SUI Price History Until Today

Since its debut, the SUI token has been on quite a ride. It entered the market and, like many new crypto assets, experienced its share of ups and downs. The token’s value has been shaped by broader market feelings, developments within its own ecosystem, and scheduled releases of new tokens into the market.

It reached its peak price in early 2025, hitting an all-time high of over $5. Conversely, its lowest point was recorded in late 2023. Currently, approximately one-third of SUI’s total 10 billion token supply is in circulation.

SUI Price Historical Data From 2023 to 2025

The price of SUI has experienced significant fluctuations since its initial release. Tracking its highest and lowest points each year gives a clear picture of its market behavior and the key price levels it has tested, as shown in the table below:

| Year | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|

| 2023 | $2.00 | $0.36 |

| 2024 | $4.50 | $1.50 |

| 2025 | $5.35 | $3.12 |

Latest Sui Price Prediction for January 2026

The price of SUI has been anything but static. Recently, it has been trading in a range, finding a solid floor around the $3.11 to $3.35 mark while facing resistance at higher levels. This price action indicates a tug-of-war between buyers seeking a favorable entry point and sellers taking profits. The token’s movements are often tied to the general health of the crypto market, particularly how Bitcoin is performing.

Several factors can influence the price of SUI. Tokenomics play a significant role; for instance, the large-scale unlocking and release of SUI tokens can put downward pressure on the price as more supply becomes available. On the other hand, positive news, such as new partnerships, growing institutional interest, and an expanding ecosystem of apps and games, can build strong upward momentum. Other key drivers include:

- Overall crypto market sentiment

- Technological updates and network performance

- Adoption rates by developers and users

- Security of the network and its applications

- Community growth programs

For January 2026, market watchers have a few different ideas about where SUI’s price might be headed. The general feeling is one of a controlled upward trend, but not without some bumps along the way. Most predictions anticipate the token continuing to build on its current support level. Technical indicators, such as the Moving Average Convergence Divergence (MACD), are starting to show signs of bullish momentum building, suggesting that an upward move could be on the horizon.

For a bullish case to play out, SUI needs to hold its ground above the $3.30 support zone. If it can do that and break through the immediate resistance levels, the path toward higher valuations opens up. Some analysts are targeting a range of $3.60 to $3.80. A strong push could even see it test the $4.00 mark. One of the key resistance levels to watch is the 50-day simple moving average (SMA).

However, it’s not all smooth sailing. A bearish scenario could unfold if the price fails to maintain its support levels, particularly if it breaks below the critical $3.11 point. Such a move could signal a deeper correction. The token unlock on October 1, 2025, where 44 million SUI tokens will be released, is another event traders are keeping an eye on, as it could introduce some selling pressure.

Here’s a look at what some of the top market analysts are predicting for SUI’s price in January 2026.

| Analyst | Potential High (USD) | Potential Low (USD) | Average Price (USD) |

|---|---|---|---|

| Coinpedia | $4.33 | $3.21 | $3.77 |

| Blockchain.News | $3.80 | $3.60 | $3.70 |

| CoinTelegraph | $3.64 | $3.11 | $3.37 |

| Brave New Coin | $4.88 | $3.35 | $4.11 |

Best 5 SUI Price Predictions in 2026

Sui’s price outlook for 2026 reflects a dynamic and evolving market. After launching in May 2023, the Layer 1 blockchain has attracted considerable attention for its technical specifications and strong backing. Analysts are closely monitoring its performance, particularly its ability to handle high transaction volumes in sectors such as gaming and DeFi. The platform’s object-centric model and use of the Move programming language are frequently cited as key points for its long-term value.

Current market data from early September 2025 indicates that SUI is trading in the $3.38 to $3.40 range. While it has experienced pullbacks, strong support appears to have formed around the $3.35 mark. The conversation around its future price involves balancing its strong fundamentals and growing ecosystem against market-wide pressures and scheduled token unlocks. These unlocks can introduce new supply into the market, creating potential downward pressure if not met with equal or greater demand from new investors and applications.

Here are five notable SUI price predictions for 2026 from various platforms and analysts.

1. Coinpedia

Coinpedia offers one of the more optimistic forecasts, with a potential high of $7.01 in 2026. This prediction is partly based on growing institutional confidence in the network. A key event supporting this view was when Mill City Ventures, a Nasdaq-listed firm, allocated a significant portion of a $450 million private placement to SUI tokens. This marked the first publicly traded company to hold SUI in its treasury, signaling strong belief from traditional finance.

