through Solana’s price history, its recent performance, and expert predictions for its future. We’ve also touched on the core technology that makes the network tick and looked at different strategies for trading SOL. The goal is to provide a solid foundation of information to help you understand the potential and the risks tied to this high-performance blockchain.

The information provided in this content is up to date as of February 2026.

Solana Price Prediction FAQs

Here are answers to ome frequently asked questions about the Solan price prediction in 2026:

How High Will Solana Go in 2026?

Predictions for Solana in 2026 vary, with most experts forecasting a positive but wide range. More conservative estimates place SOL between $200 and $335, while highly bullish scenarios, potentially fueled by a spot ETF approval, see it reaching up to $750 or even $1,000.

How Much Will 1 Solana Be in 2030?

Looking ahead to 2030, analysts are generally optimistic about Solana’s long-term value. Projections suggest that one SOL could be worth between $1,004 and $1,258 under normal market conditions. In a more bullish market, where institutional adoption is widespread, some forecasts see the price climbing as high as $2,000, assuming the network maintains its technological edge.

Can Solana Reach $5000?

Reaching $5,000 is a highly ambitious target for Solana that is not widely expected within the next decade. Such a price would require a massive increase in market capitalization, likely well over 2,000% from its current value. While some very long-term, optimistic scenarios see it as a possibility post-2030, it depends on near-perfect market conditions and overcoming significant regulatory hurdles.

Is it a Good Time to Buy Solana?

Deciding when to buy Solana depends on your risk tolerance and investment strategy. The price has shown strong recovery and significant long-term potential, with developer activity jumping 83% year-over-year in 2024. However, technical indicators currently show a mix of signals, and the market remains volatile, so a cautious approach like dollar-cost averaging could be a sensible strategy.