What is Litecoin? LTC Explained – March 2026

Litecoin, known by its ticker symbol LTC, is one of the world’s original cryptocurrencies. Launched in October 2011 by former Google engineer Charlie Lee, it was created to be a faster and more accessible version of Bitcoin. The LTC token is the native currency of the Litecoin network, used to power its operations and facilitate value transfer.

It is a peer-to-peer digital currency that operates on a decentralized, global payment network. This means it functions without a central authority, such as a government or bank, allowing users to send funds directly to one another. Every transaction is securely recorded on a blockchain.

Litecoin was designed to be the “silver to Bitcoin’s gold,” intended not to replace Bitcoin but to complement it. Its primary use is for quick, low-cost payments and everyday transactions, making it a practical option for buying goods and services or sending money across borders without the typical delays and fees associated with traditional financial systems. It has built a reputation for reliability and stability over its long history. The combination of its proven technology and focused purpose gives Litecoin a distinct identity in the crowded crypto market.

Why is Litecoin Unique? LTC Features

While Litecoin was built from Bitcoin’s original code, it introduced several key modifications that give it a unique edge. These features were designed to improve speed, efficiency, and accessibility for everyday use.

One of its most significant advantages is its speed and low cost. The Litecoin network processes a block of transactions every 2.5 minutes, which is four times faster than Bitcoin’s 10-minute average. This leads to quicker transaction confirmation.. Alongside this speed, transaction fees on the Litecoin network are typically very low, often costing only a few cents.

Litecoin also has different economic properties. Its maximum supply is capped at 84 million coins, four times larger than Bitcoin’s 21 million. This larger supply was intended to keep the price per coin lower and more psychologically accessible for small transactions. The network is secured through a mining process that uses a distinct algorithm called Scrypt. This algorithm was initially chosen to enable more people to participate in mining with standard computer hardware, thereby promoting a more decentralized and secure network from the outset.

Over the years, Litecoin has also served as a testing ground for new technologies that were later adopted by Bitcoin. It was one of the first major cryptocurrencies to activate Segregated Witness (SegWit), a technical upgrade that increases transaction capacity. More recently, Litecoin implemented MimbleWimble Extension Blocks (MWEB), a groundbreaking feature that allows users to opt in for private transactions. This enables the hiding of transaction amounts and wallet addresses.

This history of adopting new technology helps people evaluate its long-term potential. Altogether, its faster transaction speed, lower fees, different mining algorithm, and privacy features are what make Litecoin stand out.

Litecoin History, Facts & Statistics

Litecoin is one of the earliest and most established cryptocurrencies, often seen as a reliable and stable alternative to Bitcoin. Launched shortly after Bitcoin, it was designed to be a faster and more efficient version, suitable for everyday transactions. While Bitcoin earned the nickname “digital gold” for its role as a store of value, Litecoin was positioned as “digital silver,” a lighter, more transactional counterpart. This branding has endured for over a decade, solidifying its place as a foundational asset in the digital currency world.

Its longevity has allowed it to build a strong reputation and a dedicated community. Unlike many newer projects that have come and gone, Litecoin has consistently maintained its position among the top cryptocurrencies by market capitalization. It operates on a decentralized, open-source platform, meaning no single entity controls it, and its code is available for anyone to review and use. This transparency, along with its proven track record, is a key reason why it remains a popular choice for both new and experienced crypto users.

Litecoin was founded by Charlie Lee, a computer scientist and former Google engineer. Lee launched the network in October 2011, taking Bitcoin’s open-source code as a starting point. His goal was to address what he saw as some of Bitcoin’s limitations, particularly its 10-minute block confirmation time, which could be slow for point-of-sale purchases.

Lee modified the code to create a network that could confirm transactions four times faster, without compromising the core principles of security and decentralization. The project was launched fairly, with no pre-mine or initial coin offering, distributing all its tokens through the mining process. Over the years, Litecoin has served as a testbed for new technologies that were later adopted by Bitcoin.

Litecoin Key Facts & Statistics

- Litecoin was created by former Google engineer Charlie Lee and went live on October 13, 2011.

- Its total maximum supply is capped at 84 million LTC, which is exactly four times the supply of Bitcoin.

- The network’s block generation time is approximately 2.5 minutes, making it about four times faster than Bitcoin.