The analysis also points to rising interest in an SUI exchange-traded fund (ETF), with proposals currently under review. While such developments can build positive market sentiment, Coinpedia also notes a major factor to watch: a planned token unlock of approximately $320 million by the end of 2025. How the market absorbs this new supply will be critical in determining if SUI can reach these higher valuations.

2. CryptoNinjas

This platform projects a strong finish for SUI in 2026, with a price target between $5.20 and $6.00 by December. The prediction leans on historical market trends, where the fourth quarter often sees rallies in the altcoin market, partly driven by seasonal investor sentiment or “FOMO” (fear of missing out). The forecast assumes that positive momentum from major cryptocurrencies, such as Bitcoin, will also lift SUI.

Furthermore, the analysis suggests that continued growth in Sui’s Web3 gaming and DeFi ecosystems could be a primary source of new demand. The psychological resistance at the $5.00 level is seen as a key point. If SUI can break through and hold above this level, it would signal strong market confidence and set the stage for further gains heading into the new year.

3. Traders Union

Traders Union provides a more moderate forecast, with SUI expected to trade between $4.41 and $5.39 in 2026. Their analysis combines both technical and fundamental factors. They see the network’s high throughput and developer-friendly environment as core strengths that will continue to attract new projects and users, thereby creating organic demand for the SUI token.

The platform’s prediction model incorporates an analysis of market cycles. They expect that as the Sui ecosystem matures and more high-quality applications are launched, the token will see steady, sustainable growth rather than purely speculative spikes. Their price range suggests a period of healthy upward movement followed by consolidation.

4. Binance Prediction Portal

With Binance’s prediction portal, we see a conservative price target of around $3.59 for 2026. This forecast is generated based on a combination of user sentiment from their exchange and technical analysis indicators. While the long-term outlook may be positive, the price is likely to remain relatively stable or experience only modest growth in the near term.

This prediction serves as a reminder that despite strong technology, macroeconomic factors and supply-and-demand dynamics play a huge part in a token’s price journey.

5. Blockchain.news

This outlet provides a short-term forecast within 2026, targeting a range of $3.60 to $3.80. This prediction is heavily based on technical analysis of recent price movements. Analysts there point to bullish momentum building, as indicated by the MACD (Moving Average Convergence Divergence) histogram, which shows early positive signals.

They also note that the Relative Strength Index (RSI), a measure of market momentum, is in neutral territory. This is seen as a positive sign, as it suggests SUI has room to move upward without being considered “overbought.” Their analysis points to a controlled rally, where a break above the immediate resistance level of $3.85 could trigger further upward movement.

Is SUI a Good Investment?

One of the biggest advantages of investing in SUI is its cutting-edge technology. The ability to process transactions in parallel not only leads to incredible speed but also keeps transaction costs low and predictable. This horizontal scalability means that as the network gets more demand, it can add more resources to meet it without slowing down, a problem that has affected other popular blockchains. This makes Sui very attractive to developers building large-scale applications.

Another key advantage is its focus on accessibility. Features like zkLogin enable users to create a crypto wallet using familiar Web 2.0 credentials, such as a Google or Twitch account, thereby removing a major barrier for new users. Additionally, “sponsored transactions” let developers pay the gas fees on behalf of their users, creating a “gasless” experience that feels much like using a standard web application. This focus on a smooth user experience could be a major driver for mass adoption.

Finally, Sui has strong backing and a clear vision. The project was founded by a highly experienced team and has raised significant capital from top venture firms, including a $300 million Series B funding round. There is also growing institutional interest, with asset managers like Franklin Templeton partnering with the ecosystem and a VanEck SUI ETN (Exchange-Traded Note) launching in Europe. This combination of strong technology, user-friendly features, and institutional credibility creates a solid foundation for future growth.

Despite its strengths, investing in SUI comes with notable risks. A primary concern is centralization. To achieve its high speeds, the network currently relies on a relatively small set of around 100 validators. While this is efficient, it makes the network less decentralized than others like Ethereum, which could be a concern for those who prioritize censorship resistance. The project is taking steps to lower the barrier to becoming a validator, but this remains a point of attention.

The platform has also faced security challenges. In May 2025, the Cetus decentralized exchange, built on Sui, was hacked for approximately $223 million. Although the Sui Foundation and validators controversially froze a large portion of the stolen assets, the incident raised questions about the network’s security and the extent of its decentralization. Past events, including a network outage in November 2024 and various phishing scams, have also highlighted the vulnerabilities of a young ecosystem.

