What is XRP? XRP Explained – February 2026

As of February 2026, XRP is a major digital asset in the crypto world, and this guide has the latest details you need to get started on your XRP investment journey.

XRP is a digital currency that operates on its own open-source blockchain, the XRP Ledger (XRPL). It was built from the ground up for one primary job: making payments happen quickly and cheaply, anywhere in the world.

Unlike some cryptocurrencies that aim to replace traditional money, XRP is designed to work with financial institutions. Big players, such as banks and payment providers, use it to send money across borders in seconds, not days. This eliminates the need for slow, costly intermediary banks that are a fixture of the traditional international payment system.

By using the XRP network, financial institutions can swap between different currencies almost instantly. Imagine a U.S. business needing to pay a supplier in Japan. Instead of a multi-day process with high fees, they can use a service that converts U.S. dollars to XRP, sends the XRP, and converts it to Japanese Yen on the other side—all in about 3 to 5 seconds. XRP’s design for a specific, high-value purpose makes it a standout in the crypto space.

Why is XRP Unique? XRP Features

Now that you know what XRP is, let’s look at what makes it different from the rest of the pack.

| Feature | XRP | Bitcoin | Ethereum | Solana | Cardano |

|---|---|---|---|---|---|

| Transaction Speed | 3-5 seconds | 10+ minutes | 15-30 seconds | 2.5 seconds | ~20 seconds |

| Transactions Per Second (TPS) | 1,500+ | ~7 | ~15-30 | 65,000+ | ~250 |

| Average Transaction Cost | <$0.01 | $1 – $50+ | $1 – $50+ | ~$0.00025 | ~$0.17 |

| Energy Use | Extremely Low | Very High | Low | Low | Low |

| Consensus Method | Ripple Protocol Consensus Algorithm (RPCA) | Proof-of-Work (PoW) | Proof-of-Stake (PoS) | Proof-of-History (PoH) | Proof-of-Stake (PoS) |

| Main Purpose | Institutional cross-border payments | Store of Value | Smart Contracts & dApps | dApps & High-Frequency Trading | Smart Contracts & dApps |

There’s a lot more to XRP’s uniqueness, especially when you get into its background story and some of the key moments in its history.

XRP History Facts and Statistics

XRP has been a fixture in the cryptocurrency space for over a decade, making waves with its unique approach to digital finance and its fair share of headline-grabbing moments.

The story begins even before Bitcoin. In 2004, a developer named Ryan Fugger created a secure payment system called Ripplepay. The idea was to create a decentralized monetary system that allows individuals and communities to develop their own currency.

Fast forward to 2011, when developers Jed McCaleb, Arthur Britto, and David Schwartz took an interest in Bitcoin but saw its limitations. They wanted to create a digital asset that was faster, cheaper, and more energy-efficient, specifically for financial institutions.

They built what is now known as the XRP Ledger. In 2012, they approached Fugger, who handed over the reins of his project. The team, along with Chris Larsen, then formed a new company called OpenCoin, which was later rebranded as Ripple Labs and eventually became simply Ripple. Their mission was to build a global payment network for banks and financial institutions using the XRP Ledger and its native asset, XRP.

XRP’s Key Facts & Statistics

- Total Supply: A fixed amount of 100 billion XRP was created at launch in 2012. No new XRP can ever be mined or created.

