TRX Price History Until Today

TRON is a decentralized blockchain platform built to support smart contracts and a wide array of applications, from gaming to global payment systems. Founded by entrepreneur Justin Sun in 2017, its main goal has been to create a decentralized version of the internet, where content creators can connect directly with their audiences without intermediaries. The network’s native token, TRX, is the lifeblood of its ecosystem, used for transactions, governance, and staking.

Since its launch, the price of TRX has been on a rollercoaster ride. After raising $70 million in a 2017 initial coin offering (ICO), the token’s value shot up, reaching an all-time high of about $0.30 in January 2018 during the crypto market’s peak. What followed was a prolonged period of lower prices, with TRX finding a relatively stable trading range for the next few years. The token experienced another major price increase during the 2021 market rally.

More recently, TRON has found a solid footing by becoming a dominant force in the stablecoin market. Its high transaction speed and low fees have made it the go-to network for USDT transfers, with over 50% of all retail USDT transactions happening on TRON. This real-world application has driven consistent network activity, with a 67% year-over-year jump in daily transfer value. This has helped TRX show strong performance even when the broader market has been unpredictable.

TRON Price Historical Data From 2018 to 2025

The price of TRX has seen significant shifts over the years, marked by sharp peaks and long periods of consolidation. These movements often reflect key developments within the TRON ecosystem, such as the acquisition of BitTorrent in 2018 and its transition into a community-governed DAO in 2021, as well as broader cryptocurrency market trends.

The table below shows the highest and lowest prices for TRX from 2018 to mid-2025.

| Year | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|

| 2018 | $0.30 | $0.01 |

| 2019 | $0.04 | $0.01 |

| 2020 | $0.05 | $0.01 |

| 2021 | $0.17 | $0.04 |

| 2022 | $0.09094 | $0.0458 |

| 2023 | $0.1115 | $0.05538 |

| 2024 | $0.1685 | $0.1056 |

| 2025 (YTD) | $0.3400 | $0.2209 |

Understanding these historical price points provides context for the network’s growth and the token’s reception in the market. To gain a deeper understanding of the platform’s fundamentals, it’s helpful to see the types of projects that keep its ecosystem active.

Latest TRON Price Prediction for January 2026

After a strong rally in July, TRX has entered a period of consolidation, with its price holding steady below the $0.34 mark. The first half of the year was marked by consistent growth across key on-chain metrics, including transaction volume and active addresses. The network’s revenue also reached a record high in the second quarter of 2026, showing its increasing adoption and use.

This stability comes from a mix of strong fundamentals and a generally positive market sentiment. However, like any digital asset, the price of TRX is influenced by several factors that can cause it to move up or down.

Some of the main factors that can affect the price of TRX include:

- Stablecoin Volume: As the leading platform for USDT, TRON’s value is closely tied to the demand for stablecoin transactions. An increase in stablecoin use generally leads to more network activity and demand for TRX.

- Institutional Interest: The addition of major companies like Google Cloud and Kraken as network Super Representatives adds a layer of credibility and may attract more large-scale investors.

- Network Growth: The number of daily active users and total transactions are key indicators of the network’s health. In the first half of 2025, TRON ranked third among all blockchains in average daily active addresses.

- Founder’s Influence: Justin Sun remains a prominent and sometimes controversial figure in the crypto space. His actions, including an ongoing SEC lawsuit, can create price swings.

- Broader Market Conditions: General trends in the cryptocurrency market heavily influence TRX’s price. A market-wide downturn or upswing will almost certainly affect TRX as well.

- Tokenomics: The TRON network regularly burns tokens, which reduces the total supply and can put upward pressure on the price over time.

With these factors in mind, here are some of the top predictions for the price of TRX for August 2025.

| Analyst | Lowest Price Prediction (USD) | Average Price Prediction (USD) | Highest Price Prediction (USD) |

|---|---|---|---|

| Prediction A | $0.335 | $0.347 | $0.358 |

| Prediction B | $0.33 | $0.35 | $0.36 |

| Prediction C | $0.33 | $0.344 | $0.35 |

Best 5 TRX Price Predictions in 2026

Figuring out the future price of any cryptocurrency is a bit like trying to predict the weather a year from now—there are a lot of variables at play. However, by looking at TRON’s current momentum and underlying strengths, analysts can make some pretty solid forecasts.

