ADA Price History Until Today

Cardano is a third-generation, open-source, and decentralized public blockchain. It was founded by Charles Hoskinson, one of the original co-founders of Ethereum. The platform distinguishes itself with a development philosophy rooted in peer-reviewed academic research, aiming to provide a secure, scalable, and sustainable environment for decentralized applications. Its native token, ADA, is used for transactions and participating in the network’s governance.

Since its public launch, the price of ADA has been on a wild ride, marked by significant peaks and deep troughs. After its initial coin offering, ADA quickly gained traction and hit its first major peak during the crypto market boom of early 2018. The subsequent “Crypto Winter” saw its value decline substantially, and it remained so for an extended period.

Market confidence began to return with the rollout of the Shelley upgrade in July 2020, which introduced staking and improved decentralization. This, combined with growing interest in DeFi and anticipation for smart contract capabilities, propelled ADA to its all-time high of approximately $3.10 in September 2021. Following this peak, ADA’s price experienced considerable volatility, influenced by broader market conditions, economic factors, and the competitive landscape of Layer-1 blockchains. Despite these challenges, Cardano has consistently remained one of the top cryptocurrencies by market capitalization.

ADA Price Historical Data From 2017 to 2025

The price of ADA has seen dramatic shifts over the years, reflecting the volatile nature of the cryptocurrency market. From its early days to its current standing, the token has experienced massive rallies and sharp corrections, as can be seen in the table below:

| Year | Highest Price | Lowest Price |

|---|---|---|

| 2017 | $1.33 | $0.017 |

| 2018 | $1.33 | $0.027 |

| 2019 | $0.11 | $0.03 |

| 2020 | $0.19 | $0.019 |

| 2021 | $3.10 | $0.18 |

| 2022 | $1.63 | $0.24 |

| 2023 | $0.64 | $0.23 |

| 2024 | $0.80 | $0.40 |

| 2025 (YTD) | $1.33 | $0.651 |

Latest Cardano Price Prediction for January 2026

The price of Cardano has been showing renewed strength, breaking out of a long consolidation pattern and pushing past the $1.00 psychological barrier. This recent upward movement is supported by increased trading volumes and notable accumulation by large holders. Analysts are pointing to technical patterns, like a bull flag breakout, suggesting that a more substantial rally could be on the horizon if the positive momentum continues.

The market sentiment around ADA appears bullish, with its open interest in derivatives reaching record highs. This indicates a growing amount of capital flowing into ADA-related financial products. However, like all digital assets, its value is subject to a variety of internal and external pressures.

Several key elements can influence ADA’s price trajectory over time. These elements include the following:

- Overall Market Trends: The price of ADA often moves in line with the broader cryptocurrency market, especially the performance of Bitcoin.

- Network Upgrades: Major updates to the Cardano protocol, such as scalability solutions like Hydra or governance changes, can impact investor confidence.

- Ecosystem Growth: The number of decentralized applications (dApps) and DeFi projects building on Cardano directly affects the demand for ADA.

- Adoption and Partnerships: Collaborations with businesses, governments, and institutions for real-world use cases can drive significant interest.

- Market Sentiment: News, media coverage, and discussions on social platforms play a large role in shaping public perception and price movements.

- Competition: The performance of competing blockchains like Ethereum and Solana can influence investor choices and capital flow.

- Institutional Interest: The potential for financial products like a Cardano ETF can attract significant investment and legitimize the asset for a wider audience.

Here are some of the top expert forecasts for the price of ADA in January 2026.

| Analyst | Lowest Price Prediction | Average Price Prediction | Highest Price Prediction |

|---|---|---|---|

| A | $0.984 | $1.04 | $1.09 |

| B | $0.987 | $1.06 | $1.09 |

| C | $0.903 | $1.02 | $1.06 |

Best 5 ADA Price Predictions in 2026

Predicting the future price of any digital asset is a tricky business, and forecasts for Cardano’s ADA in 2025 are no exception. The outlooks from different analysts and platforms paint a varied picture, ranging from modest growth to very optimistic surges. These predictions are shaped by a mix of technical chart patterns, the pace of Cardano’s ecosystem development, and the overall health of the global crypto market.

As Cardano continues to roll out its roadmap, particularly features related to scaling and governance, these developments are expected to heavily influence its valuation. The successful launch of new dApps and a growing DeFi ecosystem on the platform are key factors that bulls are watching closely.

On the other hand, bears point to stiff competition and the project’s methodical, sometimes slow, development pace as potential dampers on its price. Ultimately, these forecasts should be seen as educated guesses based on current data, not as financial certainties.

Here are the top five notable price predictions for ADA in 2026.

Yahoo Finance: Aggregating various expert opinions, the platform presents a balanced but generally positive outlook for Cardano in 2026. The forecast suggests an average price of around $0.945, with a potential high of $1.376 and a low of $0.735. This represents a significant return from its current levels.

