Top Solana News Today – February 2026

Solana continues to be a major topic of conversation in the digital asset space, capturing attention with its high-speed network and a growing list of applications. The platform is experiencing a period of significant activity, marked by strong institutional interest and considerable price movements that keep traders on their toes. As the ecosystem matures, its performance metrics and strategic partnerships are becoming key indicators of its future direction.

Recent market behavior indicates that SOL’s price is facing pressure, having dipped below the $180 mark and now testing support levels around $160. However, data suggests that while some are selling at a loss, larger investors, often called whales, are accumulating SOL during this dip. This divergence in behavior points to a belief among major players in the network’s long-term value, even as immediate price action appears bearish.

A major driver of institutional confidence is the ongoing push for a spot Solana ETF. Asset managers like VanEck and Bitwise, along with infrastructure provider Jito Labs, are actively petitioning the SEC to permit liquid staking in Solana-based exchange-traded products. Proponents argue this would improve capital efficiency for these funds and offer new revenue streams for issuers. The anticipation of an approved ETF is fueling a surge in institutional activity, with CME Solana futures volume jumping to $8.1 billion in July 2025.

The ecosystem is also expanding through new partnerships. R3, a company trusted by financial giants like HSBC, is set to bring over $15 billion in tokenized assets to the Solana network, pointing to its growing acceptance in traditional finance. In another development, automotive maker Volkswagen is using Bee Maps, a decentralized mapping service built on the Solana-powered Hivemapper network, for its robotaxi trials. These collaborations show the network’s increasing application in real-world, enterprise-grade scenarios.

Solana Facts and Statistics

Solana’s story began in 2017 when Anatoly Yakovenko published a whitepaper detailing a new timekeeping method for distributed systems called Proof-of-History (PoH). This innovation was created to solve the scaling problems that limited older blockchains. The public mainnet officially went live in March 2020, and since then, its structure has made it a popular home for many applications.

Here are some of the key facts and statistics of the Solana network in 2026:

- The Solana mainnet beta was launched on March 16, 2020.

- The project was co-founded by Anatoly Yakovenko, Raj Gokal, Greg Fitzgerald, and Stephen Akridge.

- Solana uses a unique hybrid consensus mechanism combining Proof-of-History (PoH) with Proof-of-Stake (PoS).

- The network has a theoretical capacity of up to 65,000 transactions per second (TPS), with real-world averages often sitting around 2,400 TPS.

- One of its main attractions is the low fee structure, with the average transaction costing approximately $0.00025.

- The highest price recorded for SOL was $295.00 on January 19, 2025.

- The lowest price recorded for SOL was $0.51 on May 11, 2020.

- As of February 2026, Solana’s market cap fluctuates between $91 billion and $104 billion, ranking it among the top cryptocurrencies.

- The Total Value Locked (TVL) in Solana’s DeFi protocols is approximately $9.5 billion.

- The network is secured by over 2,300 active validators spread across more than 35 countries.

- Solana maintains a strong developer base, with 2,500-3,000 monthly active developers.

- Since its launch, the network has experienced 8 major and 10 partial outages, although stability has significantly improved, with over 262 consecutive days without a major outage reported in late 2024.

- Approximately 62.2% of the total SOL supply is staked, helping to secure the network.

- Key collaborations include integrations with Visa for USDC payment settlements and Google Cloud for easier node deployment.

- BlackRock’s tokenized fund, $BUIDL, is live on Solana, and companies like Classover and Thumzup Media have added SOL to their corporate treasuries.

Latest Solana News in February 2026

Solana’s ecosystem has continued its rapid expansion, solidifying its position as a top-tier network for decentralized applications and finance. The first half of 2026 was marked by high on-chain activity, with daily active addresses consistently numbering in the millions. This user engagement is supported by ongoing technical upgrades and a stream of new projects building on the platform.

The big story in early now is the market’s mixed signals. After a strong performance in July, SOL’s price has entered a corrective phase, breaking below key support levels at $180 and $165. Some technical analysis points to the formation of a bearish “cup-and-handle” pattern, with predictions of a potential dip toward the $140 support zone. This downturn has been partly attributed to fading hype around a spot ETF and broader market pressures.

Despite the bearish short-term price action, on-chain data reveals a different story. While retail traders may be feeling the pressure, large-scale investors are reportedly buying the dip. This accumulation by whales suggests that smart money is positioning for a potential rebound, viewing the current prices as an attractive entry point.

The network’s fundamentals support this underlying strength. The push for a Solana ETF continues, with asset managers arguing for the inclusion of liquid staking to make the products more efficient. At the same time, major technical upgrades like Firedancer promise to increase transaction throughput massively. These developments keep Solana in the conversation as a serious platform for the future of finance and decentralized applications.

In a market filled with speculation, it is critical for traders and enthusiasts to get their information from official and trusted sources. Relying on unverified accounts can lead to poor decisions. For the most accurate and timely updates, it’s best to follow the project’s direct communication channels.