For TRON, the story in 2026 is mainly about its real-world use. The network has become the undisputed king of stablecoin transactions, particularly for USDT, which gives it a level of daily activity that many other blockchains can only dream of.

This isn’t just about hype; it’s about utility. With over 324 million accounts and more than 11 billion transactions processed, the network’s fundamentals are strong. In the first half of 2025 alone, TRON saw its on-chain activity, active user addresses, and network revenue hit near-record levels.

This consistent growth, combined with continued token burns that reduce the overall supply of TRX, creates a positive outlook for its price. Analysts look at these on-chain metrics, technical chart patterns, and broader market sentiment to shape their predictions for where TRX might be headed.

1. Changelly’s TRX Forecast

The analysts at Changelly are pointing toward a year of steady growth for TRX in 2026. Their forecast suggests the token will trade within a fairly defined range, with a potential low of around $0.265 and a high reaching up to $0.381 by the end of the year. The average trading price is expected to hover around $0.365.

This prediction is likely based on TRON’s strong performance in the stablecoin sector, which provides a constant stream of transaction fees and network demand. With TRON processing a huge portion of the world’s USDT volume, its utility is not just theoretical. This consistent use case provides a solid floor for the token’s value, while overall market growth could help push it toward the higher end of the predicted range.

2. DigitalCoinPrice’s TRX Prediction

DigitalCoinPrice offers a bullish but measured forecast for TRX in 2026. Their analysis points to an average price of about $0.35, with the potential for it to climb as high as $0.36. On the lower end, they see the price finding support around the $0.33 mark.

This forecast is grounded in both technical analysis and the network’s strong fundamental metrics. The platform’s ability to handle up to 2,000 transactions per second (TPS) at a very low cost makes it an attractive alternative to other blockchains.

As more developers and users look for efficient networks for their dApps and transactions, TRON’s technical advantages should continue to drive demand and support a positive price trend throughout the year.

3. CoinCodex’s Projection

The forecast from CoinCodex suggests that TRX could see a notable increase in value by 2026, with a target of around $0.344. Their prediction models often rely heavily on historical price movements and technical indicators, suggesting that current trends are pointing toward continued positive momentum.

The projection is supported by TRON’s expanding ecosystem. In the first half of 2025, TRON announced integrations with platforms spanning payments, infrastructure, and user onboarding. This, combined with the addition of high-profile companies as Super Representatives, signals growing confidence in the network’s long-term potential and could be a key factor in driving the price toward this target.

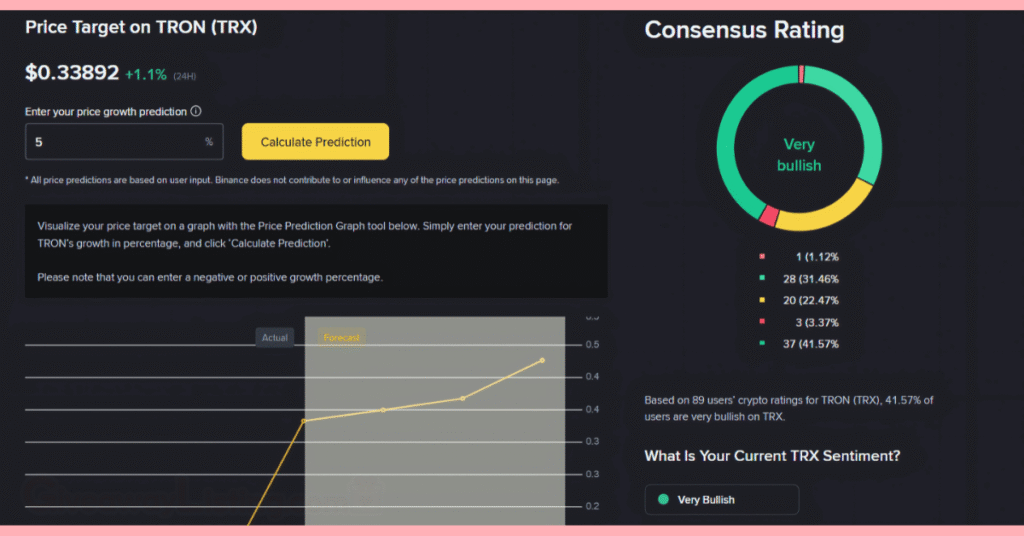

4. Binance’s TRX Forecast

Based on user-generated predictions on the platform, the sentiment for TRX in 2026 is quite positive. The collective forecast on Binance sees TRX reaching a value of approximately $0.338. While this is based on user sentiment rather than a single analyst’s view, it reflects the general optimism within the trading community.