Changelly: The experts at Changelly offer a price forecast based on a deep technical analysis of ADA’s past performance. For 2026, they anticipate an average trading price of around $1.28, with a potential peak as high as $0.966 and a minimum price of $0.651.

TokenMetrics: TokenMetrics provides a scenario-based analysis, which offers a more nuanced look at ADA’s potential price in 2026. In a bullish market where the total crypto market capitalization reaches $3 trillion, they predict ADA could trade at $1.01, assuming it maintains its current market dominance. In a more aggressive bull run pushing the total market cap to $10 trillion, ADA’s price could climb to $3.38.

DigitalCoinPrice: This platform uses an algorithm-based approach to generate its price predictions. For 2026, DigitalCoinPrice projects that ADA will see stable growth. Their forecast places the coin’s value at an average of $1.64.

Cointelegraph: Citing analysis from technical traders, Cointelegraph highlights a very bullish short-to-mid-term target for ADA that extends into 2026. Based on a “bull flag” chart pattern, some analysts project a massive rally of 100-150%, which could push the price into the $1.60 to $1.75 range.

Is Cardano a Good Investment?

Cardano stands out in the crowded crypto space due to its unique, research-first approach. Unlike many projects that rush to market, every major development on the Cardano network is based on peer-reviewed academic papers. This methodical process is designed to build a highly secure, sustainable, and scalable blockchain. Its Proof-of-Stake consensus mechanism, Ouroboros, is energy-efficient, reportedly using a tiny fraction of the energy required by Proof-of-Work networks like Bitcoin.

The platform is being built in distinct phases, each focused on a specific set of functionalities. With the introduction of smart contracts in the ‘Goguen era,’ Cardano opened its doors to a growing ecosystem of decentralized applications (dApps), from DeFi protocols to NFT projects. The current phases, ‘Basho’ (scaling) and ‘Voltaire’ (governance), are focused on making the network faster and fully decentralized, putting its future in the hands of ADA holders. This long-term vision and commitment to fundamentals are what attract many investors to the project.

Investing in Cardano, like any cryptocurrency, comes with its own set of potential upsides and downsides. On the plus side, Cardano has a capped maximum supply of 45 billion ADA, which introduces an element of scarcity similar to Bitcoin. This fixed supply could help support its value over the long run as demand grows. The platform’s energy-efficient model is another major advantage, especially in a world increasingly focused on environmental sustainability. Furthermore, its research-driven development process leads to a highly secure and stable network, which is attractive for large-scale and enterprise-level applications.

However, the biggest knock against Cardano is its slow development process. The same peer-reviewed approach that makes it secure also means that new features have historically taken longer to deploy compared to competitors. Cardano was relatively late to the smart contract game, which allowed other platforms like Ethereum and Solana to build up large, established ecosystems of dApps and users. This has left Cardano playing catch-up in terms of network activity and developer adoption. Finally, as with all digital assets, ADA is subject to extreme market volatility, making it a risky proposition for those with a low risk tolerance.

So, is Cardano a good investment? The answer depends heavily on your investment horizon and risk tolerance, but there are strong arguments for its long-term potential. While its slow and steady approach has caused it to lag behind competitors in the short term, it has also resulted in a blockchain with a reputation for security and stability. Its focus on real-world applications, such as digital identity solutions and supply chain tracking, could give it a unique edge in attracting enterprise and government adoption. For patient investors who believe in its foundational principles, Cardano may be a worthwhile addition to a diversified crypto portfolio.

Here are the basic steps you can follow to get started with investing in ADA:

- Choose a Cryptocurrency Exchange: Select a reputable platform that lists ADA, such as Coinbase, Binance, or Kraken.

- Create and Verify Your Account: Sign up with your personal information and complete the required identity verification (KYC) process.

- Deposit Funds: Add money to your account using a bank transfer, debit/credit card, or other available payment methods.

- Buy ADA: Navigate to the trading section, find the ADA market (e.g., ADA/USD), and place an order to buy the desired amount.

- Secure Your ADA: For long-term holding, it’s recommended to transfer your ADA from the exchange to a personal cryptocurrency wallet for better security.

How to Buy ADA?

Buying ADA is a straightforward process on most major cryptocurrency exchanges. Once your account is set up and funded, you can typically choose between a ‘market’ order, which buys ADA at the current market price, or a ‘limit’ order, which allows you to set a specific price at which you want to buy. After the purchase is complete, the ADA will appear in your exchange wallet.

How to Sell ADA?

Selling ADA is just as simple as buying it. If your ADA is stored in a personal wallet, you’ll first need to send it to your exchange account. From there, you can go to the ADA trading pair and place a sell order. You can choose to sell at the current market price for a quick transaction or set a limit order to sell at a specific target price. Once the sale is executed, the resulting funds will be available in your exchange account for you to withdraw to your bank.

