What is Ethereum? ETH Explained – January 2026

Ethereum is a digital frontier that has grown far beyond a simple digital currency. As of January 2026, the Ethereum ecosystem is a thriving hub for decentralized finance (DeFi), digital art and collectibles (NFTs), and thousands of applications that are transforming digital interactions. It’s a platform where developers, creators, and even major corporations come to build the next generation of the internet.

Ethereum is a decentralized, open-source blockchain network. More than just a currency, it is a global, programmable computer that isn’t owned or operated by any single entity. Its native token is called Ether (ETH), which is used to pay for activities on the network. It is better described as a platform for running smart contracts. These are programs that automatically execute when specific conditions are met, allowing for complex, automated agreements without the need for a middleman. For instance, Ethereum currently hosts over 60% of the entire DeFi market, with a total value locked of approximately $27 billion.

This programmability is what truly sets Ethereum apart. Developers use it to build decentralized applications (dApps) for a wide range of purposes, from open financial services to games where players truly own their in-game items, and social networks that are resistant to censorship. Since its launch in 2015, the network has processed over 22 million blocks and now handles approximately 1.6 million transactions daily. Its unique ability to support a vast and varied digital economy is its defining characteristic.

Why is Ethereum Unique? ETH Features

Now that you know what Ethereum is, you should also get familiar with its unique features. While many other blockchains exist, Ethereum’s combination of history, technology, and community gives it a distinct position.

| Feature | Ethereum | Bitcoin | Solana |

|---|---|---|---|

| Primary Function | A programmable network for building and running smart contracts and dApps. | A peer-to-peer digital cash system and store of value. | Often focus on high transaction speeds or specific architectures to compete with Ethereum. |

| Smart Contracts | Native, Turing-complete smart contracts are central to the platform’s purpose. | Very limited scripting ability; not designed for complex applications. | Have smart contract capabilities, but Ethereum’s are the most battle-tested with the largest codebase. |

| Consensus Mechanism | Proof-of-Stake (PoS), which is energy-efficient and allows users to earn rewards by staking ETH. | Proof-of-Work (PoW), which is very secure but requires massive amounts of energy. | Typically use variations of Proof-of-Stake or other newer, less proven consensus models. |

| Ecosystem Size | Has the largest and most active ecosystem, with hundreds of thousands of developers and thousands of applications. | The largest by market cap with a strong monetary network, but a much smaller application ecosystem. | Ecosystems are growing but are still considerably smaller and less developed than Ethereum’s. |

| Token Standards | Established the dominant token standards, like ERC-20 for digital currencies and ERC-721 for NFTs. | No widely adopted token standards; secondary asset protocols are built on separate layers. | Have their own token standards, but many projects still issue tokens on Ethereum for its liquidity and reach. |

| Economic Model | ETH is used for gas fees, staking, and as money. EIP-1559 burns a portion of fees, making ETH potentially deflationary. | A fixed supply of 21 million coins creates a deflationary monetary policy. | Various models, often with different inflation rates and fee structures designed to attract users. |

There is a lot more to Ethereum’s uniqueness in its background story and historical facts.

Ethereum History, Facts & Statistics

Ethereum’s story is central to the modern cryptocurrency landscape, introducing a level of programmability that fundamentally changed what a blockchain could do. The concept of Ethereum was first introduced in a white paper published in late 2013 by Vitalik Buterin, a 19-year-old programmer and co-founder of Bitcoin Magazine.

Buterin believed that Bitcoin’s scripting language was too limited and that blockchain technology had potential far beyond being just a peer-to-peer payment system. His vision was to create a new, more flexible platform —essentially a decentralized global computer — that could run any application developers could dream up.

This idea quickly gained traction, and in early 2014, Buterin, along with a team of co-founders including Gavin Wood and Joseph Lubin, formally started the Ethereum project. To fund its development, the team launched a public crowdsale in July 2014, which raised over $18 million in Bitcoin. Following 18 months of development, the first live version of the Ethereum network, codenamed Frontier, went live on July 30, 2015. This launch marked the official beginning of a new era for blockchain, enabling the creation of smart contracts and decentralized applications (dApps).