Lastly, SUI faces intense competition in the crowded Layer 1 market. It is up against established giants like Ethereum and Solana, as well as other high-performance chains. Additionally, the recurring pressure from large token unlocks can create significant volatility. These unlocks release large amounts of SUI into the market at scheduled times, which can lead to downward price pressure if demand doesn’t keep pace with the increased supply.

For investors with a high tolerance for risk and a long-term belief in its underlying technology, Sui is a good investment. Its architecture is specifically built to handle the demands of applications that require massive scale and low latency.

Features like zkLogin and sponsored transactions are not just minor improvements; they are practical solutions to some of the biggest hurdles that have kept mainstream users away from crypto. The combination of a world-class team, strong financial backing, and a clear focus on usability gives Sui a credible path to success.

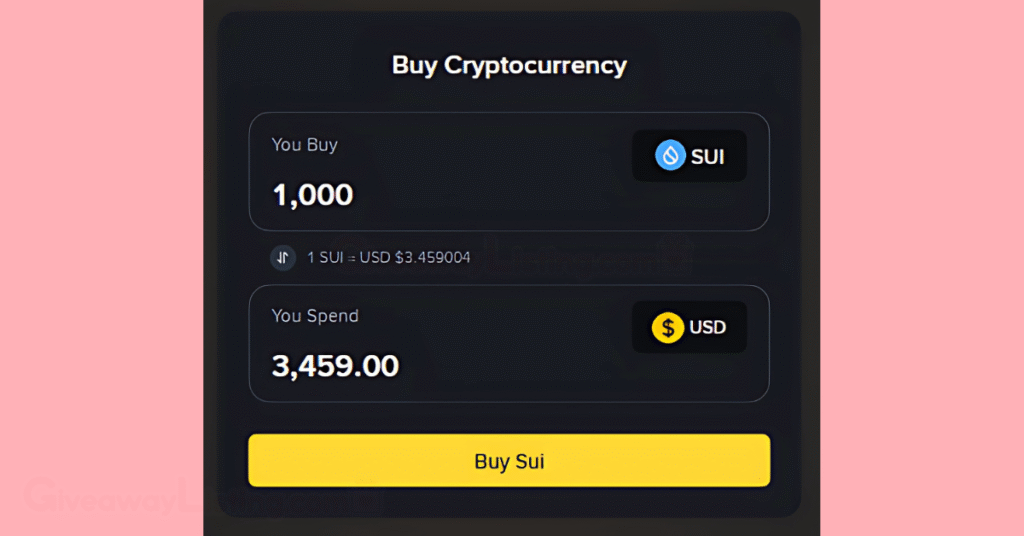

How to Buy SUI?

- Select a Cryptocurrency Exchange: Choose a reputable exchange that lists SUI. Popular options include Binance, KuCoin, OKX, and others.

- Create and Verify Your Account: Sign up on your chosen exchange. You will likely need to provide personal information and complete a verification process (KYC) to comply with regulations.

- Deposit Funds: Add funds to your exchange account. You can typically do this via a bank transfer, credit/debit card, or by depositing another cryptocurrency like Bitcoin (BTC) or USDT.

- Navigate to the Trading Pair: Find the SUI trading pair that matches your deposited funds (e.g., SUI/USD, SUI/USDT, SUI/BTC).

- Place a Buy Order: You can choose a “market order” to buy SUI at the current price or a “limit order” to set a specific price at which you want to buy. Enter the amount of SUI you wish to purchase and confirm the transaction.

- Secure Your SUI: After purchasing, it is highly recommended to move your SUI from the exchange to a personal, non-custodial wallet for better security. Options include the official Sui Wallet or other compatible wallets.

How to Sell SUI?

- Transfer SUI to an Exchange: If your SUI is in a personal wallet, send it to your wallet address on the exchange where you plan to sell it.

- Find the Trading Pair: Go to the trading section and select the SUI trading pair you want to sell into (e.g., SUI/USD or SUI/USDT).

- Place a Sell Order: Similar to buying, you can place a “market order” to sell immediately at the current market price or a “limit order” to set a specific price you want to sell at.

- Confirm the Transaction: Enter the amount of SUI you want to sell and confirm the order.

- Withdraw Your Funds: Once the sale is complete, the funds will be in your exchange account. You can then withdraw them to your bank account or use them to purchase other cryptocurrencies.