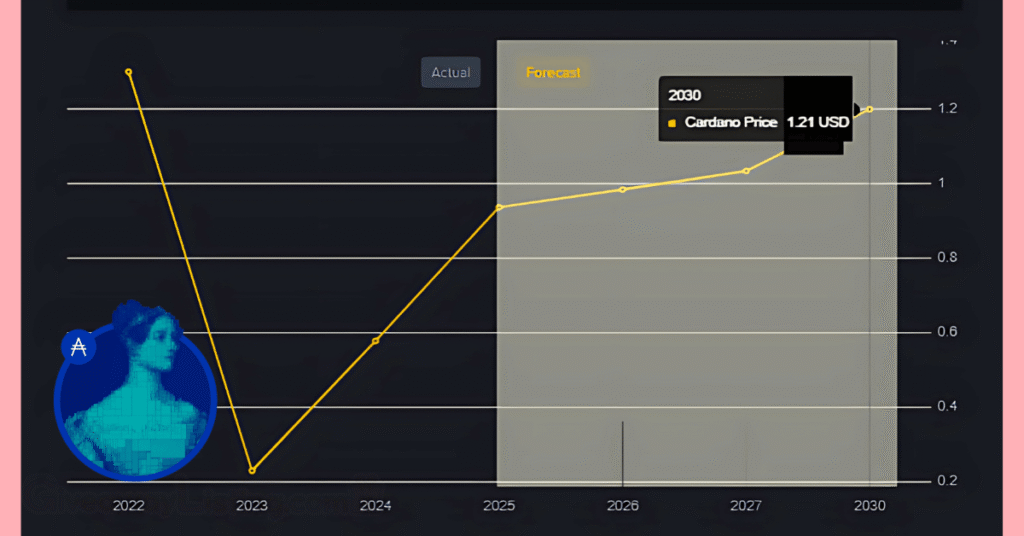

Cardano Forecast After 2026

As of mid-2026, the price of ADA has reclaimed key levels, trading at figures not seen since the last major market peak, though still below its all-time high. For 2026, forecasts point to continued positive momentum, with many analysts expecting the price to build on the gains from the previous year.

The average trading price is projected to be around $1.69, with a potential low of $1.63 and a possible high of $1.99. This steady appreciation is expected to be supported by the growing maturity of the Cardano ecosystem, increased dApp usage, and the effects of its deflationary tokenomics becoming more apparent.

Looking ahead to 2027, the upward trend is expected to continue, potentially pushing ADA to new heights. Price predictions for this year suggest an average cost of $2.46. The minimum forecasted price is around $2.39, while the upper range could see ADA reach $2.85. Such growth would likely be tied to the successful implementation of scaling solutions like Hydra and a broader adoption of the Cardano platform for real-world applications.

By 2028, Cardano could be firmly in the next phase of its market cycle. Experts in the crypto field anticipate an average trading cost of about $3.50. The price floor for the year is estimated at $3.38, with a potential peak reaching up to $4.13. At this stage, the network’s decentralized governance model would be fully operational, giving the community direct control over the treasury and future development, which could be a strong positive factor for its valuation.

The forecast for 2029 suggests another year of significant gains, with the average price expected to settle around $5.09. The lower end of the estimates places ADA at $4.92, while the most optimistic scenarios see it climbing to $5.91. This long-term growth is based on the idea that Cardano will have solidified its position as a leading smart contract platform, with a large and active user base.

Entering 2030, predictions become even more ambitious. This shows the long-term belief in Cardano’s founding principles. The average price of ADA is estimated to be around $7.47. The most conservative forecasts see it trading no lower than $7.27, while on the higher end, it could potentially touch $8.53. This valuation assumes Cardano will have achieved widespread adoption and will be a key part of the decentralized web’s infrastructure.

Trading Strategies For Cardano

Having a well-defined trading strategy is essential for managing risk, making informed decisions, and avoiding emotionally driven trades. A good strategy provides a framework for when to enter a position, when to take profits, and, most importantly, when to cut losses.

Whether you’re a short-term trader looking to capitalize on daily fluctuations or a long-term holder, your approach should be tailored to your financial goals, risk tolerance, and the amount of time you can dedicate to watching the market. Different methods work for other people, and understanding the basics of a few common strategies can help you find the right fit.

Swing Trading

Swing trading is a popular method for assets like ADA because it focuses on capturing price swings over a few days to several weeks. Unlike day trading, you don’t need to be glued to your screen all day, but it still requires active management. The main idea is to identify a likely trend using technical analysis—looking at charts, patterns, and indicators like moving averages or the Relative Strength Index (RSI)—and then enter a position to ride that trend until it shows signs of reversing.