This positive outlook is likely fueled by TRON’s impressive on-chain activity. The network has consistently ranked among the top blockchains for daily active users and transaction volume. With millions of wallets interacting with the network daily, there’s a strong user base that provides a solid foundation for the token’s value. As long as these numbers remain strong, the community expects the price to reflect that growth.

5. Kraken’s TRX Model

Kraken’s price prediction tool, which projects future prices based on historical growth rates, paints a picture of steady, incremental gains for TRX. If the token were to grow at a conservative rate of 5% annually, its price would be expected to hit around $0.35 in 2026. This model suggests a less dramatic but still positive trajectory for the token.

This type of prediction underscores the idea of TRX as a long-term hold rather than a short-term speculative play. Its value is tied to the slow-but-steady adoption of its network and its increasing role in the global financial system as a hub for stablecoins. For investors who are less interested in chasing sharp rallies and more focused on projects with tangible use cases, this kind of steady growth is an attractive feature.

Is TRON a Good Investment?

TRON has carved out a unique space for itself in the crowded world of cryptocurrencies. Instead of just being another smart contract platform, it has focused on becoming a highly efficient settlement layer for global payments, especially through stablecoins. With its ability to process thousands of transactions per second for fractions of a cent, it has become the preferred network for moving USDT, the world’s most popular stablecoin. This gives TRX a real-world utility that many other digital assets lack.

The network’s numbers speak for themselves. In the first half of 2026, TRON’s transaction volume and network revenue hit all-time highs. It’s a top-three blockchain by daily active users, showing that millions of people are actually using the network. For an investor, this level of adoption is a very positive sign, as it creates a constant demand for the TRX token to pay for network resources.

However, investing in TRON isn’t without its risks. The project and its founder, Justin Sun, have been surrounded by controversy for years. In 2018, TRON’s whitepaper was found to have copied sections from other projects, which damaged its reputation early on. More recently, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Sun in March 2023, accusing him of selling unregistered securities and engaging in manipulative “wash trading” to inflate TRX’s trading volume. These legal troubles cast a long shadow over the project.

There are also concerns about the network’s decentralization. TRON uses a Delegated Proof-of-Stake (DPoS) system where only 27 “Super Representatives” are responsible for producing blocks. Critics argue that having such a small number of validators makes the network more centralized and potentially easier to control or censor compared to networks like Bitcoin or Ethereum. Additionally, reports from organizations like the United Nations have pointed out that TRON’s low fees and high speed have made it a popular choice for illicit financial activities, which could attract unwanted regulatory attention down the line.

So, is TRX a good investment?

Yes, for investors seeking a project with proven, real-world utility who are comfortable with the high risks associated with its controversial founder and potential regulatory issues. TRON’s dominance in the stablecoin market gives it a strong foundation that many other crypto projects don’t have. Its price has shown steady growth, and its on-chain metrics point to a healthy, active network.

For those interested in getting started with TRX, here are the basic steps:

- Select a Cryptocurrency Exchange: Choose a reputable exchange that lists TRX, such as Kraken, Binance, or KuCoin.

- Create and Verify Your Account: You’ll need to sign up with an email address and complete an identity verification process, which usually requires a government-issued ID.

- Deposit Funds: Add money to your account using a credit/debit card, bank transfer, or by depositing other cryptocurrencies.

- Buy TRX: Go to the trading section of the exchange, find the TRX trading pair (like TRX/USD), and place an order for the amount you want to buy.

- Secure Your Tokens: For long-term holding, it’s best to move your TRX off the exchange and into a secure personal wallet where you control the private keys.

How to Buy TRX?