- Litecoin uses the Scrypt hashing algorithm, which was originally intended to be more accessible for mining with consumer-grade hardware like GPUs.

- Like Bitcoin, Litecoin undergoes a “halving” event roughly every four years, where mining rewards are cut in half. The most recent halving occurred in August 2023, reducing the block reward to 6.25 LTC.

- As of late 2025, more than 76 million LTC are already in circulation.

- The all-time high price for Litecoin was $412.96, recorded on May 10, 2021.

- Its all-time low price was $1.15, which occurred in January 2015 during a major market downturn.

- In a move to avoid any perceived conflict of interest, founder Charlie Lee announced in 2017 that he had sold and donated all of his LTC holdings.

- The Litecoin Foundation, a non-profit organization, helps guide the development and promotion of the network.

- Due to its faster confirmation times and low fees, Litecoin is accepted by thousands of merchants worldwide.

It is important to remember that LTC, like all digital currencies, is a volatile asset and is susceptible to sudden fluctuations in value and market uncertainties.

LTC Price Predictions. Is Litecoin Going to Crash or Moon in 2026?

Digital currencies are known for their price volatility, and Litecoin is no exception. Throughout its history, LTC has experienced significant price swings, moving between periods of rapid growth and sharp corrections. This behavior is common in the crypto market, where values are heavily influenced by market sentiment, technological developments, and broader economic factors.

Litecoin has seen some impressive peaks and deep troughs. Its price reached an all-time high of over $412 in May 2021, during a major bull run in the crypto market. On the other side, it fell to as low as $1.15 in early 2015. These record-breaking prices show just how much its value can change, offering both high-risk and high-reward opportunities for traders. The constant movement in its price keeps market watchers and analysts busy trying to forecast its next move.

For 2026, price predictions from various market analysts generally lean toward cautious optimism. Some forecasts suggest that Litecoin could stabilize and test resistance levels between $115 and $130. This view is often based on its historical performance following halving events, which reduce the supply of new coins entering the market and have previously been linked to upward price pressure.

Other experts are more optimistic, citing the overall health of the crypto market and potential for new adoption. These more positive predictions see LTC potentially climbing toward the $150 to $180 range, especially if Bitcoin continues to perform well and a broader bull market takes hold. However, some analysts remain conservative, suggesting that if Litecoin fails to break through key resistance levels, it could trade in a lower range, possibly between $90 and $110.

For more detailed trading analysis, this Litecoin price prediction provides additional price targets and technical insights.

Several factors can affect Litecoin’s value. The halving of mining rewards is a built-in feature that has historically had a positive effect on its price by reducing inflation. Technological upgrades, like the MWEB feature for enhanced privacy, can also attract new users and increase demand. Wider adoption by merchants and payment processors adds to its real-world utility, which can support a higher valuation.

On the other hand, factors can also negatively affect its price. Increased competition from newer cryptocurrencies with more advanced features could draw attention away from Litecoin. Regulatory news from governments around the world can create uncertainty in the market. Finally, general market sentiment and the price action of Bitcoin often have a strong influence on Litecoin’s performance, meaning a downturn in the broader market would likely pull its value down as well.

Litecoin Risks, Scams, and Hacks

Engaging with Litecoin, whether for trading or long-term holding, comes with its own set of challenges. The digital currency space is characterized by volatility and scammers, so users must be aware of the potential downsides. Like other cryptocurrencies, Litecoin’s value can change dramatically in short periods. Currently, LTC has experienced significant price fluctuations. This volatility presents a risk for anyone looking for a stable asset.

Beyond market fluctuations, regulatory changes pose another considerable risk. Governments worldwide are still determining how to regulate digital assets, and new regulations could impact Litecoin’s value and accessibility. Competition is also a factor; while Litecoin was an early player, newer blockchains offer different features that attract user attention, potentially impacting LTC’s market share and utility. The departure of its founder, Charlie Lee, from holding any LTC in 2017, although explained as a means to avoid a conflict of interest, remains a point of discussion among market watchers and affects their perception.