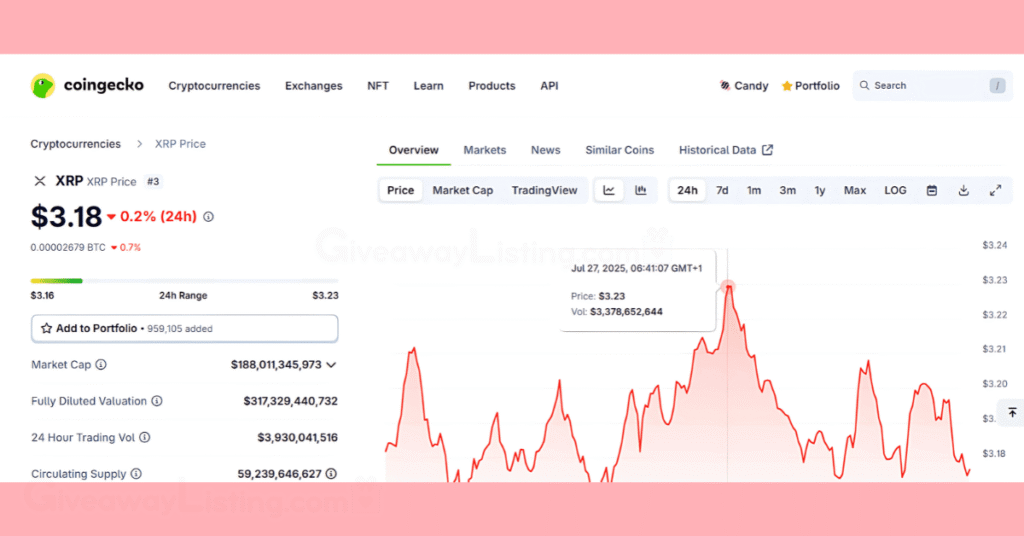

- All-Time High: The peak price for XRP was $3.66, reached on July 18, 2025.

- All-Time Low: The lowest price recorded was $0.1151 on March 13, 2020.

- Transaction Speed: Payments settle on the XRP Ledger in just 3-5 seconds.

- Transaction Throughput: The network can handle over 1,500 transactions per second (TPS).

- SEC Settlement: In a major development, Ripple reached a $50 million settlement with the SEC in May 2025, ending a long-running legal case.

- Corporate Adoption: As of 2026, corporations have put over $471 million into XRP as a treasury reserve asset.

The Relationship Between XRP Ledger, XRP, and Ripple

It’s common to see these three terms used as if they’re the same thing, but they each have a distinct role.

Ripple: This is a private fintech company. It builds payment solutions for financial institutions. Ripple utilizes the XRP Ledger and XRP in some of its products, such as On-Demand Liquidity, but it doesn’t control the ledger itself.

XRP Ledger (XRPL): This is the technology—the open-source, decentralized blockchain. It’s the public road system that anyone can build on. It has been running for more than a decade without any errors.

XRP: This is the digital currency, or the car that drives on the road. It’s the native asset of the XRP Ledger, used to pay for transaction fees and as a bridge currency to swap between different fiat currencies.

The value and future of XRP are not set in stone; the market is always moving, and its price can be affected by many factors and outside events.

XRP Price Predictions: Is XRP Going to Crash or Moon in 2026?

Digital currencies are known for their price swings, and XRP is no exception. Its history is marked by sharp climbs and steep drops. It hit an all-time low of about $0.1151 during the market crash of March 2020, but soared to a record high of $3.66 in July 2025. This kind of movement is what keeps traders on their toes.

XRP Price Prediction in 2026

Several key elements are shaping XRP’s price in 2026. One of the biggest was the conclusion of the SEC lawsuit. With a final $50 million settlement in May 2025, a huge cloud of uncertainty was removed. This legal clarity is a significant development for investors and institutions that were previously hesitant to get involved. This has opened the door for discussions about an XRP ETF, which, if approved, would make it much easier for mainstream investors to buy in.

Another huge factor is institutional interest. With companies like VivoPower International and Wellgistics Health adding hundreds of millions of dollars’ worth of XRP to their reserves, it shows growing confidence in its long-term use. This, combined with a 390% price increase over the last 90 days and massive accumulation by large wallets, paints a very positive picture for demand.

However, not everything is pointing up. The broader crypto market still heavily influences XRP’s price. If Bitcoin experiences a decline, XRP is likely to follow suit. There’s also the matter of Ripple’s escrow system, which releases up to 1 billion XRP per month. While this is meant to be predictable, large releases can put downward pressure on the price if the market can’t absorb the new supply. For a deeper look at what the charts and experts are saying, you can check out this detailed XRP price prediction for more analysis.

Is XRP Going to Crash or Moon in 2026?

The arguments in favor of a continued price pump are strong. The SEC settlement is a massive win that provides a kind of regulatory clarity. The launch of the XRPL EVM Sidechain in June 2025 also makes the network more attractive to developers, potentially bringing more projects and users into the ecosystem. Forecasts from some analysts predict that XRP could reach anywhere from $5 to as high as $15 if market conditions remain favorable and institutional adoption continues at its current pace.

On the other hand, a crash isn’t out of the question. State-level regulatory challenges, such as the lawsuit filed by Oregon’s Attorney General, indicate that the legal battles aren’t entirely over. The rise of Central Bank Digital Currencies (CBDC) could also present serious competition to XRP’s main use case for cross-border payments. If a major government launches a successful and efficient CBDC, it could reduce the need for a third-party bridge asset like XRP. Conservative estimates place XRP in the $2.50 to $4.10 range, suggesting that while a total crash is unlikely, the explosive growth may cool off.