Buying TRX is a straightforward process on most major crypto exchanges. Once your account is set up and funded, you can simply search for “TRON” or “TRX” and place a buy order. You can typically choose between a market order, which buys TRX at the current market price, or a limit order, where you set a specific price at which you want the purchase to happen. After you confirm the transaction, the TRX will be added to your exchange wallet.

How to Sell TRX?

Selling TRX is just as easy as buying it. If your TRX is stored in a personal wallet, you’ll first need to send it to your exchange wallet. Once the deposit is confirmed, you can go to the trading section and place a sell order for TRX. You can sell it for a fiat currency like USD or trade it for another cryptocurrency like Bitcoin or Ethereum. Once the sale is complete, the funds will be available in your exchange account for you to withdraw.

TRON Forecast After 2026

TRON’s history is a classic crypto story of big ambitions, dramatic price swings, and a constant push for real-world adoption. After its explosive debut in the 2017-2018 bull run, TRX entered a long period of consolidation, where its value remained relatively low. This phase was crucial for development, as the network quietly built the infrastructure that would later make it a powerhouse for decentralized applications and stablecoin transactions.

Looking back five years, the difference is night and day. In mid-2020, TRX was trading for just a couple of cents. As of 2025, the token has been holding firm in the $0.25 to $0.35 range, a massive increase from its earlier days. This growth isn’t just a reflection of the broader crypto market; it’s a direct result of TRON’s success in becoming an essential part of the digital asset economy. The network’s focus on high speed and low costs has paid off, attracting millions of users and billions of dollars in transaction volume.

TRX Price in 2026

Analysts are generally optimistic about TRON’s price in 2026, with most predictions pointing to a continued upward trend. The general consensus is that TRX will likely trade in a range between $0.38 and $0.67. This forecast is built on the expectation that TRON will maintain its dominance in the stablecoin market and continue to see growth in its dApp ecosystem.

As the network matures, and if the broader crypto market remains healthy, the constant demand for TRX for transaction fees and network resources should help push its value higher.

TRX Price in 2027

By 2027, many forecasts see TRX making a serious move toward higher valuations, with potential prices ranging from $0.50 to $0.97. This level of growth would depend on several factors, including TRON’s ability to keep its technological edge over competitors and the resolution of any lingering regulatory issues.

If the network can successfully onboard more institutional partners and see its gaming and DeFi sectors flourish, hitting the upper end of this range is a real possibility. Continued token burns will also play a key part in reducing supply and supporting the price.

TRX Price in 2028

The year 2028 could be a significant one for TRON, with some analysts predicting that TRX will finally break the coveted $1.00 mark. Predictions for this year are quite varied, with some models suggesting a high of up to $1.37.

Reaching this milestone would signal a new phase of maturity for the project. Success here would likely be driven by years of consistent network growth and the possibility of TRON becoming an even more integral part of the financial plumbing for Web3 applications and cross-border payments.

TRX Price in 2029

Looking further ahead to 2029, the forecasts for TRX become even more bullish, with many analysts expecting the token to be firmly established above the $1 mark. The predicted range for this year is wide, stretching from around $0.70 to a high of over $2.00.

A price in this territory would mean TRON has not only held its ground but has also captured a larger share of the blockchain market. Its long-term roadmap includes a focus on decentralized gaming and content, and if these sectors take off as expected, TRX would be in a prime position to benefit.