One of the most defining moments in Ethereum’s early history was the 2016 hack of “The DAO,” a decentralized venture capital fund built on the platform. A vulnerability in its code was exploited, leading to the theft of millions of dollars’ worth of ETH. The event was a major test for the young network and led to a contentious hard fork to recover the stolen funds. This split the community and the blockchain itself, creating the Ethereum we know today (ETH) and the original, unaltered chain, which became known as Ethereum Classic (ETC).

Ethereum’s Key Facts & Statistics

- Ethereum is the second-largest cryptocurrency by market capitalization, second only to Bitcoin.

- ETH reached its all-time high of nearly $4,892 in November 2021.

- The 2022 network upgrade, known as “The Merge,” transitioned Ethereum from Proof-of-Work to Proof-of-Stake, reducing its energy consumption by an estimated 99.9%.

- In July 2025, the Ethereum network is processing a daily average of $45 billion in volume across approximately 1.6 million transactions.

- As of April 2025, about 27% of the total ETH supply (32.2 million ETH) is staked by validators to secure the network.

- Since the London upgrade in August 2021, over 5 million ETH (equivalent to $15 billion) have been permanently removed from circulation through a fee-burning mechanism.

- Ethereum has the largest and most active developer community in the blockchain space, with over 49,000 stars on GitHub.

- The initial 2014 crowd sale raised 31,000 BTC, which was worth approximately $18 million at the time.

It’s important to remember that Ethereum’s technology and market standing are not set in stone; the network is in a constant state of development, and its value is subject to significant fluctuations and uncertainties.

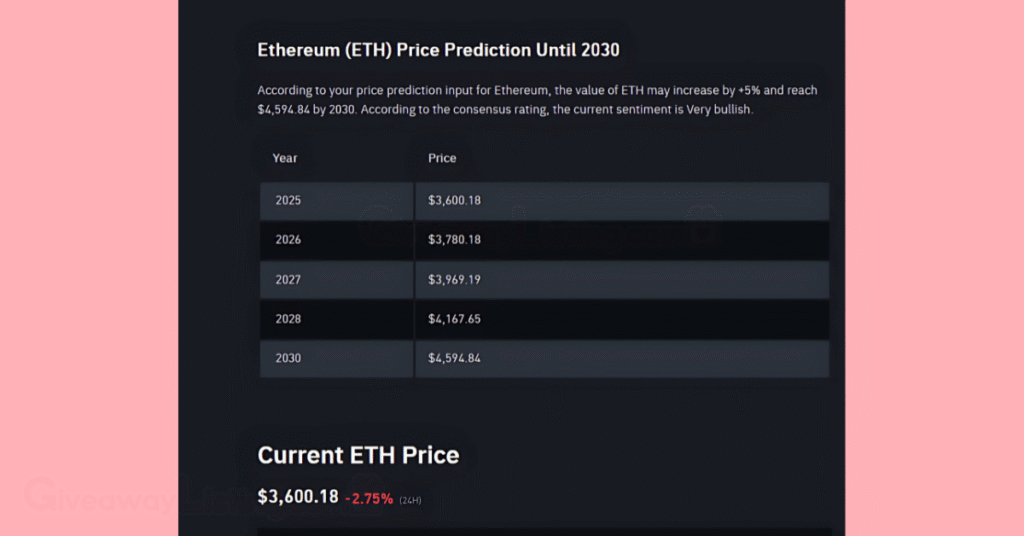

ETH Price Predictions. Is Ethereum Going to Crash or Moon in 2026?

Digital currencies are known for their price swings, and Ethereum is no exception. The asset has experienced incredible highs and lows, ranging from its all-time high of nearly $4,892 in late 2021 to a low of just $0.43 at its lowest point. A mix of technological developments, market sentiment, and broader economic factors drives this volatility.