XRP Risks, Scams and Hacks

Getting into XRP trading and investing comes with its own set of challenges, and it’s not just about market ups and downs; crafty scams are out there, and they can clean out your funds if you’re not careful.

The Risks Associated With XRP

The biggest risk with XRP, like any crypto, is its price volatility. The value can shoot up or drop dramatically in a short time. For instance, XRP’s price has been on a rollercoaster, from a low of about $0.11 to a high of $3.66. This kind of price action can bring big wins or big losses. It’s a market driven by news, sentiment, and sometimes, pure hype.

Then there’s the regulatory environment. While Ripple’s $50 million settlement with the SEC in May 2025 brought a lot of clarity at the federal level, the game isn’t over. Some states, like Oregon, are still pursuing legal action against exchanges for listing tokens they consider unregistered securities, including XRP. This patchwork of rules means the legal ground can still be shaky in certain places, which adds a layer of risk for investors.

Centralization is another point of discussion. Ripple, the company, holds a large amount of XRP in escrow, releasing up to 1 billion XRP per month. While the process is transparent, Ripple’s control over such a large portion of the supply has led to debates about how decentralized the network truly is. During times of market stress, these large releases could put downward pressure on the price.

Here’s how you can better handle these risks:

- Don’t Go All In: Spreading your investments across different assets is a smart move. It helps soften the blow if one particular investment takes a hit.

- Know Your Limits: Figure out how much you’re willing to risk losing before you invest a single dollar. Sticking to a budget is key.

- Stay in the Know: The crypto market moves fast. Keep up with news from reliable sources to understand what’s affecting prices.

- Think Long Term: Trying to time the market for quick gains is tough. Having a long-term outlook can help you ride out the short-term ups and downs.

How to Avoid XRP Scams and Hacks?

With XRP’s price hitting new highs, scammers have been working overtime. The scams have gotten more creative and harder to spot. One of the most common tricks is the fake giveaway on platforms like YouTube. Scammers hijack popular accounts, make them look like official Ripple or Brad Garlinghouse pages, and then promote bogus “airdrop” events that promise to double any XRP you send them. Of course, anything sent is gone for good.

It has become even more advanced with the use of AI-powered deepfake videos. These videos create realistic-looking but fake clips of Ripple executives announcing these phony giveaways, making the scam much more convincing. Beyond social media, there have been direct attacks on the system’s infrastructure. In a serious incident, a malicious backdoor was planted in the official xrpl.js software library, a tool developers use to interact with the XRP Ledger. This was designed to steal private keys from users’ wallets.

To keep your funds safe, watch out for these red flags:

- “Too Good to Be True” Offers: If someone promises you guaranteed profits or free XRP for sending them some first, it’s a scam.

- Impersonation: Double-check social media handles and website URLs. Scammers often use names that are just slightly different from the official ones.

- Urgency and Pressure: Scams often try to rush you into a decision by creating a sense of urgency, such as a “limited time offer!”

- Suspicious Links and Downloads: Never click on links or download files from sources you don’t trust completely.

- Requests for Private Keys: Your private keys or seed phrase are for your eyes only. No legitimate person or company will ever ask for them.

How to Secure Your XRP Wallet?

Your wallet is the key to your crypto, so keeping it secure is your top priority. Here are some essential steps to lock down your XRP:

- Get a Hardware Wallet: These are physical devices that store your crypto offline, away from online threats. Wallets from brands like Ledger, Trezor, or Keystone are popular choices.

- Guard Your Private Keys: Write down your seed phrase and store it in a secure, offline location. Never store it as a digital file on your computer or phone.

- Use Strong Passwords and 2FA: Protect your exchange accounts and software wallets with unique, complex passwords and enable two-factor authentication (2FA) for an extra layer of security.

- Beware of Public Wi-Fi: Avoid accessing your crypto wallets or exchange accounts when connected to public Wi-Fi networks, as they can be insecure.

- Download from Official Sources: Only download wallet software and updates from the official websites of the providers.

Always get your information directly from the source. Follow Ripple’s and the XRPL Foundation’s official channels for news and updates. Be skeptical of everything else, and never connect your wallet to a site or app you haven’t thoroughly vetted.

Latest News on XRP

Since its inception, XRP has evolved significantly from an idea to a key player in the digital asset space. It has weathered market storms, legal fights, and technological hurdles to establish itself with real-world applications and, recently, much-needed legal clarity in the U.S. This sets the stage for what’s happening now and what’s coming next.

Here is some of the most current XRP news and key events you should know about:

SEC Lawsuit Settled: In a landmark moment, Ripple and the U.S. Securities and Exchange Commission reached a $50 million settlement in May 2025, officially ending the long and costly legal battle.