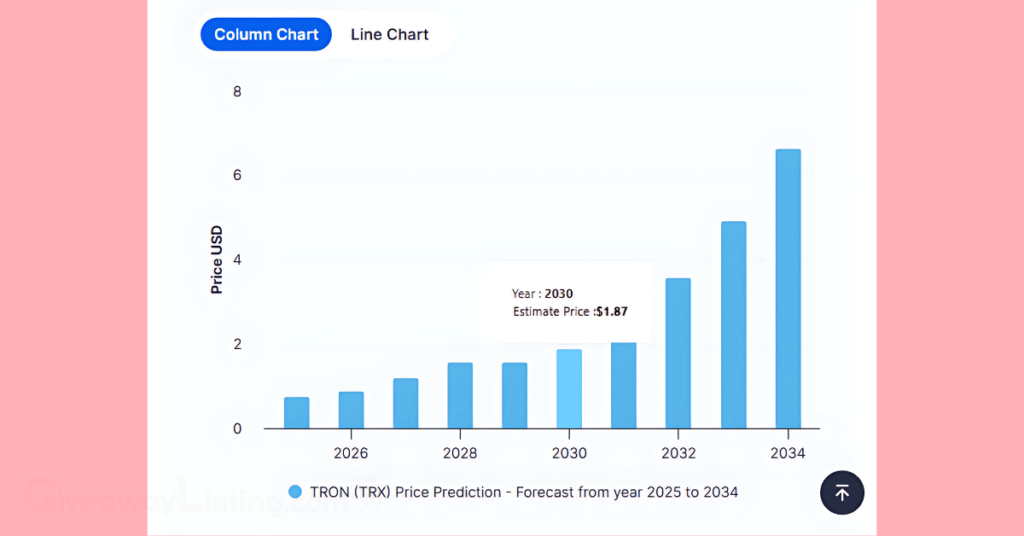

TRX Price in 2030

By 2030, predictions for TRX’s price become highly speculative, but the long-term outlook remains positive. Forecasts range from a conservative $1.00 to a more ambitious $2.96. A valuation in this range would place TRON among the top tier of blockchain projects globally.

This long-term growth is dependent on the network’s ability to stay ahead of the curve, adapt to new technologies, and continue to provide a fast, cheap, and reliable platform for its massive user base.

Trading Strategies for TRON

TRX is an interesting asset to trade because a unique mix of strong fundamentals and persistent controversy influences its price. On one hand, you have a network with massive daily transaction volume and clear utility as a stablecoin platform.

On the other, you have a project with a high-profile founder who is often in the news for the wrong reasons. This combination can create both steady trends and sudden, unpredictable price movements, making it essential to have a solid strategy before you start trading.

Whether you’re looking to make quick trades or hold for the long term, your approach should be based on your personal risk tolerance and an understanding of what drives the TRX market. Simply buying and hoping for the best is a recipe for a bad time. Instead, a more measured approach that takes into account technical chart patterns, the project’s fundamentals, and your own financial goals is much more likely to be successful.

Here are some trading strategies you can adopt:

Day Trading and Swing Trading

These short-to-medium-term strategies are all about capitalizing on TRX’s daily price fluctuations. Day traders open and close positions within the same day, while swing traders might hold on for a few days or weeks to catch a larger price swing. For these strategies to work, you need to be comfortable with technical analysis, which involves reading charts and using indicators to predict where the price might go next.

A good place to start is by identifying key support and resistance levels. Support is a price level where a downtrend is likely to pause due to a concentration of demand. Resistance is the opposite—a price level where an uptrend is expected to stall. By buying near strong support levels and selling near resistance, traders can create a simple but effective plan. Combining this with indicators like the Relative Strength Index (RSI) to spot overbought or oversold conditions can make the strategy even more effective.

The high trading volume of TRX makes it a good candidate for these strategies, as there is usually enough liquidity to enter and exit trades without much trouble. However, it’s also important to stay on top of the news, as an unexpected announcement related to Justin Sun or a new partnership can cause the price to ignore technical levels completely.

Staking for Passive Income

If you’re more of a long-term holder, staking is a great way to put your TRX to work and earn passive income. TRON’s Delegated Proof-of-Stake (DPoS) system allows you to “freeze” your tokens, which turns them into “Tron Power.” This Tron Power gives you the right to vote for the 27 Super Representatives who are responsible for running the network and validating transactions.

In return for participating in this governance process, you receive a share of the block rewards. The exact amount you can earn from staking varies, but it provides a steady stream of new TRX tokens, which can add up over time. This strategy is much lower risk than active trading, as you are not trying to time the market. Instead, you are simply holding on to your assets and getting rewards for helping to secure the network.

This approach is perfect for those who believe in the long-term potential of the TRON network and want to increase their holdings without having to constantly watch the charts. Most major exchanges and several crypto wallets offer easy-to-use staking services, making it simple to get started.