Here are three primary sources for Solana news:

- The Official Solana X account

- The Official Solana Website News Page

- The Solana Discord Community Server

Crypto news, whether positive or negative, often has an immediate effect on Solana’s price. Announcements of major partnerships or successful network upgrades can trigger upward price movements, while news of security issues or regulatory concerns can cause prices to fall. Staying informed through the right channels is key to understanding these market dynamics.

Breaking Solana Price News

The price of SOL is known for its quick and sometimes dramatic movements, making it a focal point for traders. Staying current with price-related news is not just helpful; it’s necessary for anyone looking to make informed decisions in this fast-paced market. A single development can shift market sentiment and alter the price trajectory in a matter of hours.

The last six months have been a clear example of this volatility. The year started with a bang, as SOL set a new all-time high of $295 in January. This peak was the result of sustained positive momentum, growing institutional adoption, and a bullish overall market. The event cemented Solana’s comeback story and set high expectations for the rest of the year.

However, the period from June to August brought a sharp correction. After trading comfortably above $200, the price saw a steady decline that broke through several important psychological and technical support levels. This drop was a surprising turn for many who had grown accustomed to the upward trend. The cool-down in ETF speculation and profit-taking from earlier highs were major contributing factors to this reversal.

The real breakthrough news, however, has been the resilience of institutional interest. Even as prices corrected, large investors continued to accumulate SOL, a strong vote of confidence in the network’s long-term potential. This trend shows a maturing market where the asset’s value is being assessed on its technological foundation and growing ecosystem, not just short-term price hype.

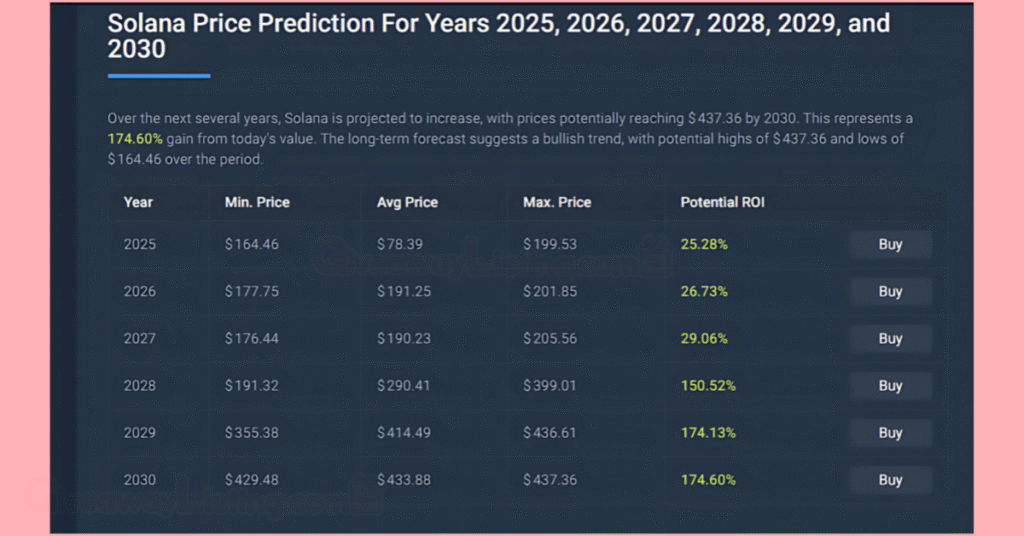

Given these recent price shifts and the underlying strength shown by on-chain metrics, many are now looking ahead to see where the price might go next.

Best Upcoming Solana Events in 2026

The Solana ecosystem has been buzzing with activity throughout 2026, with a calendar full of events that bring together developers, creators, and investors. Earlier in the year, events like the Solana Foundation Summit in New York and the dedicated Solana pavilion at NFT.NYC set a strong tone, offering spaces for deep work and networking.

Here are some of the top upcoming Solana events to keep an eye on:

