XLM Price History Until Today

Stellar is a decentralized network designed to facilitate faster and more affordable cross-border transactions. Founded in 2014 by Jed McCaleb, who also played a role in creating Ripple, Stellar aims to connect the global financial systems. Unlike many other blockchains, Stellar employs its own consensus method, the Stellar Consensus Protocol (SCP), which eliminates the need for mining, resulting in a faster and more energy-efficient process.

Since its launch, the price of XLM has been on a rollercoaster ride, a typical characteristic of cryptocurrencies. It started as a sub-penny asset, flying under the radar for its first few years. The token garnered mainstream attention during the major crypto bull run of 2017-2018, when its value skyrocketed, reaching its all-time high in January 2018.

Following that peak, XLM experienced a prolonged downturn along with the rest of the market. However, it has shown resilience, with significant rallies during subsequent market upturns, such as in 2021. This history shows that XLM’s price is heavily influenced by broader market sentiment, technological updates within its ecosystem, and its growing list of partnerships.

XLM Price Historical Data From 2014 to 2025

The value of XLM has experienced significant fluctuations over the years. From its humble beginnings, it has reached impressive highs and weathered significant lows, reflecting the dynamic nature of the cryptocurrency market.

Below is a look at its price journey.

| Year | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|

| 2014 | $0.00942 | $0.00123 |

| 2015 | $0.00584 | $0.00133 |

| 2016 | $0.00338 | $0.00143 |

| 2017 | $0.3904 | $0.00162 |

| 2018 | $0.9381 | $0.0928 |

| 2019 | $0.1590 | $0.0423 |

| 2020 | $0.2296 | $0.0274 |

| 2021 | $0.7930 | $0.1242 |

| 2022 | $0.2959 | $0.0707 |

| 2023 | $0.1848 | $0.0711 |

| 2024 | $0.6261 | $0.0761 |

| 2025 | $0.5193 | $0.2232 |

Latest Stellar Price Prediction For January 2026

Several factors can affect the price of Stellar over time. Strategic partnerships are a major driver; collaborations with companies like IBM and MoneyGram add real-world utility and credibility. The adoption of the network for cross-border payments and remittances, particularly in developing countries, can also increase demand for XLM. Furthermore, technological improvements, such as the introduction of smart contracts, expand the network’s capabilities and attract more developers and projects.

Looking at January 2026, forecasts for XLM’s price vary significantly. Some analyses suggest a period of stabilization, with the token trading within a range of $0.36 to $0.38. This outlook is based on current market trends and historical data, which indicate periods of consolidation following significant price movements.

Other predictions are much more bullish. Technical analysis based on recent chart patterns suggests a potential breakout for XLM. One particularly optimistic forecast predicts a price of $0.63 by January. This is supported by growing network activity and the anticipation surrounding the Protocol 23 upgrade.

Data from the period shows that XLM has already experienced a notable range, with highs reaching around $0.46 and lows dipping to approximately $0.35. This existing volatility suggests that both conservative and bullish scenarios are on the table.

Ultimately, whether XLM trends toward the higher or lower end of these predictions will likely depend on a combination of factors. A positive turn in the overall crypto market, coupled with successful upgrades and increased adoption of the Stellar network, could push the price toward the more optimistic targets.

Best 5 XLM Price Predictions in 2026

Unlike many cryptocurrencies that are purely speculative, XLM’s value is closely tied to the adoption of the Stellar network for cross-border payments and asset tokenization. This connection to tangible use cases provides a more grounded basis for analysis, though it doesn’t eliminate the volatility inherent in the crypto market. As of 2026, the network shows robust activity, with a significant uptick in transactions and active addresses.

Predictions for 2026 range from cautiously optimistic to wildly bullish. The more conservative estimates factor in broader market conditions and potential regulatory headwinds, while the more optimistic forecasts are based on major adoption milestones and the network’s technical superiority in terms of speed and cost efficiency. Transaction settlement takes approximately 5 seconds, with an average fee of just $0.00005, metrics that are challenging for many competitors to match.

