Top Ethereum News Today January 2026

Ethereum is experiencing a significant comeback in January 2026, marked by strong upward momentum and a flurry of positive developments.

This article provides the latest information on the Ethereum ecosystem as of January 2026. It will cover key Ethereum facts and statistics, the latest Ethereum news in January 2026, breaking Ethereum price news, and insights into the best upcoming Ethereum events in 2026. We will also examine new Ethereum partnerships and the overall future outlook for Ethereum.

After a period of underperformance, the world’s second-largest digital asset has surged, with its price climbing past the $3,700 mark. This revival is not just about price; it’s fueled by a potent mix of surging institutional interest, accelerating corporate adoption, and an increase in network activity, solidifying its position as a central pillar of the digital economy.

The biggest story this month is the institutional capital pouring into Ethereum. Spot Ether exchange-traded funds (ETFs) have been on a remarkable 16-day inflow streak, pulling in over $450 million on some days. In a notable shift, Ether ETFs have outpaced their Bitcoin counterparts for six consecutive days, attracting a massive $2.4 billion in net inflows during that period. BlackRock’s iShares Ethereum Trust (ETHA) has been a standout performer, becoming the third-fastest ETF in history to exceed $10 billion in assets under management.

This institutional rush extends beyond ETFs. Major corporations are now establishing their own Ethereum treasuries. Bitcoin mining firm BitMine Immersion Technologies made headlines by purchasing over $2 billion worth of ETH.

Ethereum’s market capitalization grew by over $150 billion in July alone, supported by a record increase in new addresses and a 37% surge in active addresses throughout 2026. This user growth is complemented by a “supply shock” dynamic, as the amount of ETH held on exchanges has fallen to a multi-year low. This suggests that more investors are moving their assets into long-term storage or using them within the Ethereum ecosystem, reducing the available supply for selling and signaling strong holder conviction.

Ethereum Facts and Statistics

Ethereum moved beyond the concept of a simple peer-to-peer currency and introduced a programmable blockchain, a sort of global computer for running decentralized applications and services. This opened the door for everything from decentralized finance (DeFi) to non-fungible tokens (NFTs) and a wide array of blockchain-based games.

- Launch Date: The Ethereum network officially went live on July 30, 2015.

- The Creators: The concept was first introduced in a whitepaper by Vitalik Buterin in 2013. He was joined by a team of co-founders including Gavin Wood, Charles Hoskinson, Anthony Di Iorio, and Joseph Lubin.

- Market Position: Ethereum is consistently the second-largest cryptocurrency by market capitalization, second only to Bitcoin.

- Core Technology: Ethereum pioneered the use of smart contracts, which are self-executing contracts with the terms of the agreement written directly into code. These run on the Ethereum Virtual Machine (EVM).

- Consensus Shift: Initially using a Proof-of-Work (PoW) system similar to Bitcoin, Ethereum transitioned to a more energy-efficient Proof-of-Stake (PoS) model with “The Merge” upgrade on September 15, 2022.

- All-Time High Price: Ethereum reached its peak price of $4,891.70 on November 16, 2021.

- All-Time Low Price: The lowest recorded price for Ethereum was $0.4209.

- Network Growth: The Ethereum ecosystem is home to thousands of decentralized applications (dApps) and has been instrumental in the growth of the DeFi and NFT sectors.

Latest Ethereum News in January 2026

Ethereum’s growth in January 2026 has been nothing short of explosive. The network is firing on all cylinders, driven by a surge in institutional buying, major corporate treasury acquisitions, and a corresponding increase in on-chain activity. This powerful combination has reignited market confidence and positioned Ethereum as a leader in the current crypto cycle.

One of the most significant developments this month is the torrent of money flowing into spot Ether ETFs. These investment products have seen a stunning 16-day streak of positive inflows, pulling in more than $1.4 billion in a single week. For six straight days, Ether ETFs attracted more capital than Bitcoin ETFs, a clear signal of shifting institutional focus. BlackRock’s iShares Ethereum Trust (ETHA) has been a particular standout, reaching $10 billion in assets under management in just 251 days, the third-fastest pace in U.S. history.

The corporate world is also making big moves. In a jaw-dropping display of conviction, Bitcoin mining firm BitMine Immersion Technologies acquired over $2.1 billion in ETH, instantly becoming the largest corporate holder by staking a massive 5% of Ethereum’s total circulating supply. This trend isn’t isolated; other public companies are building their own ETH treasuries, and staking providers like P2P.org have reported a 30% jump in inquiries from institutions looking to get involved.

This institutional and corporate demand is creating a classic supply squeeze. Whale wallets have been in heavy accumulation mode, with data showing they’ve scooped up over $4.1 billion worth of ETH in just two weeks. At the same time, the amount of Ether available on exchanges continues to shrink as investors move their holdings into self-custody wallets or staking contracts. While there’s been a noticeable increase in the validator exit queue, topping $2 billion, this is seen as healthy profit-taking after the recent price run-up rather than a sign of weakening conviction.