The anonymous nature of crypto makes it a target for various scams. Phishing attempts are common, where fake websites or emails trick users into revealing their wallet keys. Fraudulent giveaways on social media often promise to double any LTC sent to a specific address, but they simply steal the funds. Pump-and-dump schemes, although less common with an established coin like Litecoin, can still artificially inflate the price before a massive sell-off, leaving many with losses.

How to Avoid Litecoin Risks, Scams and Hacks?

Staying safe in the Litecoin space requires a good dose of skepticism and careful practices. Always double-check website URLs and email sender addresses before clicking any links or downloading files. If an offer seems too good to be true, such as a promise of guaranteed high returns or free LTC with a deposit, it almost certainly is.

Be cautious of unsolicited messages or friend requests on social media platforms from individuals offering investment advice or inside information. Verify information through official channels rather than relying on rumors or unverified posts. Before sending LTC, confirm the receiving address is correct, as blockchain transactions are irreversible. Also, be wary of unknown airdrops or free tokens that appear in your wallet, as interacting with them can sometimes compromise your security.

How to Secure Your LTC?

Protecting your Litecoin holdings is critical. Simply leaving your coins on an exchange where you bought them is not recommended for long-term storage, as exchanges can be targets for hackers. Taking control of your assets with a personal wallet is a much safer approach.

- Use a Hardware Wallet: For significant amounts of LTC, a hardware wallet (cold storage) is the top choice. These devices keep your private keys offline, making them immune to online hacking attempts.

- Enable Two-Factor Authentication (2FA): On any exchange or service you use, activate 2FA. This adds an extra layer of security beyond just a password.

- Back Up Your Seed Phrase: When you set up a wallet, you’ll receive a seed phrase. Write this down and store it in a secure, offline location. Never store your seed phrase digitally or share it with anyone. This phrase is the only way to recover your wallet if you lose access to your device.

- Keep Software Updated: Ensure your wallet software and device operating system are always running the latest versions to protect against known vulnerabilities.

- Use Strong, Unique Passwords: Avoid reusing passwords across different platforms. A strong password combined with 2FA offers solid protection for your accounts.

To keep up with the project’s security updates and official announcements, it’s best to rely on news from the official Litecoin channels. Avoid connecting your wallet to unfamiliar decentralized applications or websites, as they can be a gateway for losing your funds.

Latest News on Litecoin

Since its creation in 2011, Litecoin has consistently incorporated new technology to maintain its relevance. More recently, the network introduced MimbleWimble Extension Blocks (MWEB).

These developments show a commitment to improving the network’s core functions for payments. The project has also built a reputation as a reliable testbed for features that are later considered for Bitcoin. Here are some of the most recent updates and events in the Litecoin ecosystem.

- Institutional Interest: MEI Pharma, a biopharmaceutical company, announced a treasury strategy that includes holding Litecoin.

- Layer-2 Smart Contracts: The launch of LitVM, a Layer-2 solution in 2025, is set to bring smart contract capabilities to the Litecoin network, opening up possibilities for DeFi and interoperability with other blockchains like Bitcoin and Cardano.

- Adoption by Payment Processors: Major payment platforms, such as BitPay and PayPal, continue to support LTC, and over 4,000 merchants now accept Litecoin for goods and services.

- Network Activity: The Litecoin network has processed over 300 million transactions to date, underlining its consistent use as a medium of exchange.

- Social Tipping: Integration with platforms like the Telegram Wallet allows for easy and low-cost tipping and peer-to-peer payments using LTC.

For more regular updates, check out the latest Litecoin news. Staying informed with timely and accurate information is key to understanding the market.

To get information directly from the source, follow the official Litecoin and Litecoin Foundation social media accounts:

How to Get Started with Litecoin?

Getting started with Litecoin is a direct process, whether you want to use it for payments, hold it as an asset, or contribute to the network’s security. It’s one of the oldest and most established cryptocurrencies, which means there are plenty of user-friendly tools and resources available.