Here are what some of the top platforms and analysts are predicting for XLM in 2026:

1. Changelly

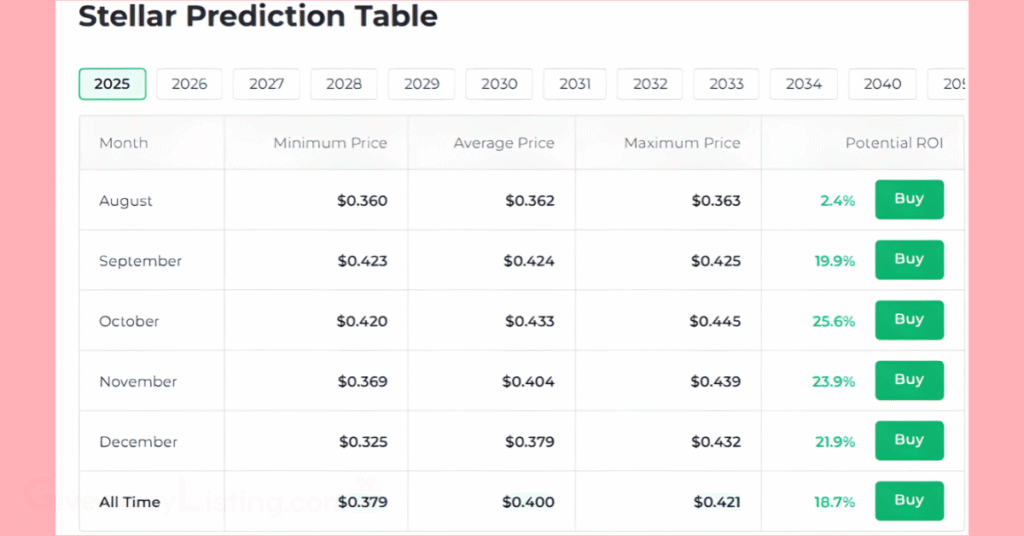

Analysts at Changelly project a steady upward trend for Stellar. Their forecast for 2026 suggests an average price of approximately $0.40. This is based on the expectation of continued growth in partnerships and increasing use of the Stellar network for its core purpose.

The analysis indicates a growing ecosystem and positive technical indicators as the primary drivers of this sustained, albeit non-explosive, growth trajectory throughout the year.

2. Telegaon

Taking a significantly more bullish stance, Telegaon’s analysis suggests that XLM could see a substantial price increase. Their forecast places Stellar’s potential high for 2025 at an impressive $1.13. This optimistic projection is based on the belief that Stellar’s role in facilitating global payments, particularly in emerging markets, will become increasingly prominent.

They see the network’s ability to tokenize real-world assets and its integration with services like MoneyGram and Circle’s USDC as powerful catalysts that could propel XLM’s value far beyond its current levels.

3. CoinCodex

The forecast from CoinCodex is moderately bullish, with a prediction that XLM could reach an average of $0.52 in 2026. Their analysis often relies on a combination of historical price patterns and market cycle sentiment.

The expectation is that as the broader cryptocurrency market continues to mature, assets with strong fundamentals and clear utility, such as Stellar, will attract more investment. The full deployment of the Soroban smart contract platform is also a key factor, as it opens up the Stellar network to a new world of decentralized applications.

4. Benzinga

Benzinga’s forecast predicts an average price for XLM of $0.32 for 2026. This prediction acknowledges Stellar’s potential but also weighs the significant challenges it faces, including intense competition from other payment-focused blockchains and the ever-present risk of regulatory changes.

This more cautious outlook suggests that while the fundamentals are solid, widespread adoption is a gradual process, and the price will likely reflect a slower, more measured pace of growth.

5. WalletInvestor

On the opposite end of the spectrum, WalletInvestor’s algorithm-based forecast presents a bearish outlook. Their model, which heavily weighs historical volatility and market risk, has labeled XLM as a high-risk investment.

Their prediction points to a potential price decline, suggesting that traders should be cautious. This type of analysis focuses purely on technical chart patterns and may not fully account for fundamental developments like new partnerships or technology upgrades.

Is Stellar a Good Investment

Investing in XLM is essentially a bet on the idea that the world needs a more efficient and inclusive method for handling payments. The project’s non-profit foundation, the Stellar Development Foundation (SDF), focuses on financial inclusion, aiming to serve unbanked populations in developing regions.