XRPL EVM Sidechain is Live: The Ethereum Virtual Machine (EVM) compatible sidechain for the XRP Ledger went live in June 2025. This enables developers to integrate Ethereum-based apps and smart contracts into the XRPL ecosystem.

Ripple’s Stablecoin (RLUSD): Ripple launched its own U.S. dollar-backed stablecoin, Ripple USD (RLUSD), in December 2024. It’s available on both the XRP Ledger and Ethereum.

Institutional and Whale Accumulation: This year has seen a massive influx of institutional money, with corporations allocating over $471 million to XRP. At the same time, large “whale” wallets have been accumulating hundreds of millions of XRP.

Strategic Acquisitions: Ripple has been expanding its reach by acquiring key companies, including crypto prime brokerage Hidden Road and custody firm Metaco.

To keep up with the latest developments, make sure you’re following the official sources. Here are the verified links:

- Ripple’s Official Website: ripple.com

- Ripple on X (formerly Twitter): @Ripple

- XRP Ledger’s Official Website: xrpl.org

- XRPL Developers on X: @RippleXDev

- Ripple’s Official Blog: ripple.com/insights

How to Get Started with XRP?

Getting your hands on some XRP is actually pretty straightforward. Here’s a simple rundown to get you started.

- Pick Your Crypto Exchange. First, you need a place to buy it. Since the SEC lawsuit was resolved, XRP is once again available on major U.S. exchanges. You can use well-known platforms like Coinbase, Kraken, or Binance.US. Choosing the right platform is your first move.

- Set Up and Verify Your Account. Once you’ve picked an exchange, you’ll need to create an account. This typically involves a security process known as KYC, so be prepared to provide some personal information, such as a photo of your ID and proof of address. It’s a standard procedure to prevent fraud.

- Add Funds to Your Account. Next, you need to deposit money to trade with. Most exchanges let you link a bank account for transfers (ACH), use a debit card for instant purchases, or send a wire transfer. Debit card buys are usually the fastest but might come with slightly higher fees.

- Buy Your XRP. Now for the fun part. Search for XRP on the exchange. You’ll see its current price. You can then enter the amount of money you want to spend or the amount of XRP you want to buy. Confirm the transaction, and just like that, you’re an XRP holder.

- Move It to Your Own Wallet. For better security, move your XRP to a personal wallet where you—and only you—control the private keys. You can choose a software wallet for your computer or phone, or a hardware wallet that keeps your assets completely offline.

XRP has carved out a distinct niche for itself in the cryptocurrency world by focusing on fast, inexpensive global payments for financial institutions. However, it’s critical to remember that the crypto market is risky and can be a space for scammers and hackers. Always be on high alert, practice strong security habits, and never invest more than you’re willing to lose.

Here are some important points to always remember:

- XRP’s main job is to make international money transfers fast and affordable.

- With the SEC lawsuit settled, a major cloud of uncertainty has been lifted in the U.S.

- After buying XRP, move it from the exchange to a personal, secure wallet.

- Be on the lookout for scams, especially fake giveaways using deepfake videos of company execs.

- The XRP price hit an all-time high of $3.66 in July 2025, but it can be extremely volatile.

This information is current as of February 2026.

What is XRP? FAQs

Below are answers to some frequently asked questions about XRP in 2026:

Is XRP a Good Investment?

Investing in XRP involves high risk due to its price volatility, as its value has swung from $0.1151 to $3.66. The recent $50 million SEC settlement has boosted confidence, with corporations adding $471 million to their reserves. Still, its future value depends heavily on continued adoption and the overall health of the market, so it might be a good investment, or a bad one, depending on your goals.

What Does XRP Actually Do?

XRP is a digital currency designed for fast, low-cost international payments, primarily for financial institutions. It settles transactions in 3-5 seconds for a fee of less than a penny. The network can handle over 1,500 transactions per second, making it a quick alternative to traditional systems.

Will XRP Reach $100?

A $100 price point for XRP is highly improbable because of its large supply of 100 billion tokens. Reaching that price would give XRP a market capitalization of $10 trillion, far exceeding the value of the world’s largest companies. Most long-term forecasts from analysts fall significantly short of this mark.

Can You Buy XRP on Binance?

Yes, you can buy XRP on Binance and Binance.US. After the $50 million SEC settlement, major exchanges, including Binance, relisted the asset for trading. You can purchase it directly with fiat currency or trade it for other cryptocurrencies, such as Bitcoin and Ethereum.