A common swing trading approach for ADA might involve buying when the price breaks above a key resistance level with strong volume, suggesting the start of an upward move. The trader would then set a price target to take profits, which could be the next resistance level. At the same time, they would place a stop-loss order below their entry point to automatically sell if the trade goes against them, limiting their potential loss. This disciplined approach is key to being successful over the long term.

Scalping

Scalping is a very short-term trading style that aims to profit from tiny price changes. Scalpers place a high volume of trades throughout the day, often holding positions for only a few minutes or even seconds. This strategy requires intense focus, a deep understanding of market mechanics, and access to a trading platform with very low fees, as transaction costs can quickly eat into the small profits from each trade.

For a volatile coin like ADA, scalpers might look for opportunities during periods of high trading volume, such as after a major news announcement or during peak market hours. They use tools like order book analysis and very short-term charts (like the 1-minute or 5-minute charts) to make rapid-fire decisions. Because the profit on each trade is so small, scalping is a high-stakes game that is generally better suited for experienced traders who can make quick decisions under pressure.

Margin Trading

Margin trading is an advanced strategy that allows you to open larger positions than your account balance would normally allow. In effect, you are borrowing funds from the exchange to increase your buying power. For example, with 2x leverage, a $1,000 investment can control $2,000 worth of ADA. This can greatly increase your potential profits if the price moves in your favor.

However, margin trading is a double-edged sword. It also magnifies your losses by the same amount. If the market moves against you, your losses can quickly exceed your initial investment, leading to a “margin call” where the exchange forces you to add more funds or automatically closes your position at a loss. Because of this high risk, margin trading should only be attempted by experienced traders who fully understand the mechanics and have a solid risk management plan in place.

How to Learn More About Cardano?

Cardano’s commitment to academic rigor and a research-first development process makes it one of the most interesting projects in the crypto world, but this depth can also make it a bit of a challenge for newcomers. Its unique two-layer architecture, the Ouroboros proof-of-stake system, and the phased rollout of its roadmap are complex topics. Getting a solid grasp of these fundamentals is a good first step before putting any money on the line.

Fortunately, there is a wealth of information available for those willing to put in the time. From official documentation to community discussions, these resources can help you build a strong understanding of the platform.

Here are some of the top places to learn more about Cardano:

- The Official Cardano Website: You can find detailed explanations of the technology, the development roadmap, and the various organizations that form the Cardano ecosystem. The site also hosts a collection of peer-reviewed research papers that form the foundation of the platform, perfect for those who want to go deep into the technical details.

- The Cardano Developer Portal: If you have a technical background or are interested in building on the blockchain, this portal is an indispensable tool. It contains all the documentation, tutorials, and starter kits you need to begin creating smart contracts, minting native tokens, or even running a stake pool.

- Community Channels: To get a real-time pulse of the project, diving into its community channels is a must. The official Cardano Forum is a great place for structured, long-form discussions on a wide range of topics.

- IOHK and Cardano Foundation Resources: Input Output (IOHK) is the primary engineering and research company behind Cardano’s development. The IOHK blog and YouTube channel provide regular updates, explainers on new technology, and interviews with the team.

To stay current with the fast-paced developments, you can follow the latest Cardano news.

This guide has offered a look at Cardano’s journey and its potential future. We looked at various expert predictions for the remainder of 2026 and provided longer-term forecasts for the years leading up to 2030, offering a glimpse into what might be ahead.

The information provided in the content is up to date as of January 2026.

Cardano Price Prediction FAQs

Here are answers to some frequently asked questions about the Cardano price predictions:

What is Cardano’s Price Prediction in 2026?

Expert forecasts for 2026 are generally positive, with predictions suggesting an average price between $0.945 and $1.28. Bullish scenarios see ADA reaching a maximum of $1.376, which would mark a significant return for current holders. This optimism is fueled by the expansion of Cardano’s DeFi ecosystem and growing institutional interest.

Can Cardano Reach $10?

Reaching a $10 price point is considered a long-term possibility rather than a short-term expectation. Some detailed price analyses suggest that ADA could trade between $10.56 and $12.65 by the year 2031. This would depend on sustained growth, widespread adoption, and favorable market conditions over the next several years.

Can Ada Reach $20?

A price of $20 for ADA is a very long-term target that appears in some optimistic forecasts. Projections based on technical analysis and market growth models indicate ADA could reach a maximum price of $25.87 by 2033. Achieving this milestone would require Cardano to capture a much larger share of the smart contract market.

What Can Cardano Reach in 5 Years?

Looking ahead five years to 2030, price predictions for Cardano are quite bullish. Forecasts suggest an average trading price of approximately $7.47. In a strong market, the price could reach a high of $8.53, representing substantial growth from its current levels.