This mission, combined with high-profile partnerships with companies like IBM, Franklin Templeton, and MoneyGram, gives Stellar a strong narrative and a clear path to real-world adoption. The network’s design for tokenizing real-world assets is another major point of interest.

However, like any investment in the digital asset space, putting money into XLM comes with its own set of considerations. The advantages are compelling: the network is incredibly fast, with transactions confirming in about five seconds. The cost is minuscule, making it ideal for everything from micropayments to large institutional settlements. Furthermore, the total supply of XLM is fixed at 50 billion tokens, which means it isn’t subject to the inflationary pressures seen in some other cryptocurrencies or traditional fiat money. This scarcity could be a significant value driver if network demand increases.

On the flip side, the risks are very real. The cryptocurrency market is famously volatile, and XLM’s price often moves in tandem with the broader market’s sentiment, regardless of the Stellar network’s individual progress. Competition is another major factor. Stellar is often compared to Ripple (XRP), as both target the cross-border payments market and were co-founded by Jed McCaleb. While their approaches differ, they are vying for dominance in the same arena.

Another point of contention for some is the SDF’s large holdings of XLM. Although the foundation operates as a non-profit with a clear mandate to support the ecosystem, its control over a substantial portion of the supply raises concerns about centralization for some market participants. Finally, the global regulatory landscape for cryptocurrencies remains uncertain. Future regulations could impact Stellar’s operations and the value of XLM. You can explore a variety of Stellar trading strategies to manage these risks.

Stellar is a good investment option for those with a higher tolerance for risk and a long-term belief in the potential of blockchain to transform the global financial system. Its value proposition is tied directly to its utility and adoption rate, making it a more fundamentally grounded project than many purely speculative assets.

If you’ve decided that XLM aligns with your investment goals, here are the general steps to get started:

- Do Your Research: Understand Stellar’s technology, its use cases, and the risks involved.

- Select a Crypto Exchange: Choose a reputable platform that lists XLM, such as Coinbase, Binance, or Kraken.

- Create and Secure Your Account: Register for an account and complete the required identity verification (KYC) process. Enable two-factor authentication (2FA) for added security.

- Deposit Funds: Add money to your exchange account using a bank transfer, credit/debit card, or another supported method.

- Place Your Order: Navigate to the XLM trading pair (e.g., XLM/USD, XLM/USDT) and place a buy order.

- Store Your XLM Safely: For long-term holding, consider moving your XLM off the exchange and into a personal crypto wallet where you control the private keys. This can be a software wallet on your computer or phone, or a more secure hardware wallet.

How to Buy XLM?

Buying XLM is a straightforward process on most major cryptocurrency exchanges. After setting up and funding your account, find the market for Stellar or XLM. You’ll typically have the option to place a “market order,” which buys the tokens at the current best available price, or a “limit order,” which allows you to set a specific price at which you want to buy. Once your order is executed, the XLM tokens will appear in your exchange wallet.

How to Sell XLM?

Selling your XLM is just as simple. If your tokens are in a personal wallet, you’ll first need to transfer them to your exchange account. Once the XLM is on the exchange, navigate to the trading page and place a sell order. You can sell for fiat currency or trade it for another cryptocurrency. After the sale is complete, you can withdraw the funds to your bank account or keep them on the exchange for future trades.

Stellar Forecast After 2026

Stellar’s journey in the crypto market has been a rollercoaster of sharp climbs and steep drops. After its launch in 2014, its native token, XLM, traded for fractions of a cent for years before experiencing a surge during the 2017-2018 bull run, reaching an all-time high of over $0.93 in January 2018.

In the years that followed, the prices tumbled, testing the patience of many holders. However, the network’s focus on real-world utility, particularly in cross-border payments, allowed it to weather the storm and see significant price action in subsequent market cycles.

At the end of 2020, XLM closed at about $0.12. By the end of the 2021 bull run, it had more than doubled to around $0.27. The market downturn in 2022 saw it fall back to roughly $0.07, but it recovered to about $0.13 by the end of 2023. As of 2026, the price is hovering around $0.36, showing notable recovery and resilience.

Looking ahead to 2026, forecasts for Stellar’s price show a wide range of possibilities. More conservative models suggest a potential trading range between $0.16 and $0.22. However, other analyses indicate a more optimistic outlook, with some predictions placing the average price around $0.75 and a potential high of nearly $0.84. This growth could be fueled by increased adoption of its payment network and favorable market conditions.

