XRP is a digital asset native to the XRP Ledger (XRPL), a decentralized, open-source blockchain network created in 2012. It was designed for fast and low-cost global payments, aiming to be a more efficient alternative to traditional systems. Transactions on the XRPL typically settle in 3-5 seconds for a fraction of a cent. Unlike many other digital currencies, XRP was not mined; the total supply of 100 billion tokens was created at its inception.

The performance of XRP’s price has been a topic of much discussion. Its history includes periods of significant upward movement followed by corrections. After its launch, the price remained relatively stable for several years before experiencing a massive surge in the 2017-2018 crypto market boom, where it reached its all-time high.

Following this peak, its value saw considerable fluctuation, influenced by broader market trends and developments specific to its ecosystem, including a high-profile legal case in the United States. More recently, the asset has shown a renewed surge, breaking past previous resistance levels and sparking fresh interest among market participants.

XRP Price Historical Data From 2015 to 2025

The journey of XRP’s price has been marked by notable highs and lows, reflecting the volatile nature of the digital asset market. Over the years, its value has responded to a variety of catalysts, from technological upgrades on its ledger to shifting regulatory landscapes and overall market sentiment.

The table below contains the XRP prices in the last 10 years:

| Year | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|

| 2015 | $0.03 | $0.005 |

| 2016 | $0.01 | $0.005 |

| 2017 | $2.85 | $0.005 |

| 2018 | $3.84 | $0.24 |

| 2019 | $0.51 | $0.17 |

| 2020 | $0.77 | $0.11 |

| 2021 | $1.96 | $0.21 |

| 2022 | $0.91 | $0.29 |

| 2023 | $0.93 | $0.30 |

| 2024 | $0.72 | $0.42 |

| 2025 | $3.66 | $2.13 |

Understanding the technology and the factors that influence its market is key for anyone interested in its performance.

Latest XRP Price Prediction for February 2026

Predicting the price of any digital asset is complex, and XRP is no exception. Its value has demonstrated significant volatility, recently surging to multi-year highs before experiencing corrections. This price action is influenced by a blend of internal and external factors.

Several key elements that can affect XRP’s price over time include:

- Regulatory Developments: News related to legal cases and government oversight, particularly in the U.S., plays a huge role in shaping investor confidence.

- Institutional Adoption: Increased use of XRP and the XRP Ledger by banks and financial institutions for cross-border payments can drive demand.

- Market Sentiment: The overall mood of the crypto market, often led by Bitcoin’s performance, heavily influences XRP’s price.

- Partnerships and Technology: New collaborations announced by Ripple and upgrades to the XRP Ledger can create positive momentum.

- ETF Speculation: The possibility of a spot XRP Exchange-Traded Fund (ETF) in the U.S. is a major point of interest that could attract significant investment.

- Whale Activity: Large-scale purchases or sales by major holders can create significant price floors or selling pressure.

Based on these factors, various analysts have offered their outlooks for February 2026.

| Analysts Predictions | Minimum Price (USD) | Maximum Price (USD) |

|---|---|---|

| Prediction 1 | $3.00 | $3.80 |

| Prediction 2 | $3.10 | $3.40 |

| Prediction 3 | $2.75 | $3.60 |

| Prediction 4 | $3.15 | $3.42 |

Best 5 XRP Price Predictions in 2026

With recent developments breathing new life into the XRP prospects, forecasting the future price of XRP has become a popular sport among market watchers. After a long period of sideways movement, a combination of positive legal outcomes and growing institutional interest is fueling a more optimistic outlook.

Analysts are now looking at a future where its value could see substantial growth, though the exact figures vary widely. These predictions are not just pulled from thin air; they are based on a mix of technical chart patterns, fundamental analysis of the XRP Ledger’s utility, and macroeconomic factors. Some forecasts are more conservative, suggesting a steady climb, while others are incredibly bullish, pointing to a potential price explosion.

A key factor in many of these outlooks is the increasing chance of a spot XRP ETF in the United States, which could create a new wave of capital. Some of the best predictions are as follows:

1. Standard Chartered’s Institutional Outlook

Some of the more grounded predictions come from observers watching institutional behavior. A typical target floating in these circles is a range between $5 and $5.50 by the end of 2026. This forecast is built on the idea that more corporations and financial institutions will begin to adopt XRP for its primary use case: fast and cheap cross-border payments.

This view is supported by Ripple’s expanding network of partners and its active involvement in over 20 central bank digital currency (CBDC) pilot programs. As these real-world applications grow, the demand for XRP is expected to follow suit. The launch of Ripple’s own stablecoin, RLUSD, also adds a new layer of utility, as fees are collected in XRP and burned, which could create deflationary pressure over time.