Sui Forecast After 2026

Sui’s journey since its mainnet launch in May 2023 has been a rollercoaster, reflecting the fast-paced and often turbulent crypto market. The platform quickly captured attention with its high-performance technology, leading to a surge that established an all-time high of $5.35 in early 2025.

However, the climb wasn’t without its pitfalls. The market saw significant pullbacks, with the price dipping to an all-time low of $0.3648. These downturns were reactions to broader market corrections, security incidents like the May 2025 hack on the Cetus DEX, and the scheduled release of large batches of tokens, which increased the circulating supply and created selling pressure.

Considering its relatively short history, the current price represents substantial growth from its lowest point, but also highlights the volatility that traders have had to manage. It sits significantly below its peak, suggesting there’s room for recovery if the project continues to build out its ecosystem and attract users.

| Year | Potential Low | Average Price | Potential High |

|---|---|---|---|

| 2026 | $5.10 | $7.20 | $9.35 |

| 2027 | $6.30 | $9.15 | $11.90 |

| 2028 | $8.00 | $12.70 | $15.40 |

| 2029 | $9.50 | $14.60 | $19.75 |

| 2030 | $12.60 | $18.20 | $23.80 |

Trading Strategies For Sui

Given Sui’s position as a relatively new but technologically advanced Layer-1 blockchain, trading its native token requires more than just a gut feeling. The token is sensitive to a mix of factors, including scheduled token unlocks, developments within its growing DeFi and gaming ecosystems, and the overall health of the crypto market. A well-thought-out plan can make a big difference in navigating its price swings and capitalizing on opportunities.

A strategic approach allows traders to set clear entry and exit points, manage risk, and align their actions with their long-term beliefs about the project. Whether you’re aiming for quick profits from volatility or steady accumulation for the future, having a defined method is key to staying grounded when the market gets shaky.

Staking for Passive Rewards

Staking is an excellent strategy for those who believe in the long-term prospects of the Sui network and want to earn passive rewards. The network uses a Delegated Proof-of-Stake (DPoS) system, which means you don’t have to run your own validator node. Instead, you can delegate your SUI tokens to one of the existing validators who process transactions and secure the network.

In return for helping to secure the network, validators earn rewards from transaction fees and protocol subsidies. A portion of these earnings is then distributed to the users who delegated their tokens to them. This method allows you to increase your SUI holdings over time, as rewards are typically paid out in SUI. It’s a lower-stress approach compared to active trading, as it focuses on accumulation rather than timing market peaks and troughs.

Swing Trading on Key Levels

For more active traders, swing trading can be a way to profit from Sui’s price fluctuations. This method involves identifying key technical support and resistance levels on the price chart and making trades based on them. Support is a price level where a downtrend can be expected to pause due to a concentration of demand, while resistance is where an uptrend is likely to pause temporarily, due to a concentration of supply.

For example, looking at recent price action, SUI has shown strong support around the $3.11 mark and faced resistance near $3.85 and $4.44. A swing trader might look to buy SUI when it approaches a support level and shows signs of bouncing back up, and then sell it as it nears a resistance level. This strategy requires a good understanding of technical analysis and staying updated on market news, as events like major partnerships or large token unlocks can cause these levels to break.

Providing Liquidity in DeFi

Engaging with Sui’s DeFi ecosystem by providing liquidity is a strategy for those with a higher risk tolerance. Platforms like Cetus, a decentralized exchange on Sui, allow users to become liquidity providers (LPs). This involves depositing your SUI tokens, along with another asset like USDC, into a liquidity pool. These pools are what other users trade against.

As an LP, you earn a share of the trading fees generated from that pool, proportional to your contribution. This can be a great way to put your assets to work and earn income from the trading activity on the network. However, it’s important to be aware of impermanent loss, a potential risk where the value of your deposited assets can decrease compared to simply holding them in your wallet.

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging is one of the most straightforward and effective long-term strategies, especially for a volatile asset like SUI. Instead of trying to time the market by investing a large sum at what you hope is the lowest price, DCA involves investing a fixed amount of money at regular intervals, regardless of the price.

This approach smooths out your average purchase price over time. When the price is low, your fixed investment buys more SUI, and when the price is high, it buys less. DCA reduces the impact of volatility and removes the emotional stress of trying to perfectly time your entry. It’s a disciplined method for steadily building a position in an asset you believe has strong long-term fundamentals.

For anyone looking to stay up-to-date with the fast-moving developments, keeping an eye on the latest Sui news is crucial for making informed decisions.