By 2027, the gap between bearish and bullish predictions widens. Some analysts anticipate a potential high of around $1.14, which would finally push XLM past its 2018 peak. The average trading price in this scenario is projected to be about $1.05. Achieving this milestone would likely depend on the successful expansion of its smart contract capabilities and solidifying its role in the tokenization of real-world assets.

For 2028, the positive momentum is expected by many to continue. Projections suggest an average trading price of $1.35, with a potential peak reaching as high as $1.44. The low-end estimates for this period still sit above $1.20, indicating a general consensus that the token’s value could see sustained growth if the project’s development roadmap stays on track and it maintains its competitive edge.

Entering 2029, forecasts become even more ambitious. The average expected price for XLM is around $1.65, with some predictions pushing the maximum value to $1.74. These long-range forecasts often assume a maturing crypto market and greater mainstream integration of blockchain technology, an area where Stellar’s focus on connecting traditional and decentralized finance could pay off significantly.

By 2030, predictions for Stellar’s price are incredibly varied, reflecting the inherent uncertainty of long-term crypto forecasting. Some models suggest an average price of around $1.95, with a potential high of over $2.00. More bullish scenarios, however, envision XLM reaching between $7.00 and $8.65. Such a massive jump would likely require Stellar to have captured a substantial share of the global remittance market and for its network to be a foundational layer for multiple central bank digital currencies (CBDCs).

Trading Strategies For Stellar

Having a clear strategy is what separates calculated trading from simple gambling. Different timelines and risk appetites call for various methods. Whether you’re looking to make quick daily trades or hold a position for months, there’s a framework that can guide your decisions. The key is to find a strategy that aligns with your financial goals and the amount of time you can dedicate to watching the market.

Day Trading

Day trading involves opening and closing positions within a single day to profit from small, short-term price fluctuations. For a token like XLM, this means paying close attention to intraday charts and technical indicators. Day traders often look for patterns that suggest a price move is imminent, executing multiple trades to accumulate small gains that add up over time.

Because this strategy relies on high volume and speed, it can be intense and requires discipline. The very low transaction fees on the Stellar network—costing just 0.00001 XLM per transaction—are a significant advantage for day traders, as costs won’t eat into profits from frequent trades. However, success depends on a solid understanding of technical analysis and the ability to react quickly to market changes without letting emotion take over.

Swing Trading

Swing trading is a strategy focused on capturing gains over a period of a few days to several weeks. Unlike day traders, swing traders aren’t glued to their screens all day. Instead, they identify a potential “swing” or trend in XLM’s price and hold their position until that trend appears to be reversing. For example, a trader might buy XLM after a positive announcement, ride the upward momentum for two weeks, and sell as the hype dies down.

This approach often combines technical analysis with short-term fundamental catalysts. Traders might use tools like moving averages or the Relative Strength Index (RSI) to spot entry and exit points. It’s a middle ground that requires less time commitment than day trading but more active management than long-term holding.

Position Trading

Position trading is a long-term strategy where traders hold an asset for months or even years, betting on its fundamental strength. This approach is less concerned with daily price noise and more focused on the big picture. A position trader in XLM would analyze the project’s underlying value, such as its growing network of active addresses, increasing transaction volume, and high-profile partnerships with companies like MoneyGram and Franklin Templeton.

The goal is to identify a long-term uptrend based on the project’s real-world adoption and technological progress. This requires patience and a strong belief in Stellar’s mission to reshape global payments. Traders using this strategy might follow developments related to the Stellar Consensus Protocol and other core updates to inform their decisions, rather than reacting to short-term market sentiment. This method is closer to investing, but with a defined strategy for entering and eventually exiting the position.

Quantitative Trading

Quantitative, or “quant,” trading uses algorithms and statistical models to make trading decisions automatically. Instead of relying on gut feelings, quant traders create systems based on historical data to identify profitable opportunities. For XLM, a quant strategy might involve programming a bot to execute trades based on specific conditions, such as price breakouts, volatility changes, or correlations with other assets like Bitcoin or XRP.