2. EGRAG Crypto’s Technical Projections

Technical analysts often look at historical price charts to find patterns that might repeat. One popular method is Elliott Wave Theory, which suggests that markets move in predictable, repetitive cycles. Based on this model, some analysts have mapped out several potential profit-taking zones for 2026.

The projections based on these technicals are quite broad, with some of the more conservative targets falling in the $4 to $6 range. However, more optimistic interpretations of the wave patterns point to a second, more probable region between $11 and $13. These targets are derived from Fibonacci extensions and comparisons to previous bull market cycles, suggesting that if history rhymes, a significant upward move is on the table.

3. Bloomberg Analysts’ ETF-Driven Forecast

The prospect of a spot XRP ETF getting approved in the U.S. is a massive catalyst that has many analysts excited. Some market experts, including those at Bloomberg, have put the chances of approval at over 85%. An ETF would make it much easier for both retail and institutional players to get exposure to XRP without having to buy and store the digital asset themselves.

This potential influx of new money has led to predictions that XRP could surge to the $6 to $8 range shortly after approval. The logic is simple: an ETF provides legitimacy and access, which in turn drives demand and price. The successful launches of Bitcoin and Ethereum ETFs have set a precedent, and many believe XRP is next in line.

4. High-End Bullish Forecasts

On the more ambitious end of the spectrum, some market commentators see XRP reaching double-digit figures, with targets ranging from $10 to as high as $15 by the end of 2026. These predictions are often a blend of all the positive factors combined: successful ETF approval, accelerating institutional adoption, and favorable technical patterns.

This camp believes that the current price does not fully reflect XRP’s potential to disrupt the multi-trillion-dollar cross-border payments industry. They point to the growing number of on-chain transactions and the increasing number of large-scale holders (whales) as signs that smart money is positioning for a major price increase.

5. Utility-Based Growth Scenario

Another compelling view focuses on Ripple’s long-term goal of competing with the SWIFT network. Ripple’s CEO has publicly stated a goal of capturing a significant portion of SWIFT’s global transaction volume. If the company makes meaningful progress toward this goal, the utility-driven demand for XRP would be enormous.

This scenario supports a price target in the $5 to $7 band. Unlike predictions based purely on speculation or technicals, this forecast is tied directly to the real-world success of Ripple’s payment solutions. As more banks and payment providers use Ripple’s On-Demand Liquidity (ODL) service, which uses XRP as a bridge currency, the asset’s fundamental value increases.

Is XRP a Good Investment?

Investing in XRP could be good or bad, depending on your goals. Viewing XRP as an investment means buying into its core mission: to make global payments faster, cheaper, and more reliable. This clear and specific use case is what separates it from thousands of other digital assets that lack a defined purpose. For years, its value has been closely tied to the progress of Ripple, the company that is its largest holder and primary champion in the financial world.

The primary advantage of holding XRP is its established utility in the cross-border payments sector. Transactions on the XRP Ledger settle in 3-5 seconds at a cost of just $0.0002 per transaction, making it incredibly efficient.

However, investing in XRP is not without risks. Like all digital currencies, it is subject to high price volatility, and its value can swing dramatically based on market sentiment. While the legal picture is clearer, it is not completely resolved, and any negative developments could impact its price. Furthermore, a large portion of the total XRP supply is held by Ripple and its founders, which has led to concerns about potential selling pressure on the market. The asset’s price is still highly speculative and can be influenced by factors beyond its fundamental utility.

Ultimately, XRP presents a unique case. It is a bet on the modernization of global finance, backed by a company actively working to make it happen. Its clear use case, growing adoption, and improved regulatory standing make a solid case for its long-term potential. While the risks are real, the potential reward for those who believe in its mission could be substantial.

For those looking to get started, the process is straightforward:

- Select a Crypto Exchange: Choose a reputable platform that lists XRP, such as Binance, Kraken, or Coinbase.

- Create an Account: Sign up and complete the necessary identity verification steps.

- Deposit Funds: Add money to your account using a debit card, bank transfer, or other available payment methods.

- Buy XRP: Go to the trading section, find the XRP pair (like XRP/USD), and place an order.

- Secure Your Assets: For long-term holding, it’s best to move your XRP off the exchange and into a secure personal wallet.

How to Sell XRP?

To sell your XRP, you would first transfer it from your personal wallet back to your exchange account if it’s not already there. Then, you can place a sell order to convert your XRP into a fiat currency like U.S. dollars or another cryptocurrency.

Once the sale is complete, you can withdraw the funds to your linked bank account. Alternatively, you can explore peer-to-peer (P2P) platforms, which allow you to sell directly to another individual.