With so much happening, it’s critical for traders and enthusiasts to get their information from reliable sources. Sticking to official channels can help you cut through the noise. For verified updates, consider checking out the official Ethereum Foundation blog, their X (formerly Twitter) account, and the active community on the r/ethereum subreddit.

The impact of this month’s news on Ethereum’s price has been profound. The combination of ETF inflows, corporate buys, and on-chain demand directly fueled a rally of over 48%, pushing the price past key resistance levels at $3,600 and $3,800. This created a Golden Cross on the charts—a bullish technical signal that often points to further upward potential.

Breaking Ethereum Price News

The price of Ethereum is famously volatile, and keeping up with the latest price news is essential for anyone looking to make informed trading decisions. Market movements can be sudden and sharp, often driven by a mix of technical patterns, network developments, and broader economic factors.

The last six months have been a tale of two halves for Ethereum. The early part saw the asset lagging, with its price dipping to around $1,450 in April. This period of underperformance led some to question its momentum. However, starting in mid-May, the tide began to turn. A steady recovery gained steam, leading into the comeback summer where the price exploded upwards by more than 48%, decisively breaking the $3,800 barrier and reigniting bullish sentiment across the market.

Perhaps the most shocking news for the market was the sheer speed and scale of institutional adoption. While the approval of Ether ETFs was anticipated, the voracity of the inflows took many by surprise. The fact that corporate players like BitMine would make a $2.1 billion treasury allocation to ETH was a stunning vote of confidence that few had on their bingo card. This rapid accumulation by both funds and companies created a demand shock that helped propel the price upward so aggressively.

The breakthrough news that truly changed Ethereum’s trajectory this year was the launch and immense success of spot Ether ETFs in the United States. This regulatory green light served as the key that unlocked the door for a flood of institutional capital. The resulting inflows not only provided direct buying pressure but also gave a stamp of legitimacy that has encouraged more conservative investors to get exposure.

Best Upcoming Ethereum Events in 2026

The first half of the year has already been a whirlwind of activity for the Ethereum community. Major events like ETHDenver and Consensus 2026 brought together thousands of developers, investors, and enthusiasts, setting a high-energy tone for the year.

These gatherings were packed with big announcements and a healthy dose of building, and the momentum is set to continue through the rest of the year with several can’t-miss events on the calendar:

ETHEREUM NYC 2025

Just before the main ETHGlobal event, the community gets another chance to connect in the Big Apple. ETHEREUM NYC, scheduled for August 11, 2025, is poised to be a pivotal gathering point for all stakeholders within the ecosystem. This event typically features a blend of insightful talks from industry pioneers, panels discussing the future of decentralized finance and Web3, and plenty of networking opportunities.

This is the kind of event where you can get a real-time pulse of the market and the technology. It’s a prime spot for developers to showcase their latest projects, for investors to discover the next big thing, and for anyone curious about Ethereum to learn from the people building it. Expect in-depth discussions on Layer 2 scaling solutions, the latest developments in smart contract security, and insights into the expanding role of institutional players in the space.

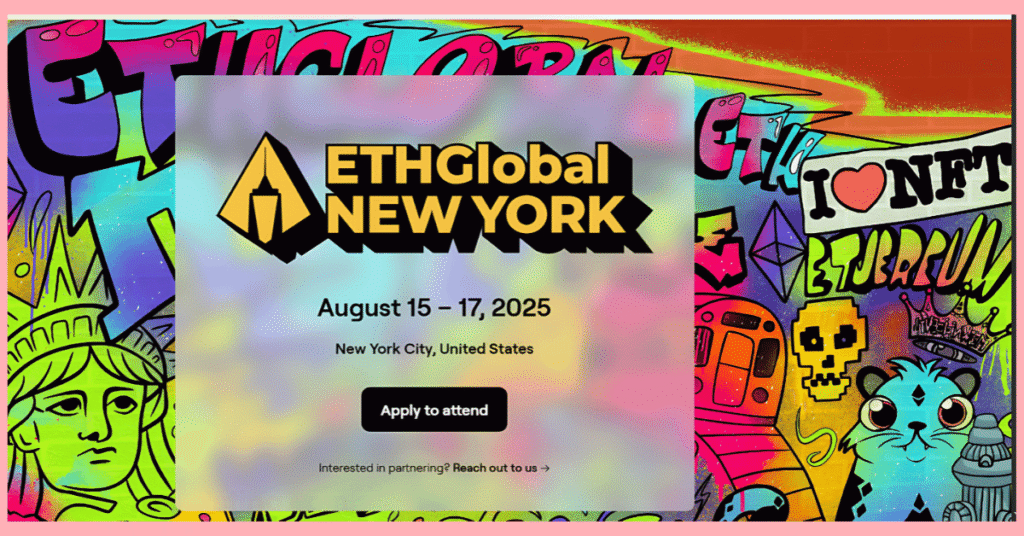

ETHGlobal New York 2025

From August 15 to 17, 2025, ETHGlobal will be in New York for one of its flagship events of the year. ETHGlobal events are legendary in the developer community, renowned for their high-energy hackathons, also known as #BUIDLathons, where teams work around the clock to create new applications and solutions on the Ethereum blockchain.