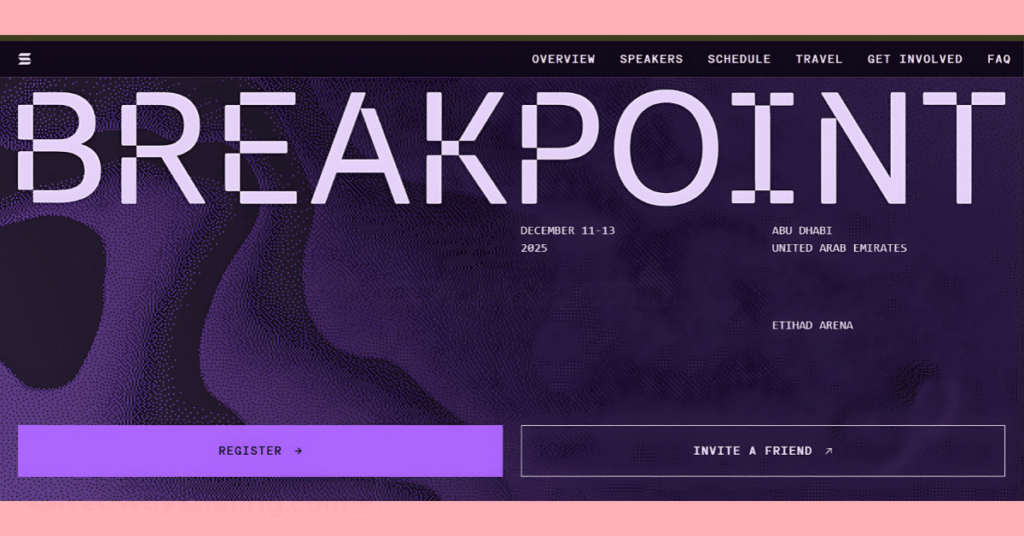

Breakpoint 2026

This is the main event of the year for the entire Solana community. Breakpoint is the official annual conference that brings together thousands of people from all corners of the ecosystem. For 2025, the event is set to take place in the global capital hub of Abu Dhabi, promising to be the biggest installment yet.

Breakpoint is where major announcements are made, from technical upgrades to new partnerships. The agenda is packed with keynotes from industry leaders, technical deep dives, and project showcases. It’s an essential event for anyone looking to stay at the forefront of what’s happening on Solana and in the broader digital asset space.

PlayGG Festival

For the gamers in the ecosystem, the PlayGG festival in San Diego is a key event. This summit is dedicated entirely to the world of web3 gaming on Solana. It brings together game developers, players, and content creators to celebrate the latest titles and technical innovations in the space.

Attendees can expect hands-on demos of upcoming games, tournaments with prize pools, and talks from the creators of top Solana-based games like Star Atlas and Aurory. It’s a great place to see how Solana’s high speed and low fees are being used to create new kinds of gaming experiences.

New Solana Partnerships

Solana has been actively forming alliances with major players across technology and finance to broaden the reach and utility of its network. This approach is designed to embed Solana’s technology into existing platforms with massive user bases, making it easier for both businesses and consumers to interact with the blockchain.

- Visa: The global payments giant has expanded its USDC settlement pilot to include the Solana blockchain. This allows for faster and cheaper cross-border payments, showing Solana’s capacity to handle enterprise-level financial transactions.

- Google Cloud: This partnership gives Solana developers access to Google’s powerful cloud infrastructure. It simplifies the process of running a node and building applications on the network, making it more accessible to a wider range of builders.

- Shopify: Through an integration, Shopify merchants can now use Solana to mint and sell NFTs directly from their storefronts. This opens up new possibilities for brands to connect with their customers through digital collectibles, all with low transaction fees.

- Stripe: The payment processing company has added deeper support for global crypto payouts using Solana. This allows businesses to pay sellers, freelancers, and content creators around the world with USDC on the Solana network, offering a fast and efficient payment rail.

- Brave Browser: The privacy-focused web browser has integrated a native Solana wallet. This makes it simple for Brave’s millions of users to store, manage, and transact with SOL and other Solana-based tokens directly within the browser.

Solana Future Outlook

The first half of the year has been a defining period for Solana, marked by high network activity and a mix of bullish and bearish price action. However, the summer months brought a significant price correction, with SOL pulling back to the $160-$180 range.

The potential approval of a spot Solana ETF in the United States remains a major catalyst. Asset managers are actively working with regulators, and any positive news on this front could open the door to a new wave of institutional capital. The project’s strategic focus on becoming the foundational layer for “Internet Capital Markets” and its growing adoption for tokenized real-world assets further support a positive long-term outlook.

In summary, Solana has spent 2026 maturing into a platform that is attracting serious attention from both institutional finance and major technology companies. While it has faced challenges with price volatility and past network stability, its technical roadmap is one of the most ambitious in the space.

The information provided is up to date as of February 2026.

Solana News FAQs

Below are answers to some frequently asked questions about Solana in 2026:

Is There Any Future for Solana?

Solana’s future appears promising due to its technical upgrades and growing institutional adoption. The Firedancer upgrade aims to significantly boost network performance, while a new consensus algorithm is in the works. In 2026, institutional interest has shifted from speculative investment to active integration, with over 200% growth in institutional holdings compared to 2024.

What is Happening With Solana?

Solana is currently in a market correction phase, with its price pulling back from a July high of over $205 to key support levels around $164. This has led to over $57 million in long position liquidations. Despite the price drop, on-chain data shows large investors are accumulating SOL, suggesting underlying confidence in the network.

Should I Hold Solana for the Long Term?

Holding Solana long-term depends on your risk tolerance, but its fundamentals show potential. The ecosystem is expanding with a Total Value Locked in DeFi of $9.85 billion and strong developer activity. Partnerships with major companies like Visa and Google Cloud, along with a focus on real-world asset tokenization, support its long-term growth prospects.

Is it Better to Hold Solana or Bitcoin?

The choice between Solana and Bitcoin depends on investment goals. Bitcoin is seen as a more stable store of value. Solana offers higher growth potential but also greater volatility, appealing to those interested in the DeFi and NFT ecosystems.