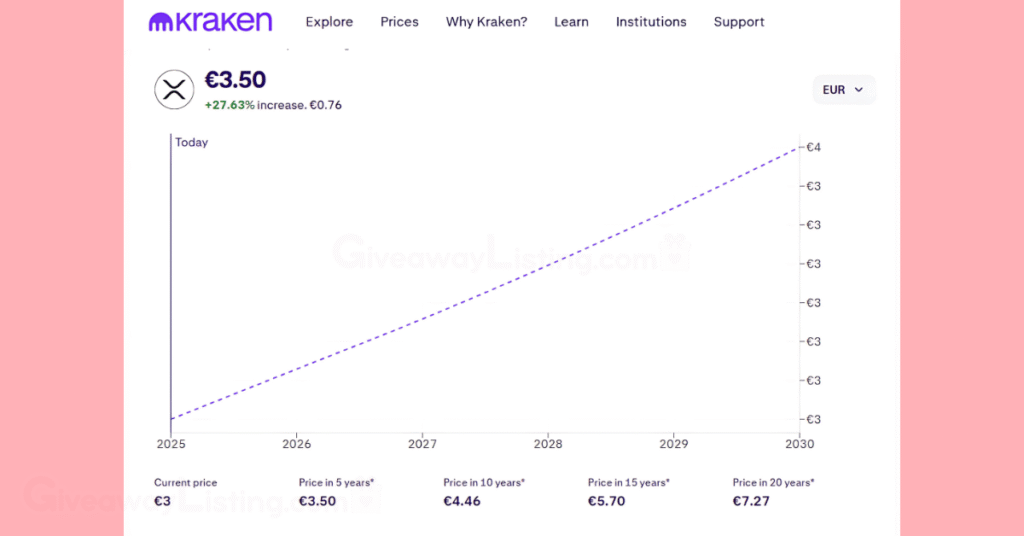

XRP Forecast After 2026

The price journey of XRP has been a roller coaster, marked by explosive climbs and sharp downturns. Looking back five years, the asset’s current valuation around the $3.15 mark represents a significant increase. In 2020, for instance, XRP’s price was as low as $0.11 and peaked at only $0.77.

The years that followed saw it battling legal headwinds and market-wide downturns, with a high of $1.96 in 2021 and a low of $0.29 in 2022. The recent performance shows a clear rebound from those tougher times, reigniting discussions about its long-term potential.

Looking ahead to 2026, many analysts expect the upward momentum to continue, assuming the broader crypto market remains healthy. Predictions for this year often land in the $5 to $7.55 range. The key drivers behind this outlook include the compounding effects of institutional adoption and the potential for new financial products, like derivatives and other funds, to be built around XRP following a spot ETF approval. If Ripple continues to expand its payment network and solidify more partnerships, this could add fundamental strength to the asset’s value.

For 2027, the forecasts become even more optimistic, with some models suggesting a price between $7.50 and $10. By this point, the market may have a clearer picture of XRP’s role in the global financial system. Increased use of the XRP Ledger for tokenizing real-world assets and for powering central bank digital currencies could be significant factors. If the ledger’s utility expands beyond just cross-border payments, it could attract a new class of developers and users, pushing demand higher.

Some analysts place XRP’s potential value in the $10 to $13 range in 2028. This long-term forecast depends heavily on Ripple achieving a meaningful slice of the global payments market. Success in this area would mean a constant flow of transactions through the XRP Ledger, creating organic demand for the token and solidifying its position as a major player in finance.

By 2029, should the bullish trends persist, some price models point to a potential range of $14 to $18. These predictions are based on the idea that by the end of the decade, the digital asset landscape will be more mature and integrated into the traditional financial system. XRP, with its regulatory clarity and established use case, would be well-positioned to benefit from this integration.

The year 2030 is a focal point for many long-term predictions, with incredibly varied forecasts. On the conservative side, some analysts see XRP reaching around $4. However, more bullish scenarios, particularly those that assume significant market share gains from SWIFT and widespread adoption, suggest prices could be much higher. Some ‘max case’ scenarios from asset managers even float numbers as high as $29.

These figures highlight just how much potential upside some believe XRP has, though they depend on nearly perfect execution and favorable market conditions.

Trading Strategies for XRP

Given its history of sharp price movements, trading XRP without a plan is like sailing in a storm without a compass. A well-thought-out strategy is essential to manage risk and spot opportunities in its often-unpredictable market.

Whether you’re aiming for short-term gains or positioning for a long-term hold, understanding different trading methods can make a huge difference in your results;

Day Trading and Swing Trading

These strategies focus on capitalizing on short-to-medium-term price changes. Day traders open and close their positions within a single day, aiming to profit from small, intraday price fluctuations. This method requires constant attention to the market and a solid understanding of technical analysis to identify entry and exit points quickly. Because gains on each trade are small, day traders often make many trades to build up their profits.