Ethereum Price Prediction Factors in 2026

Several key elements are shaping Ethereum’s price trajectory in 2026. One of the biggest drivers is institutional adoption, which has gained serious momentum. The launch of spot ETH Exchange-Traded Funds (ETFs) has opened the doors for a new wave of capital, with record-breaking inflows seen in mid-2025. We’re also seeing a trend of publicly traded companies adding ETH to their balance sheets, creating a new source of consistent buying pressure that wasn’t present in previous market cycles.

Continuous network upgrades are another critical factor. The Dencun upgrade in early 2024 significantly lowered transaction fees for Layer-2 scaling solutions, making the ecosystem more affordable and attractive to users. The upcoming Pectra upgrade brings further enhancements to the user experience, staking, and overall network efficiency. These upgrades are designed to address scalability and usability, which are vital for long-term growth and adoption.

Finally, the health of the broader DeFi and NFT ecosystems plays a huge role. As more financial services are built on Ethereum and digital ownership becomes more mainstream, the demand for ETH—the network’s native asset used to pay for all this activity—naturally increases. This utility-driven demand is a core part of Ethereum’s long-term value proposition.

Is Ethereum Going to Crash or Moon in 2025?

The big question for 2026 is whether ETH will continue its strong performance or face a significant downturn. As of late January 2026, Ethereum is experiencing a powerful rally, with its price hitting a seven-month high above $3,800 after nine straight days of gains. This surge is backed by massive accumulation from large investors, or “whales,” who have reportedly purchased over 500,000 ETH in just two weeks.

Some market analysts are incredibly bullish. Tom Lee of Fundstrat has described Ethereum as “Wall Street’s preferred choice” for blockchain infrastructure and has set a price target of $10,000 to $15,000 by the end of 2025. Other experts, like Arthur Hayes, see ETH potentially reaching $10,000, citing institutional cash flow and its essential role in DeFi. If you want to check out more detailed price targets, you can find more information in this Ethereum price prediction article.

However, some traders remain skeptical, referring to the current run as “the most hated rally” due to underlying bearish sentiment. A significant amount of short positions could be liquidated if the price surpasses the psychological $4,000 mark, which could trigger a “short squeeze” and drive the price even higher. The technical charts indicate that ETH is approaching a critical resistance zone around $4,000, a level that has previously held it back multiple times. A strong break above this level could signal the next major upward move, while a failure to do so might lead to a period of consolidation.

Ethereum Risks, Scams, and Hacks

While trading and investing in Ethereum present many opportunities, the space is also filled with market risks and crypto scams that can lead to significant financial loss if you’re not careful.

The Risks Associated With Ethereum

The primary risk in the Ethereum market is its price volatility. Its value can swing dramatically in short periods due to market sentiment, regulatory news, and macroeconomic trends. This means that while there’s potential for high returns, there’s an equally high chance of substantial losses. Another big concern is smart contract risk. Because Ethereum’s ecosystem is built on programmable code, bugs or vulnerabilities in a dApp’s smart contract can be exploited by attackers. This has led to massive losses in the past, such as the Parity wallet bug in 2017 that permanently froze $280 million worth of ETH.

Regulatory uncertainty also hangs over the market. Governments worldwide are still determining how to approach digital assets, and any new laws or classifications could impact Ethereum’s value and usage. Finally, while Ethereum is decentralized, concerns about centralization persist. A large portion of network validators is concentrated within a few major staking pools, and the issue of Miner Extractable Value (MEV), where block producers can reorder transactions for profit, raises questions about fairness for the average user.

To manage these risks, consider the following:

- Do Your Own Research (DYOR): Before investing in any Ethereum project, thoroughly vet its technology, team, and community. Don’t rely on hype from social media.

- Manage Your Risk: Never invest more than you can afford to lose. Use tools like stop-loss orders when trading to automatically sell your position if the price drops to a certain level.

- Diversify: Avoid putting all your funds into a single asset or protocol. Spreading your investments can help cushion the blow if one of them performs poorly.