The main advantage here is the removal of human emotion, which often leads to poor decisions. These strategies can be backtested against historical price data to see how they would have performed in the past. For instance, backtesting a Keltner Channel breakout strategy for XLM has shown a profit factor of 3.61 and an annualized ROI of over 400% during certain periods, demonstrating the potential of a data-driven approach.

Margin Trading

Margin trading is an advanced and high-risk strategy that involves borrowing funds to increase the size of a trading position. This is also known as trading with leverage. For example, with 2x leverage, a trader could use their $1,000 to control a $2,000 position in XLM. If the price of XLM goes up, the profits are doubled. However, the same is true for losses, which are also amplified.

This strategy should only be attempted by experienced traders who fully understand the risks. A small price movement against a highly leveraged position can lead to a “margin call,” where the exchange automatically liquidates the position to cover the loan, resulting in a total loss of the initial capital. While it offers the potential for larger gains, it requires careful risk management and a deep understanding of market dynamics.

How to Learn More About Stellar?

To get a solid grip on Stellar, it helps to go straight to the source and supplement that with data from trusted platforms. Here are some of the best places to build your knowledge base:

- The Official Stellar Website: This is your ground zero for all things Stellar. The site’s “Learn” section is packed with easy-to-read guides on the network’s core components. You can get clear explanations of how Lumens (XLM) function, what makes the Stellar Consensus Protocol (SCP) different from other blockchains, and the role of “anchors” in connecting digital assets to traditional currencies. It’s the best starting point for understanding the project’s main goals.

- Stellar Developer Docs: If you want to go a layer deeper and understand the mechanics, the developer documentation is an excellent resource. While aimed at builders, its “Learn” section offers fundamental explanations of the technology, APIs, and network architecture. You don’t need to be a coder to get value from it; the guides provide a more detailed look at how the system operates.

- The Stellar Consensus Protocol White Paper: For those who really want to get into the nuts and bolts, the original white paper by David Mazières is the definitive document. It’s a technical read, but it lays out the cryptographic and theoretical foundations of the Federated Byzantine Agreement model that keeps the network secure and fast. It explains exactly why Stellar doesn’t need energy-intensive mining to confirm transactions.

- Crypto Data Aggregators: Websites that track cryptocurrency market data are indispensable tools. They offer real-time price information, historical charts, trading volume, and circulating supply figures.

- Community Forums: Platforms like Reddit have active communities where you can see what actual users and developers are talking about. The r/Stellar subreddit is a hub for news, discussion, and support from other enthusiasts.

Staying current with developments is critical in the fast-moving crypto space. You can follow the latest happenings and breaking stories to see how they might affect market movements. For more information, check out the latest Stellar news.

This guide covered the nuts and bolts of Stellar, from its creation by Jed McCaleb to its unique consensus protocol that delivers rapid, low-cost transactions. By examining both the technology’s potential and the market’s behavior, you can gain a more comprehensive understanding of where Stellar might be headed, then make your next move.

The information provided in the content is current as of January 2026.

Stellar Price Prediction FAQs

Here are answers to some frequently asked questions about Stellar price predictions in 2026:

Can Stellar Reach $10?

Reaching a $10 price point is a distant target for XLM. Most market analysis suggests its value will remain below $3 through 2031. However, some highly optimistic long-term forecasts see a potential climb to $10.84 by 2030, showing a massive upside if network adoption accelerates significantly.

What Will XLM Be Worth in 2026?

Forecasts for 2025 show a wide range of potential values for XLM. Conservative estimates place the average price between $0.32 and $0.47. More bullish scenarios suggest the price could push towards a high of $1.09, depending on market conditions and continued network growth.

How Much Will XLM Be Worth In 2030?

Projections for 2030 vary quite a bit among analysts. Many forecasts place XLM’s price in a range of $1.86 to $3.30. Some more aggressive models, however, predict a potential high between $8.65 and $10.84, reflecting strong belief in its long-term adoption for global payments.

Is XLM a Buy For the Long Term?

Stellar’s focus on fast, cheap global payments gives it long-term potential. Its partnerships with companies like IBM and MoneyGram support its real-world use case. The network processes transactions in 2-5 seconds for a fee of just 0.00001 XLM, making it a practical tool for cross-border value transfer.