Swing trading, on the other hand, involves holding positions for several days or even weeks. The goal here is to capture a larger ‘swing’ in the price. This approach is less demanding than day trading but still requires a good grasp of market trends and key support and resistance levels. Swing traders often use a combination of technical indicators to time their trades, looking for moments when momentum is likely to shift.

Using Technical Analysis

Technical analysis is the art of using historical price charts and trading volume to forecast future price movements. For XRP traders, this is an indispensable tool. It involves analyzing patterns such as triangles, flags, and head-and-shoulders to gain clues about the potential direction of the price. For instance, a breakout above a key resistance level on high volume is often seen as a bullish signal.

Traders also rely on indicators like Moving Averages (MAs) to smooth out price action and identify trends. The 50-day and 200-day MAs are popular choices; when the shorter-term MA crosses above the longer-term MA, it’s often called a ‘golden cross’ and considered a buy signal. Oscillators like the Relative Strength Index (RSI) help determine if an asset is overbought or oversold, providing signals for potential trend reversals.

Algorithmic Trading

For those who prefer a more hands-off approach, algorithmic trading offers a way to automate the process. This involves using computer programs, or ‘bots,’ to execute trades based on a set of predefined rules. For example, a bot could be programmed to buy XRP whenever its RSI drops below a certain level and sell when it rises above another. The main advantage here is that it removes emotion from trading, as the bot will stick to the strategy without fear or greed.

This method is particularly effective for high-frequency trading and arbitrage—exploiting minor price differences for the same asset across different exchanges. The XRP Ledger’s fast settlement times and low transaction costs make it well-suited for such strategies. However, setting up a profitable trading bot requires a good deal of technical skill and extensive backtesting to ensure the strategy is sound before risking real capital.

Margin and Futures Trading

These are advanced strategies that are not recommended for beginners due to their high-risk nature. Margin trading allows you to borrow funds from an exchange to increase the size of your position. This can amplify your profits if the trade goes your way, but it will also magnify your losses if it doesn’t. If the market moves against you, you could face a ‘margin call,’ forcing you to either add more funds or have your position automatically closed at a loss.

Futures trading involves buying or selling contracts that bet on the future price of XRP. You’re not trading the asset itself but rather an agreement to buy or sell it at a specific price on a future date. Like margin trading, futures allow for the use of leverage, which dramatically increases both the potential rewards and the risks. These tools are powerful but require a deep understanding of the market and strong risk management skills.

How to Learn More About XRP?

Getting into XRP can feel a bit like jumping into the deep end of the pool. It’s not your typical digital currency story. With its deep ties to the banking industry, a history of high-stakes legal battles, and a unique technological foundation, it can be a lot for a beginner to take in. The good news is, there are plenty of places to get up to speed without needing a degree in finance or computer science.

Here are some types of resources that can help you get a better handle on the platform:

The Official Ledger Documentation

This is the go-to source for direct information. Maintained by the community, these official portals offer everything from high-level explanations of the technology to deep technical documentation for developers. They are packed with tutorials and use cases that explain exactly how the XRP Ledger works. Its method is to provide accurate, developer-first information straight from the source.

Financial News and Crypto Education Sites

Dozens of reputable financial news outlets and crypto-focused educational platforms offer articles and guides on XRP. These resources are great for breaking down complex subjects into easy-to-understand content.

You can find everything from basic What is XRP? articles to detailed analyses of its market performance. Their method is to translate technical jargon and market data into plain language for a broader audience.

The information provided in this content is up to date as of February 2026.

XRP Price Prediction FAQs

Here are answers to some frequently asked questions about XRP price predictions in 2026:

How Much Will 1 XRP be in 2030?

Predictions for 2030 vary widely. More conservative forecasts place its value around $4, while bullish scenarios see it reaching between $14 and $18. Some ‘max case’ models from asset managers even suggest a potential price of $29, depending on market share gains in global finance.

Is XRP Expected to Skyrocket?

A significant price increase is considered possible, tied to key events like a spot ETF approval, which some analysts give an 85% chance. Success in capturing even a fraction of the cross-border payments market could also fuel major growth. Some technical models point to potential targets between $11 and $13 if bullish conditions persist.

Can XRP go to $100?

Reaching $100 per token is considered highly speculative. With a circulating supply of nearly 60 billion, a $100 price would create a market cap of around $6 trillion. This valuation would be larger than the entire cryptocurrency market’s peak value to date, making such a target exceptionally ambitious.

Can XRP Reach 500 Dollars?

A price of $500 is extremely unlikely under current economic models. At that price, XRP’s market cap would exceed $29 trillion, a figure substantially larger than the market capitalization of gold. This would require a fundamental and unprecedented shift in global asset valuation that is not supported by current data.