Futures and Algorithmic Trading

For more experienced traders, futures and algorithmic trading offer more advanced ways to interact with the TRX market. Futures contracts let you speculate on the future price of TRX without actually owning the token. You can go “long” if you think the price will go up, or “short” if you think it will go down. Many exchanges, like Kraken, also offer margin trading, which allows you to borrow funds to increase the size of your position, although this comes with much higher risk.

Algorithmic trading takes things a step further by using automated bots to execute trades based on a set of pre-defined rules. A trading bot can analyze market data and execute trades much faster than a human ever could, which is a big advantage in the fast-moving crypto market. You could program a bot to buy TRX whenever a certain technical indicator gives a buy signal or to sell if the price drops below a key support level.

These strategies are complex and come with a high degree of risk, so they are not recommended for beginners. However, for those who have the skills and knowledge, they can be powerful tools for trading TRX. Success in this area often depends on having a well-tested strategy and choosing the right exchanges that offer the features and liquidity you need.

How to Learn More About TRON?

Getting into TRON can feel a little overwhelming at first. It’s a complex ecosystem with numerous moving parts, ranging from its unique resource model of Bandwidth and Energy to its ever-growing list of decentralized applications. For anyone new to the space, determining whether it’s the right time to buy, sell, or hold can be a real challenge. The good news is that there are plenty of great resources out there that can help you get up to speed.

Here are some of the best places to continue your TRON education:

- TRON DAO Official Website: This should always be your first stop. The official site has the most accurate and up-to-date information on network statistics, like the current number of accounts and total transaction volume. It’s also where the TRON team posts major announcements, updates, and news about new partnerships. You can find links to their social media channels here as well, which are great for real-time information.

- The TRON Whitepaper: If you really want to get into the technical details of how TRON works, the whitepaper is the place to go. It breaks down the network’s three-layer architecture, its Delegated Proof-of-Stake consensus mechanism, and the technical specifics of its smart contracts and token standards. It’s a dense read, but it provides a full picture of the project’s original vision and technical design.

- TRON Developer Hub: While this is aimed at developers, it’s also a great resource for anyone who wants a deeper technical understanding of the network. It offers guides and tutorials on everything from setting up a node to interacting with smart contracts. You can learn a lot about how TRON’s technology works just by reading through the documentation available here.

- Community Forums and Social Media: To get a sense of what real users and investors are thinking, there’s no better place than TRON’s community channels. The official TRON DAO X (formerly Twitter) account is great for quick updates, while forums on platforms like Reddit offer a space for more in-depth discussions. These communities are where you can ask questions, see what other people are excited about, and get a feel for the general sentiment around the project.

- Crypto News and Analysis Sites: Staying on top of the market requires keeping up with the news. Reputable crypto news outlets provide regular updates on TRON, including price analysis, news about network upgrades, and any developments related to Justin Sun and the ongoing SEC case. Keeping tabs on the latest TRON news is key to making informed decisions.

The information presented here reflects the state of the TRON network and market analysis as of January 2026. The crypto world moves fast, so it’s always a good idea to keep up with the latest developments.

Tron Price Prediction FAQs

Here are answers to some frequently asked questions about Tron price prediction in 2026:

How Much Will 1 TRON Cost in 2030?

Forecasts for 2030 are speculative, but many analysts see TRX showing significant growth, with some predictions pointing to a range between $1.00 and $2.96. This outlook depends on the network maintaining its strong position in stablecoin transfers and expanding its dApp ecosystem.

Is TRON a Good Investment?

TRON can be a solid investment due to its real-world utility, as it handles over 50% of all retail USDT volume. However, the project carries notable risks tied to its founder’s legal issues with the SEC. Its impressive on-chain metrics are balanced by these considerable regulatory and reputational concerns.

Is TRON Better Than Dogecoin?

From a technical standpoint, TRON offers far more utility, with a smart contract platform that processes up to 2,000 transactions per second. Dogecoin functions mainly as a digital payment method and has a much smaller ecosystem. If you’re looking for a platform with a wider range of applications, TRON has the edge.

Is TRON Similar to Ethereum?

Yes, they share many similarities as smart contract platforms, and TRON’s TVM is compatible with Ethereum’s EVM. TRON even started as an ERC-20 token before moving to its own mainnet. The key difference is TRON’s consensus mechanism, which allows for significantly faster and cheaper transactions.