This isn’t just about coding, though. The event is a three-day marathon of learning and connection. Attendees can join workshops led by experts from top projects, listen to talks on cutting-edge technology, and connect with a global network of builders. It’s a place where many of the next-generation dApps get their start. If you’re a developer, this is an unmatched opportunity to test your skills, get feedback from the best in the business, and maybe even find funding for your idea.

New Ethereum Partnerships

Ethereum’s growth is being supercharged by a growing number of strategic partnerships with some of the biggest names in finance and technology. The platform is increasingly seen not just as a cryptocurrency network but as a foundational settlement layer for a new, decentralized internet.

These alliances are critical, as they bridge the gap between the traditional economy and the on-chain world, paving the way for mainstream adoption.

- BlackRock and Asset Tokenization: The world’s largest asset manager, BlackRock, has deepened its involvement with Ethereum. The firm is actively using the network for the tokenization of real-world assets (RWAs). Its BUIDL fund, which represents tokenized U.S. Treasury bills, is a prime example of how traditional financial products are being brought onto the blockchain, offering the speed and transparency of blockchain technology.

- Corporate Treasury Adoption: A new trend is emerging where public companies are adding ETH directly to their balance sheets. Firms like BitMine Immersion Technologies and Sharplink are leading this charge, treating Ether as a primary reserve asset. This is a significant vote of confidence in Ethereum’s long-term value and its role in the future of corporate finance.

- Major Brands Building on Ethereum: Over 50 major non-crypto companies are actively developing products and services on Ethereum and its Layer 2 networks. This includes giants like PayPal, which launched its own stablecoin on the network, and Sony, which is developing its own L2 for gaming and entertainment applications.

Ethereum Future Outlook

The year has been a defining one for Ethereum, marked by a powerful resurgence that has quieted skeptics and energized its supporters. The summer brought an incredible rally, with ETH’s price jumping over 48% in July alone, fueled by a perfect storm of positive developments.

The launch of spot Ether ETFs in the U.S. proved to be a massive success, attracting billions of dollars in institutional capital and surpassing Bitcoin funds in weekly inflows for the first time. This wasn’t just passive investment; major corporations began actively adding ETH to their treasuries, with BitMine’s $2.1 billion purchase sending a clear message about Ether’s growing role as a strategic reserve asset.

Looking ahead, the future for Ethereum appears incredibly bright. The network’s roadmap is packed with key upgrades designed to address its few remaining pain points. These technical improvements are crucial as they make the network cheaper and more efficient for the next wave of users and developers. This ongoing commitment to scaling is a primary reason why many believe Ethereum will maintain its lead as the top smart contract platform.

In summary, 2026 has been a year of validation for Ethereum. The price has responded to a surge in institutional and corporate buying through newly approved ETFs and direct treasury allocations. On-chain metrics show a healthy and growing network, while key partnerships continue to bridge the gap to mainstream adoption. With major upgrades on the horizon and a clear path for further institutional products, the outlook is strong.

All information provided in this article is current as of January 2026.

Ethereum News FAQs

Here are answers to some frequently asked questions about Ethereum news:

Is Ethereum Expected to Rise Again?

Yes, many indicators point to continued upward movement. Following a 48% price surge in January 2026, spot Ether ETFs attracted over $2.4 billion in just six days. Whale wallets have also accumulated over $4 billion in ETH recently, signaling strong buying pressure and confidence in the asset’s future.

Will Ethereum Hit $10,000?

Hitting $10,000 is a real possibility according to several analysts, with some even targeting $15,000 this cycle. This bullish outlook is supported by forecasts of $20 billion in institutional demand over the next year. This projected demand is nearly 7 times the amount of new ETH expected to be issued, creating a significant supply squeeze.

What is Happening to Ethereum?

Ethereum is seeing a massive surge in institutional and corporate adoption. In January 2026, spot Ether ETFs recorded 16 straight days of inflows. In a landmark move, the company BitMine acquired a $2.1 billion stake, becoming the largest corporate holder of ETH and signaling a new trend in corporate treasury management.

Should I Hold or Sell Ethereum?

While this is a personal decision, on-chain data offers clues. The amount of ETH on exchanges has hit a multi-year low, suggesting more investors are holding for the long term. Although the validator exit queue recently topped $2 billion, indicating some profit-taking, the broader trend points toward strong accumulation and reduced selling pressure. Holding or selling depends on your goals.

What Will Eth Be Worth in 5 Years?

Price predictions for 2030 are highly optimistic, with some analysts forecasting a value between $19,500 and $25,000. This long-term growth is expected to be driven by the completion of Ethereum’s scaling roadmap. The mainstream adoption of DeFi and tokenized real-world assets on the network is another key factor for this outlook.

Will Ethereum be the Next Bitcoin?

Ethereum isn’t trying to be the next Bitcoin; it has a different purpose as a programmable “world computer.” While it’s unlikely to surpass Bitcoin’s price per coin due to supply differences, the “flippening” debate focuses on market capitalization. With a current market cap of over $445 billion, it continues to challenge Bitcoin’s dominance.