- Understand the Tech: Take time to learn the basics of how Ethereum, smart contracts, and wallets work. Knowing the fundamentals is your first line of defense.

How to Avoid Ethereum Scams and Hacks?

Ethereum’s popularity has unfortunately made it a prime target for scammers and hackers. The platform’s history includes some of the largest heists in crypto history. The 2016 hack of The DAO, an early decentralized investment fund, resulted in $60 million in ETH being siphoned off due to a code vulnerability.

Scammers are constantly adapting their methods. Phishing remains one of the most common tactics, where fake websites or emails that look like legitimate services trick users into giving up their private keys or seed phrases. Major network upgrades, like The Merge, are often used as bait for scams, with bad actors creating fake “ETH2” tokens or fraudulent staking pools to lure unsuspecting victims. Social media is another hotbed for scams, with impersonators of high-profile figures like Vitalik Buterin promoting fake giveaways that require you to send crypto first.

Here are some common red flags and tips to stay safe:

- If it sounds too good to be true, it probably is. Be highly skeptical of promises of guaranteed high returns or free crypto that require you to send money or connect your wallet first.

- Check URLs carefully. Scammers often use URLs that closely resemble those of official websites. Always double-check that you are on the correct site before connecting your wallet or entering any sensitive information.

- Never share your private key or seed phrase. Anyone who asks for this information is trying to steal your funds. Your seed phrase is the master key to your entire wallet.

- Beware of unsolicited DMs. Scammers frequently reach out on platforms like X (formerly Twitter), Telegram, and Discord, pretending to be from a project’s support team. Legitimate support will never DM you first or ask for your keys.

How to Secure Your Ethereum Wallet?

Your wallet is the gateway to your digital assets, and securing it is your top priority. Choosing the right setup and following best practices can make all the difference in keeping your ETH and other tokens safe from thieves.

Follow these steps to keep your wallet secure:

- Use a Hardware Wallet: For any significant amount of crypto, a hardware wallet like a Ledger or Trezor. is the gold standard. These devices keep your private keys offline, making it nearly impossible for hackers to access them through your computer or phone.

- Store Your Seed Phrase Securely: Write down your seed phrase on paper or another physical medium and store it in a safe, private location. Never store it as a digital file on your computer or phone, or in a cloud service.

- Use Strong Passwords and 2FA: Protect your exchange accounts and any software wallets with a strong, unique password and enable two-factor authentication (2FA) using an app like Google Authenticator, not just SMS.

- Be Cautious with Browser Extensions: Only install wallet extensions from official sources. Malicious extensions can be used to steal your information.

- Revoke Token Approvals: Periodically review and revoke permissions you’ve given to dApps. If a protocol you’ve used gets hacked, this can prevent them from accessing your funds.

The best advice is to remain cautious. Always obtain your information from official Ethereum channels and exercise caution when connecting your wallet to a new or unfamiliar website.

Latest News on Ethereum

Since its launch, Ethereum has been on a path of continuous improvement, marked by significant upgrades that have reshaped its capabilities. The network’s transition to a Proof-of-Stake consensus mechanism in 2022, known as The Merge, was a monumental feat that drastically reduced its energy footprint. More recent upgrades, such as Dencun, have focused on making the network more scalable and affordable for everyone by reducing fees in its Layer-2 ecosystem.

ETH has been on a major rally, climbing over 50% during the month to reach prices above $3,800. The newly approved spot ETH ETFs have seen massive inflows, pulling in over $2.18 billion in a single week. This, along with news of publicly traded companies adding ETH to their balance sheets, points to growing institutional confidence.

The Ethereum developer community is actively working on the Fusaka upgrade, which will introduce PeerDAS to significantly increase the network’s data handling capacity, paving the way for even lower Layer-2 fees and higher transaction throughput.

Following the Pectra upgrade, the network’s roadmap includes a series of updates codenamed “Verge,” “Purge,” and “Scourge,” all aimed at improving scalability and decentralization in the latter half of 2025. For the most up-to-the-minute information, check out the latest Ethereum news.