Here is a step-by-step approach for beginners looking to get involved with Litecoin:

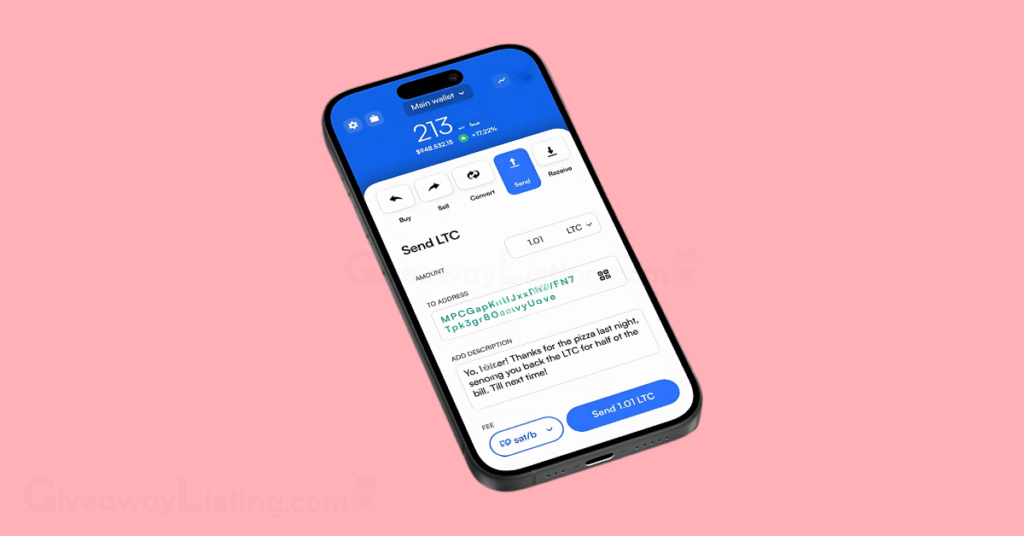

- Set Up a Litecoin Wallet: Before you can acquire any LTC, you need a place to store it. A wallet is a program that manages your private keys, which are what you need to access and spend your coins. For everyday use and smaller transactions, a software wallet on your mobile phone or desktop is convenient. Options like LiteWallet or Exodus are popular choices. For long-term storage and larger amounts, a hardware wallet is the most secure option. Devices from Trezor or Ledger keep your private keys offline, safe from online threats.

- Acquire Litecoin (LTC): Once your wallet is ready, you can get some LTC. There are several ways to do this via cryptocurrency exchanges like Binance, Coinbase, and Kraken, which list Litecoin. You can sign up, verify your identity, and buy LTC with traditional currency. Some mainstream payment apps, such as PayPal, allow users to buy and sell a selection of cryptocurrencies, including Litecoin.

- Explore Litecoin mining: If you are more technically inclined, you can participate in securing the network and earn LTC as a reward. Litecoin mining is performed with specialized hardware known as ASIC miners, which are specifically designed for the Scrypt algorithm. General-purpose computers (CPUs or GPUs) are no longer effective for direct mining. For individuals, joining a mining pool is the most practical approach. Pools combine the computational power of many miners to find blocks more consistently. Rewards are then shared among members based on their contributions.

This information is current as of March 2026.

What is Litecoin FAQs

Here are answers to some frequently asked questions about Litecoin:

How is Litecoin Different From Bitcoin?

Litecoin confirms transactions with a 2.5-minute block time, making it four times faster than Bitcoin’s 10 minutes. It also has a larger maximum supply of 84 million coins compared to Bitcoin’s 21 million. Lastly, Litecoin uses the Scrypt mining algorithm, which is different from Bitcoin’s SHA-256 and was initially designed to be more accessible for miners.

Is Litecoin a Good Investment?

As a long-standing cryptocurrency, Litecoin is a high-risk asset subject to significant market volatility, having reached a peak of over $410 before major price drops. Its future value depends on user adoption, its ability to compete with newer technologies, and overall market sentiment. Its established history provides some stability, but it is not immune to market fluctuations.

Why Do People Buy Litecoin?

Many people buy Litecoin for its fast and affordable transactions, with fees often costing only a few cents. Others see it as “digital silver,” a store of value that complements Bitcoin’s role as “digital gold.” Its widespread availability on most major exchanges and long track record also makes it an accessible and trusted option for many crypto users.

How Do I Convert Litecoin to Cash?

To turn Litecoin into cash, you first send LTC from your wallet to a cryptocurrency exchange that supports fiat currency, like Kraken or Coinbase. On the exchange, you sell your Litecoin for a currency such as U.S. Dollars or Euros. After the sale, you can withdraw the cash from the exchange directly to your linked bank account.