How to Learn More About Sui?

Sui’s design, centered on an object-based model rather than the more common account-based system, allows it to process many transactions at once. This parallel execution is a core reason for its impressive speed and low fees, making it a strong contender for gaming and high-volume financial applications.

For anyone new to cryptocurrency, however, these technical distinctions can make getting started feel somewhat challenging. Understanding how assets are managed as “objects” and how the Move programming language provides a secure environment is key to appreciating Sui’s potential.

To get a solid grip on the Sui network, here are some of the best places to start your research:

Sui Official Website

The official website, Sui.io, is the central hub for the entire project. It’s the most reliable source for official announcements, blog posts from the development team, and detailed documentation. For developers, it offers an extensive set of tools and guides for building on the network.

For investors and users, the site provides a great overview of the ecosystem, highlighting key projects and partners that are building on Sui. It’s the best starting point to get verified information directly from the source.

Sui Whitepaper

For those who want to delve beyond surface-level explanations, the Sui whitepaper serves as the foundational document. It offers a deep technical breakdown of the blockchain’s architecture, from the object-centric data model to its unique consensus mechanism.

Be warned, it’s a dense read filled with technical jargon, but it provides an unfiltered look into the core principles that make Sui work. Reading it provides a much clearer picture of what distinguishes Sui from other Layer 1 blockchains.

Crypto Data Aggregators

Websites like CoinGecko and CoinMarketCap are essential for any crypto investor. They provide real-time data on SUI’s price, market capitalization, 24-hour trading volume, and circulating supply. You can also review historical price charts to identify trends and patterns.

Official Social Media Channels

Sui’s official X account is a must-follow for timely updates. It’s where the team posts the latest news on partnerships, network upgrades, and ecosystem growth. Following the official account, as well as key figures from Mysten Labs, provides a direct line to the project’s pulse. It’s also a great way to gauge community sentiment and see what others are saying about the network’s progress.

Blockchain Explorers

A blockchain explorer like Suiscan is like a search engine for the Sui network. It lets you look up any transaction, wallet address, or smart contract on the blockchain. You can see real-time network activity, check the status of your transactions, and see how many active wallets are on the network. This is an indispensable tool for verifying on-chain data and getting a transparent view of the network’s health and activity levels.

If you want to learn more about the Sui network itself, check out this article on What is Sui?

By putting together its technical strengths, the growth of its ecosystem, and broader market trends, it’s possible to build a well-rounded view of where SUI might be headed. The information provided in this guide is current as of January 2026.

SUI Price Prediction FAQs

Here are answers to some frequently asked questions about SUI price prediction for 2026:

Will SUI Reach 10 Dollars?

Hitting the $10 mark is a realistic target for SUI, with some forecasts placing it in that range between 2028 and 2029. This growth depends on the continued expansion of its DeFi and gaming ecosystems. Achieving this would require its market cap to grow substantially, driven by genuine utility and widespread adoption.

Can SUI Reach $50?

A price of $50 is a long-term possibility, with projections pointing toward the 2040 timeline. Reaching this valuation would mean Sui has become a core piece of Web3 infrastructure, integrated into mainstream finance and entertainment. It’s a very ambitious target that counts on decades of sustained growth and innovation.

What Will SUI Be Worth in 2026?

By the end of 2026, Sui’s price is predicted to trade between a potential low of $3.84 and a high of $7.01. This forecast is supported by growing institutional interest and major token unlocks scheduled throughout the year. The actual price will be heavily influenced by overall crypto market sentiment and the successful rollout of new dApps.

Is SUI Better Than Bitcoin?

Sui and Bitcoin are built for entirely different tasks. Bitcoin functions as a store of value, while Sui is a high-performance platform for decentralized applications. Sui can theoretically handle up to 297,000 transactions per second, whereas Bitcoin processes about 7, making them fundamentally different technologies solving separate problems.

Is SUI Better Than Cardano?

Sui prioritizes speed and real-time performance, which is a departure from Cardano’s slower, more academic development approach. Sui’s parallel processing architecture gives it a distinct performance advantage for applications needing instant finality. This makes it more suited for high-frequency use cases like on-chain gaming and trading.

Should I Invest in Sui or Solana?

The choice between Sui and Solana comes down to weighing a newer platform against an established one. Solana has a larger ecosystem but has experienced network outages. Sui offers a potentially more reliable architecture and the security-focused Move language, but has a smaller validator set of around 100, making it a different kind of bet on future growth.