As of January 2026, all major Ethereum clients support EIP-4444, an update that allows node operators to prune historical data from before The Merge. This change can reduce the required disk space by 300-500 GB, making it easier for more people to run a node and contribute to securing the network.

To stay informed with verified information, be sure to follow the official Ethereum channels:

- Official Ethereum Blog: blog.ethereum.org

- Ethereum.org Website: ethereum.org

- Ethereum Community on X: @ethdotorg

How to Get Started with Ethereum?

Getting your hands on ETH and diving into its ecosystem is a straightforward process. If you’re ready to get started, here are the basic steps to follow.

- Get a Wallet: This is your digital account on Ethereum where you’ll store your ETH and other assets. You have a few options to choose from. Software wallets are apps for your phone or browser extensions that are easy to set up and use for daily transactions.

- Acquire Some ETH: Once you have a wallet, you’ll need some Ether. The most common way to obtain it is by purchasing it from a cryptocurrency exchange, such as Coinbase, Binance, or Kraken. You can typically buy ETH using your local currency via a bank transfer or credit card.

- Explore Decentralized Apps (dApps): With ETH in your wallet, you’re ready to explore the thousands of applications built on Ethereum. You can lend or borrow assets in the world of DeFi, buy or sell digital art and collectibles as NFTs, join a decentralized autonomous organization (DAO), or play a game where you truly own your in-game items. Simply connect your wallet to the dApp’s website to get started.

This guide has walked you through the essentials of Ethereum, from its core concept as a programmable global computer to its unique features that set it apart. We’ve covered its history, from a visionary white paper in 2013 to its current status as a digital economic powerhouse, and looked at the market forces shaping its price in 2026.

It’s crucial to remember that while the opportunities are vast, the risks are just as real. The cryptocurrency world is characterized by extreme price volatility, and security threats are a constant concern. Always be security-conscious, do your own research, and never invest more than you are willing to lose.

Here are the most essential points to remember:

- Ethereum is more than a currency; it’s a decentralized platform for building and running applications and smart contracts.

- Its native token, Ether (ETH), is used to pay for transactions and computational services on the network.

- The Merge upgrade in 2022 transitioned Ethereum to a Proof-of-Stake system, cutting its energy consumption by over 99.9%.

- Ethereum has the largest and most active developer community in the crypto space, which is a key driver of its innovation.

- The price of ETH is highly volatile. While there’s potential for significant gains, you should be prepared for major price swings.

- Security is your responsibility. Using a hardware wallet and never sharing your seed phrase are critical steps to protect your assets.

This information is current as of January 2026.

What Is Ethereum FAQs

Here are answers to some frequently asked questions about Ethereum in 2026.

Is Ethereum a Good Investment?

Ethereum is considered a high-risk, high-reward asset class. Its value is supported by a massive ecosystem of decentralized finance (DeFi) and NFTs. The network hosts over 60% of all DeFi activity, but potential investors should be aware of its significant price volatility and the ongoing regulatory uncertainties in the digital asset space. It can be a good investment if you understand the strategies.

How Much is 1 Eth Worth Right Now?

The current price of one Ether (ETH) is $3,593. This valuation gives Ethereum a total market capitalization of approximately $458.7 billion, making it the second-largest digital asset in the world. The price can change quickly due to the high volatility of the cryptocurrency market.

Which is Better, Bitcoin or Ethereum?

Neither is definitively better, as they serve different purposes. Bitcoin is primarily seen as a store of value, with a focus on security and decentralization. Ethereum, on the other hand, is a programmable platform for building decentralized applications, handling a much larger volume of daily transactions, with an average of 1.6 million. The better choice depends on your investment goals.

How Much is $1000 in Ethereum 5 Years Ago?

On July 24, 2020, the price of one ETH was approximately $279. An investment of $1,000 at that time would have purchased about 3.58 ETH. Based on today’s price, the same investment would now be worth approximately $12,863.